Market Performance Update

Advance Auto Parts Q4 2025 Earnings: Fourth Quarter Results

Fourth quarter net sales hit $2.0 billion. This included an extra week versus last year. So, results benefited from 13 weeks of sales. Still, comparable sales grew 1.1%. Also, the holiday season performed well. Adjusted gross margin reached 44.2%. This was up 527 basis points. As a result, adjusted operating income was $73 million. This marked a swing from a $99 million loss last year. In fact, adjusted operating margin was 3.7%.

2025 Full Year Performance

Full year 2025 net sales totaled $8.6 billion. This was down 5.4% year-over-year. But, comparable store sales grew 0.8%. Also, adjusted gross margin expanded 164 basis points to 43.9%. Furthermore, adjusted operating income reached $216 million. This compared to just $35 million last year. So, adjusted operating margin was 2.5%. That marked over 200 basis points of expansion.

Quarterly Revenue Trend

Advance Auto Parts Q4 2025 Earnings: Quarterly Revenue Performance (2024-2025)

Strategic Plan Progress

CEO Shane O’Kelly noted 2025 progress. He stated the team laid a foundation for the future. Also, the company returned to positive comparable sales growth. This ended three years of negative results. In fact, adjusted operating margin expanded over 200 basis points. So, the strategic plan is working. Furthermore, store footprint was optimized. The firm closed 522 stores during 2025. As a result, the network is more efficient.

Key strategic pillars include merchandising excellence. Also, supply chain improvements are underway. Plus, store operations are being enhanced. These focus on the right part, right place, and right service. Looking ahead, market hub expansion will continue.

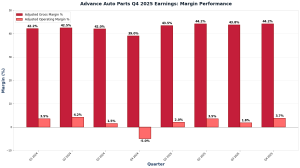

Margin Performance Analysis

Advance Auto Parts Q4 2025 Earnings: Gross Margin and Operating Margin Trends

Full Year 2026 Outlook and Guidance

Management provided full year 2026 guidance. Net sales are expected at $8.485 billion-$8.575 billion. Also, comparable store sales growth targets 1.0%-2.0%. Furthermore, adjusted operating margin guidance is 3.8%-4.5%. This shows continued margin expansion. Capital spending will be about $300 million. Plus, free cash flow is expected at about $100 million. Finally, 40-45 new stores will open. Also, 10-15 market hubs will launch.

Store Operations and Network

Advance operates 4,305 stores as of January 2026. This includes 4,066 AAP stores. Also, 239 Carquest stores operate. During 2025, 39 stores opened. But, 522 stores closed for optimization. As a result, the footprint is leaner. In addition, service improvements continue. Customer experience remains a focus. So, transaction growth is a priority.

Capital Allocation and Dividend

The company declared a quarterly dividend of $15 million. This is payable on April 24, 2026. Also, the balance sheet remains stable. Cash and equivalents total $3.1 billion. Furthermore, total debt is $3.4 billion. The net leverage ratio is 2.4x. So, financial flexibility supports investments.

Advance Auto Parts Q4 2025 Earnings: Key Takeaways

In summary, Advance Auto Parts Q4 2025 earnings showed turnaround progress. Adjusted gross margin expanded 527 basis points. Also, comparable store sales returned to growth. As a result, profitability improved. The strategic plan focuses on three pillars. These include merchandising, supply chain, and store operations. Looking ahead, management expects 1.0%-2.0% comparable sales growth. Also, operating margins should reach 3.8%-4.5%. For more detailed coverage, see the Advance Auto Parts investor relations page. For additional company information, visit Advance Auto Parts official website.

Click Here to visit the AlphaStreet website.