Financial Results

YoY Financial Comparison

| Metric | FY 2025 | FY 2024 | YoY Change |

| Revenue | $1,522.0M | $1,517.6M | +0.3% |

| Adjusted EBITDA | $156.8M | $142.1M | +10.4% |

| Net Income (GAAP) | $49.3M | $44.1M | +11.8% |

| Diluted EPS (GAAP) | $1.80 | $1.61 | +11.8% |

| Adjusted Diluted EPS | $2.28 | $2.06 | +10.7% |

| Operating Cash Flow | $122.9M | $110.4M | +11.3% |

| Free Cash Flow | $6.4M | $(5.9M) | Improved YoY |

EBITDA Performance Breakdown

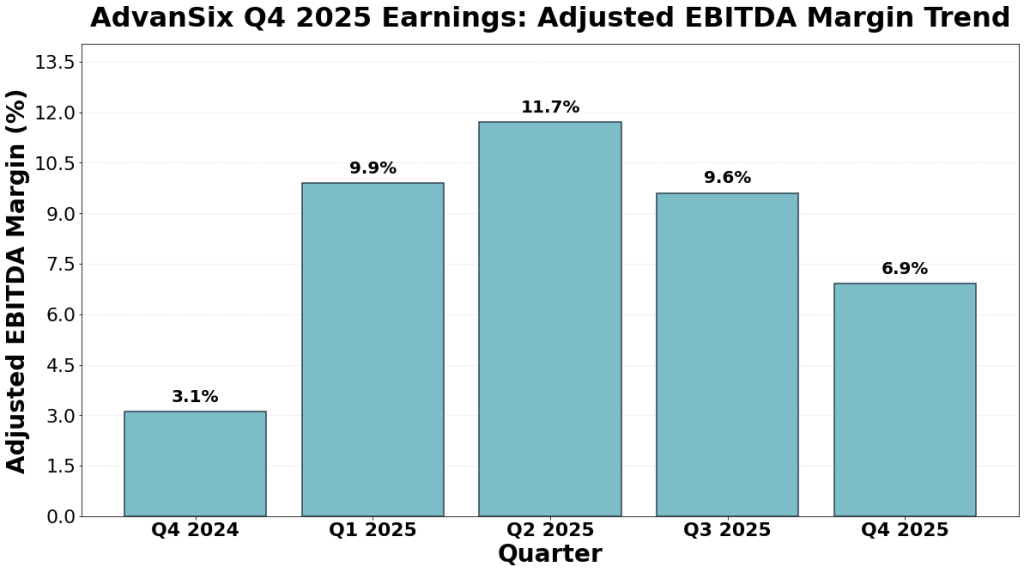

Adjusted EBITDA for the full year 2025 totaled $156.8 million. This represents a 10.4% gain from $142.1 million in 2024. Adjusted EBITDA margin expanded to 10.3% from 9.4%, marking a 90 basis point improvement year-over-year.

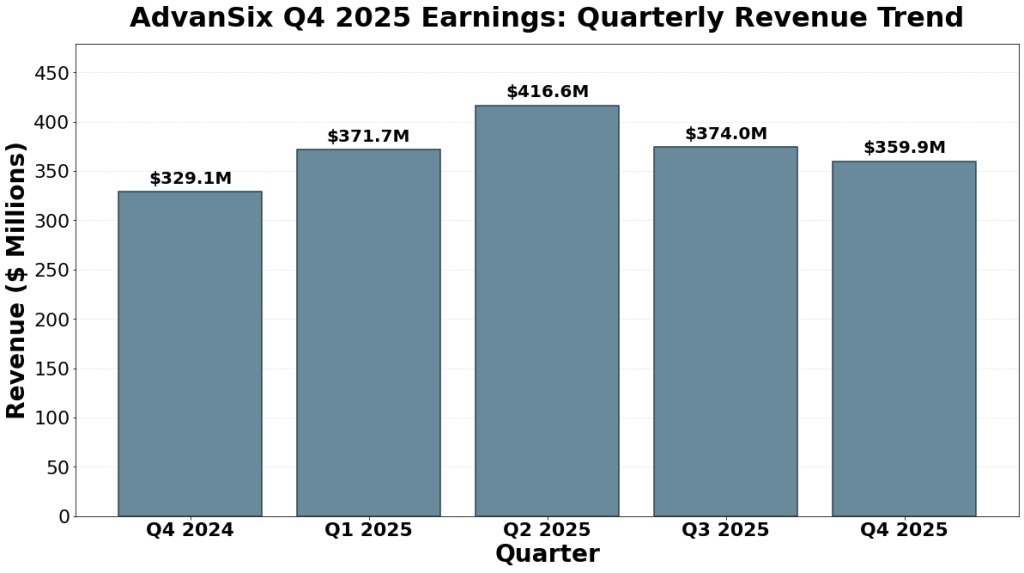

Quarterly Revenue Trend Chart

Figure 1: AdvanSix Q4 2025 earnings quarterly revenue trend displays quarterly performance from Q4 2024 through Q4 2025.

Segment Performance Analysis

In 2025, AdvanSix Q4 earnings reflected diverse segment performance. Plant Nutrients delivered $563.7 million in revenue. Caprolactam generated $271.4 million. Nylon Solutions contributed $309.7 million amid an extended market cycle trough. Chemical Intermediates produced $377.5 million.

EBITDA Margin Trend

Figure 2: AdvanSix Q4 2025 earnings adjusted EBITDA margin trend illustrates margin progression across company quarters.

Outlook and Strategic Initiatives

Looking ahead to 2026, AdvanSix Q4 2025 earnings guidance indicates planned capital expenditures ranging from $75 million to $95 million. Plant turnaround expenses are estimated at $20 million to $25 million. The company expects to benefit from 45Q carbon capture tax credits and fixed cost reduction programs targeting $30 million in savings over multiple years.

Key Takeaways

- AdvanSix Q4 2025 earnings delivered $359.9M in revenue, up 9.4% vs. prior year quarter.

- Full-year 2025 adjusted EBITDA reached $156.8M, up 10.4%, with margin expansion to 10.3%.

- Plant Nutrients segment led growth with improved supply fundamentals.

- Extended nylon cycle trough continues to pressure chemical intermediates.

- 2026 guidance reflects reduced capital spending and strategic cost initiatives.

- Positive free cash flow generation supports shareholder returns.