Pro and online momentum benefit comps

The company recorded high-single-digit comps in its Pro customer segment during the quarter, with broad-based growth across geographies and positive comps across all merchandising divisions. LOW revamped its Pro loyalty program, MyLowe’s Pro Rewards, with tailored offerings for its target customer – small to medium Pros. It continues to invest in improving the shopping experience for Pros in order to drive greater engagement and repeat purchases.

Lowe’s online sales grew 9.5% in Q4, with improvement across all merchandising divisions. Hurricane-related demand positively impacted Q4 comp sales by around 100 basis points.

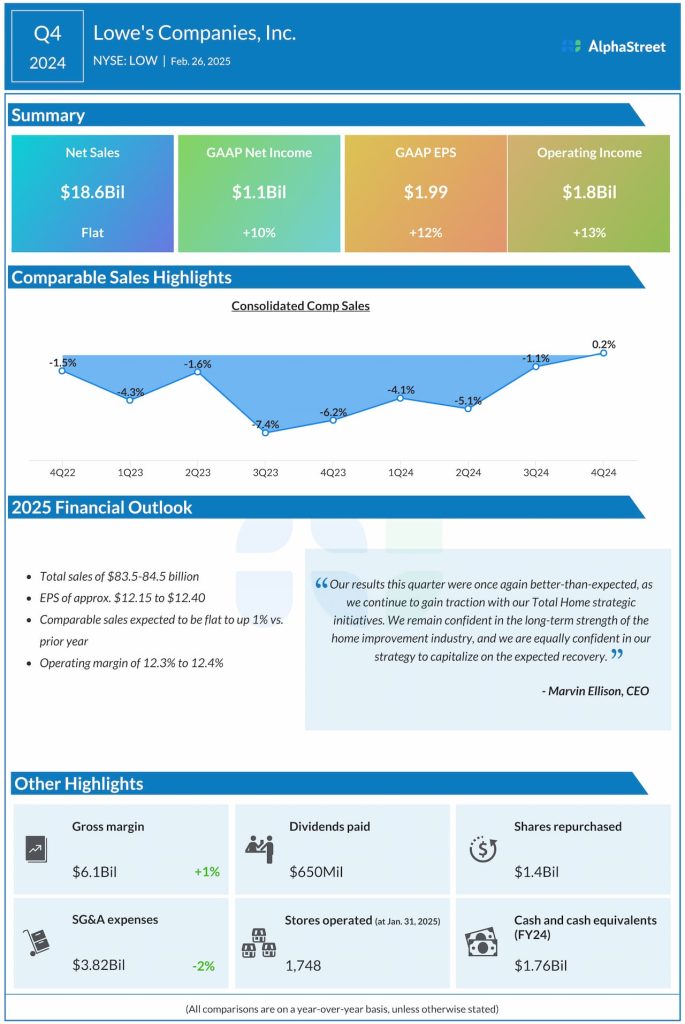

Lowe’s GAAP earnings per share increased 12% YoY to $1.99 while adjusted EPS amounted to $1.93.

Pressure on DIY discretionary spending

The pressure on do-it-yourself (DIY) discretionary spending continues, especially in bigger ticket projects as consumers remain cautious amid inflationary headwinds and high mortgage rates. In Q4, comparable transactions declined 1.3%, due to continued DIY pressure, especially in large interior projects. Comparable average ticket rose 1.5%, helped by positive comps in appliances, momentum in Pro, and storm recovery project spend.

Outlook

The home improvement market faces continued uncertainty, especially for larger-ticket discretionary spend. Mortgage rates are anticipated to remain high, putting pressure on existing home sales and larger projects. Based on this, Lowe’s expects the home improvement market to be roughly flat this year, with Pro outpacing DIY, driven by repair and maintenance.

Lowe’s expects total sales of $83.5-84.5 billion for fiscal year 2025. Comparable sales are expected to be flat to up 1% compared to the previous year. EPS is expected to be approx. $12.15-12.40 for the year.