And using that machine learning and data science we can determine which impressions in the programmatic marketplace are most likely to yield conversions or positive business outcomes for our customers. Most of the other DSPs in the market are leveraging tactics that we believe are dated and limited. These are mostly cookie-based, or ID-based.

Tell us a bit about your SPAC acquisition, and your reasoning for choosing the SPAC model.

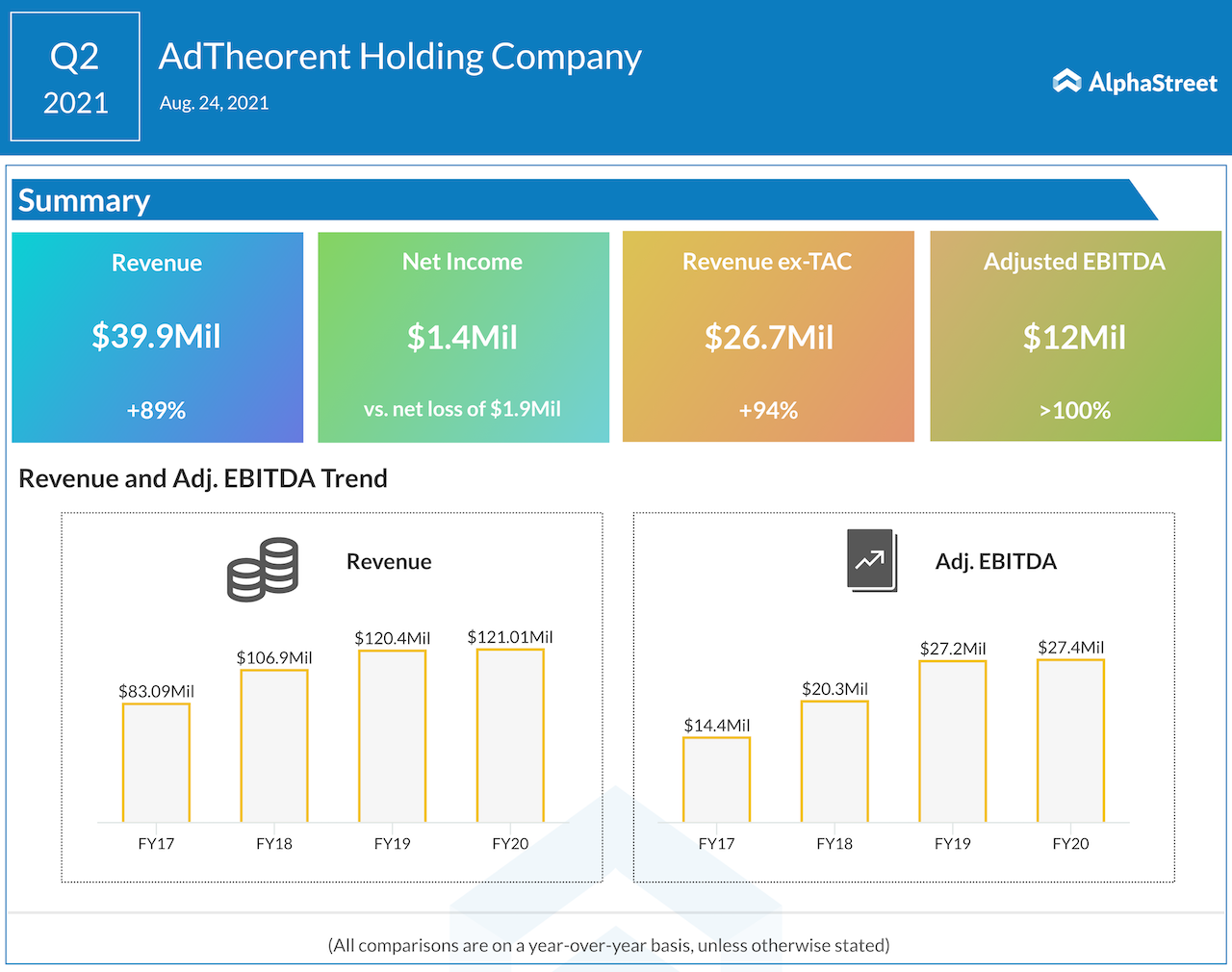

We have a long track record of financial performance. We have a very strong fundamental revenue and EBITDA generation profile. In 2021, we’ll do a $161 million GAAP revenue and over $30 million in EBITDA. We believe that we should be on that bigger stage now and need the opportunity to tell our story to more investors.

As far as why SPAC, the partnership with Monroe is just too good to pass up (AdTheorent entered into a merger agreement with MCAP Acquisition Corp through a SPAC deal earlier this year). We’ve been working with Monroe Capital for many years. They were one of our lenders and we know them well. And they have a good and strong track record with SPACs.

Over the past few years, consumers have increasingly become conscious and protective of their privacy. How do you mitigate this fear, all the while offering value to your clients?

It’s one of the main reasons why we are special and why customers are demanding what we’re doing more than ever. When you target digital ads there are a number of ways to do it. The most prevalent method for programmatic DSPs to target ads these days is essentially leveraging behavioral tactics or cookies.

Where has the user been and what other websites? That’s essentially what cookies allow you to understand. The other method is licensed audience segments, which essentially are lists of IDs and they come from a number of different sources. They have, in some cases, unclear origins. The freshness of the data is often unclear. We throw all that out and we’re able to access signals in real-time from our publisher partners.

And when we access these signals, we’re not utilizing and relying on individual ideas in order to determine which ads we target, or which digital impressions we purchase. What we are doing is identifying correlations of data attributes. It could be data about the publisher, it could be data about keywords on the page, it can be data about the device, it can be data about the ad unit itself.

Any number of non-individualized data points can be used in a machine learning environment. The machine and data science can connect the dots in a way that a regular human mind just can’t do. And because you have that power of machine learning and statistics, you’re also very privacy forward. You’re not essentially marketing based on the development of user-profiles.

ALSO READ Kontrol Technologies CEO Paul Ghezzi: Our focus is on reinvesting for growth

Of late, we are seeing an increasing trend where consumers are willing to pay more so that they get an ad-free experience. Do you feel this trend is something that could impact your market?

No, I don’t think so. I think that the open and free internet is a beautiful thing that most people value very much. And I think that the type of ad targeting that’s happening especially among top publishers and top brands like the ones we work with, it’s really about making the experience better for users.

And advertisement does not need to be and should not be an off-putting experience. The advertisement in the digital environment should be something that adds value. We don’t believe that the future of the internet is a series of private paywall content areas and zones. We think that the open internet subsidized by effective, efficient, and responsible digital advertising is the future. And we’re happy to be a part of elevating the game, and making those types of ads better in the sense that they are going to be more relevant to the user.

And they’re going to be ads that users are more likely to engage with and add value to their lives.

ALSO READ Avalo Therapeutics CEO Mike Cola on product pipeline and market potential

You had recently raised your guidance citing strong growth in the first half. What were the factors that acted as a tailwind during this period?

We had a really good first half of the year. We have great demand for the ability to drive performance in a privacy-forward manner. We’ve grown our relationships with brands increasingly. We work directly with some of the great agencies, but we also work directly with a number of large brands, and those relationships have grown.

Our brand direct, for example, year-over-year through the first half growth was over 80%. We’ve some great partnership commitments with agencies that work with us on a long-term basis. And those partnership understandings of spend have grown 60% through the first half of the year. Bookings were up over 50%. CTV is an area of great growth for us. We were up 300% through the first half of the year. And video was 40%.

For us, it’s all about if we can drive ROI. If we can show the customer that by working with us, they were able to sell more, or they were able to engage more, we have a great future. And we’ve been very good at that.

And we’ve spent a lot of time and we’ve invested a lot of money, and we have a lot of, really brilliant data scientists and analytics, and tech within our organization. What a pharmaceutical advertiser is trying to achieve is different than a quick-service restaurant. And we have invested in solutions that are different based on those business challenges in those APIs. And also based on the type of data that is considered acceptable to be used in those different verticals.

ALSO READ Leaf Mobile CEO Darcy Taylor: Aiming to double game portfolio by year-end

What is going to be the management’s focus over the next two years?

We have been a disciplined group since 2012. I feel in many respects that we’ve operated as a public company for the last few years, in the sense that we take our commitments very seriously. We have a multi-year track record of really disciplined operational and financial success. Our core platform and technology and products are highly differentiated and we need to continue to invest in that.

We’re gonna invest in our technology. We need to grow our team. We need more people on our team to go tell our story. And there are new markets that we are yet to explore. We’re relatively early stages in CTV. We’ll triple our revenue there, but it’s relatively early stages for us. We haven’t made any incredibly big investment there, and we look forward to making an investment in some of these areas, where we can capture a greater piece of the market.

________