Earnings of Agilent Technologies (Nasdaq: A), which manufactures instruments used in medical laboratories, increased in the second quarter but missed the market’s prediction. Margins got a modest boost from favorable pricing and higher sales. The management also lowered full-year revenue guidance. The company’s shares dropped sharply during Tuesday’s after-hours trading session, following the report.

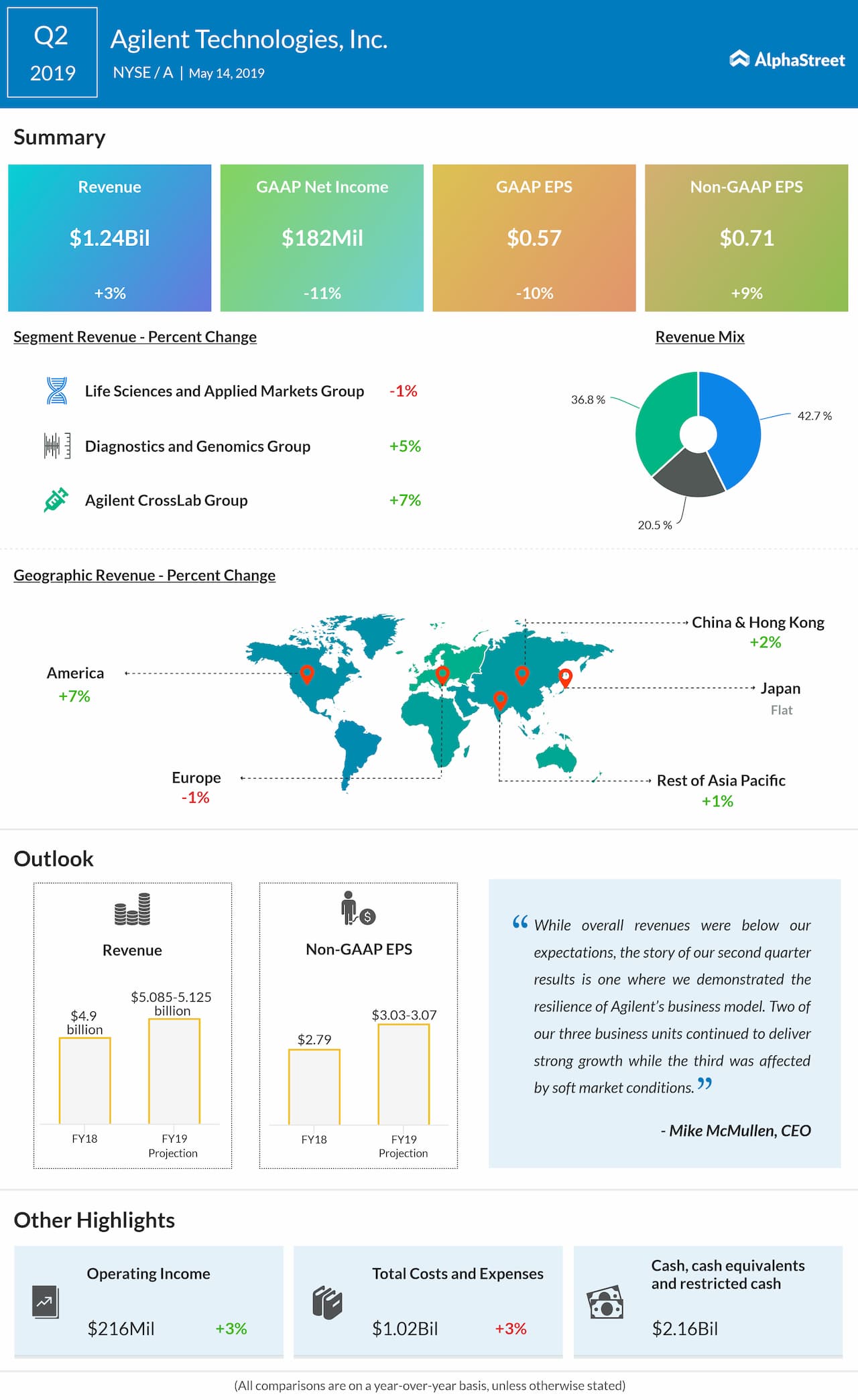

Revenues of the Santa Clara, California-based healthcare company moved up 3% annually to $1.24 billion but fell short of expectations.

There was a 9% increase in adjusted earnings to $0.71 per share, which however missed Wall Street’s expectation. Reported profit, meanwhile, dropped to $182 million or $0.57 per share from $205 million or $0.63 per share in the second quarter of 2018.

Mike McMullen, Agilent’s CEO, said, “While overall revenues were below our expectations, the story of our second quarter results is one where we demonstrated the resilience of Agilent’s business model.”

There was a 9% increase in adjusted earnings to $0.71 per share, which however missed Wall Street’s expectation

Revenues of Life Sciences and Applied Markets Group edged down by 1%, owing mainly to lower demand in the pharma and food markets. Agilent CrossLab Group registered a 7% growth aided by solid demand overseas, especially China. Diagnostics and Genomics Group was up 5%.

Discouraged by the weak results, the management lowered its fiscal 2019 revenue guidance to the range of $5.09 billion to $5.13 billion from the earlier outlook of $5.15-$5.19 billion. Meanwhile, full-year adjusted earnings per share forecast has been reaffirmed in the $3.03-$3.07 range.

Also see: Agilent Technologies Inc. Q1 2019 Earnings Conference

The earnings guidance for the third quarter, on an adjusted basis, is between $0.71 per share and $0.73 per share. June-quarter revenues are currently expected to come in the range of $1.23 billion to $1.25 billion.

Among others, Quest Diagnostics (DGX) recently reported an 8% fall in first-quarter earnings to $1.40 per shares, mainly due to a decline in revenues.

The majority of analysts have assigned buy rating on Agilent. The stock continues to impress investors with its stable growth and resilience to market headwinds. At $87, the average price target is nearly 26% above the current levels.

Last month, the shares reached a 19-year high, recovering steadily from the lows seen in December. The stock, which gained 16% since the beginning of the year, dropped about 10% during the extended trading session Tuesday.