Apparel retailer Abercrombie & Fitch (NYSE: ANF) reported a net loss for the second quarter of 2019, compared to profit last year, even as sales declined modestly. The bottom line beat analysts’ forecast, while sales missed. The company also lowered its full-year guidance to reflect the impact of trade-related uncertainties, sending the stock sharply lower immediately after the announcement on Thursday.

Second-quarter net loss, on an adjusted basis, was $0.48 per share, compared to a profit of $0.06 per share last year. Analysts had forecast a slightly bigger loss. On an unadjusted basis, the company posted a loss of $31.14 million or $0.48 per share, compared to a loss of $3.85 million or $0.06 per share last year. Operating margin dropped by 470 basis points year-over-year to a loss of 4.7%, owing mainly to the adverse impact of flagship store exit charges.

Flat Sales

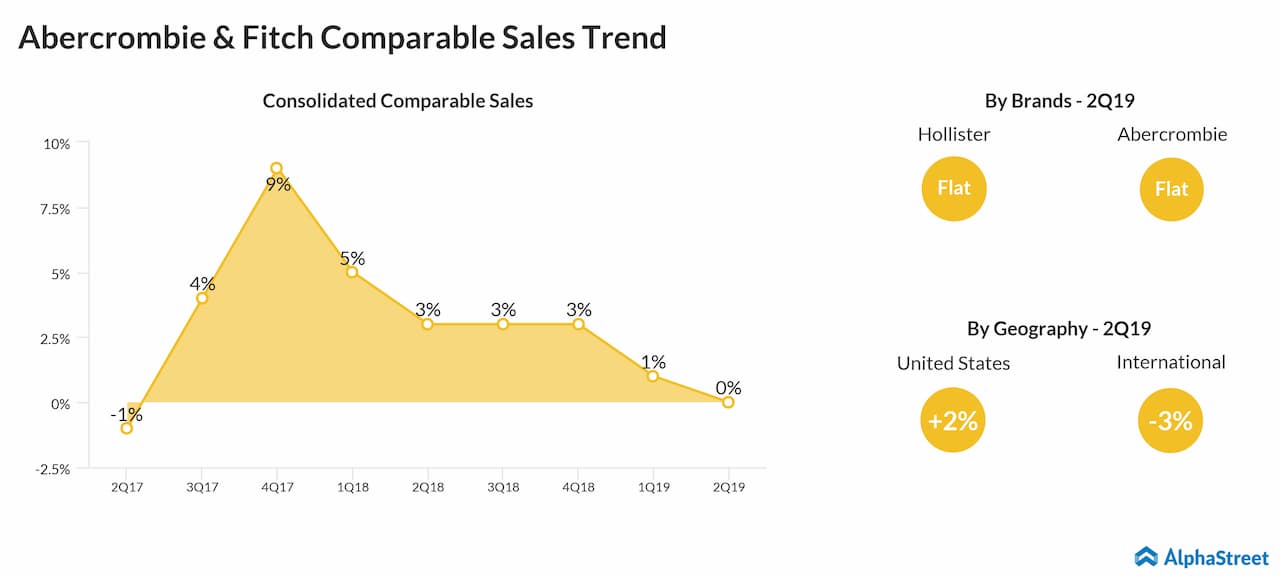

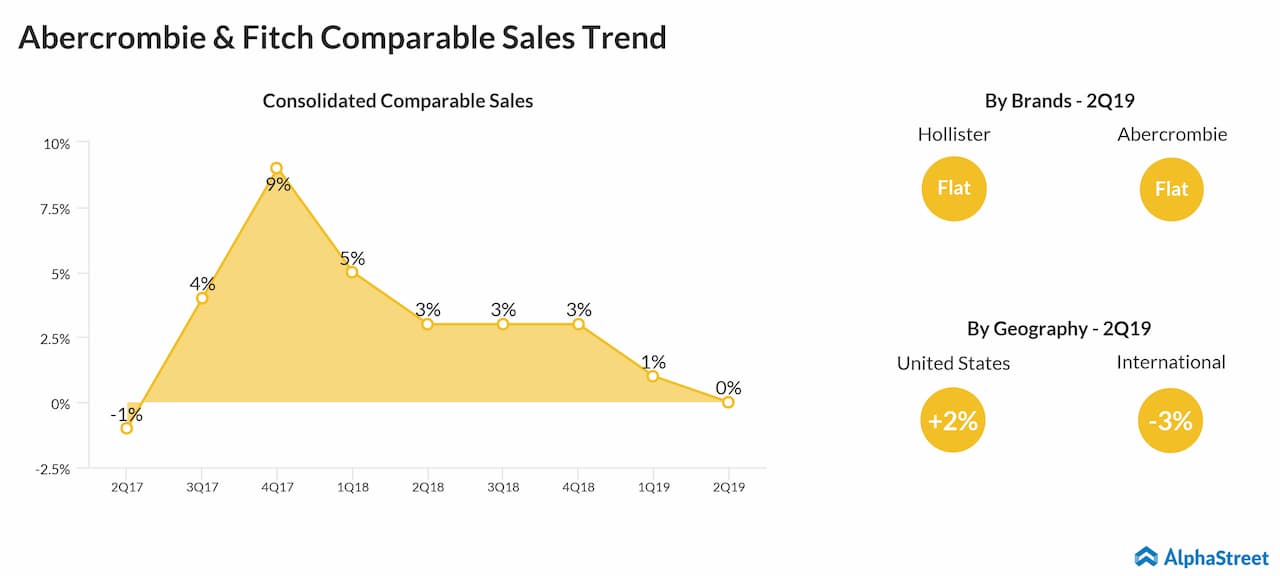

Net sales dropped to $841.1 million during the three-month period from $842.4 million in the corresponding period of last year and missed the estimates. Comparable sales were flat against positive sales of 3% last year.

Also read: Guess? Stock jumps after Q2 results beat estimates

Fran Horowitz, CEO, said, “While we are committed to delivering near-term results, we remain keenly focused on our long-term goals as we execute on our transformation initiatives. We plan to build on these actions as we continue to lay the foundation to achieving our fiscal 2020 target.”

Guidance

For the third quarter of fiscal 2019, the management expects net sales to be up around 1%, reflecting the impact of changes in foreign exchange rates. Comparable sales are estimated to be flat and gross profit rate to be down 100 basis points year-over-year.

The company, meanwhile, revised down its full-year outlook and currently expects sales to be flat to up 2%, reflecting positive comparable sales and new store openings. Same-store sales are forecast to be flat to up 2%, while the gross profit rate is seen falling by 50-90 basis points annually.

Capital Return

The company repurchased 3.5 million shares in the second quarter. It has returned a total of $84.2 million to stockholders through share buybacks and dividends so far this year. Earlier this month, the board of directors declared a quarterly cash dividend of $0.20 per share, to be paid on September 16, 2019, to stockholders of record on September 6, 2019.

Related: Abercrombie & Fitch Q1 2019 Earnings Call Transcript

Abercrombie shares are still struggling to recover from the massive loss they suffered after the first-quarter earnings report. The stock lost about 12% early Thursday after closing the previous trading session higher.