Categories Analysis, Health Care

Alexion Pharmaceuticals could still be a valuable addition to your portfolio

Biopharmaceutical firm Alexion Pharmaceuticals (NASDAQ: ALXN) has been going through a volatile phase lately. The company was expected to be the takeover target for Amgen Inc (NASDAQ: AMGN), but the latter snubbed Alexion at the last minute and instead picked Celgene’s (NASDAQ: CELG) Otezla business for $13.4 billion in a cash transaction.

This came as a huge jolt for Alexion investors, who were hoping to see big gains post the acquisition. ALXN stock, meanwhile, plunged following the announcement of the deal with Celgene.

Things took an even worse turn for Alexion when ally-turned-foe Amgen challenged three of its patents relating to its flagship drug Soliris. Soliris is a drug used in the treatment of rare diseases and accounts for almost 90% of its total sales.

The US Patent and Trademark Office (PTO) will review these patents and if they fall, Amgen will have the chance to launch biosimilars of this drug, which have been under development for some time.

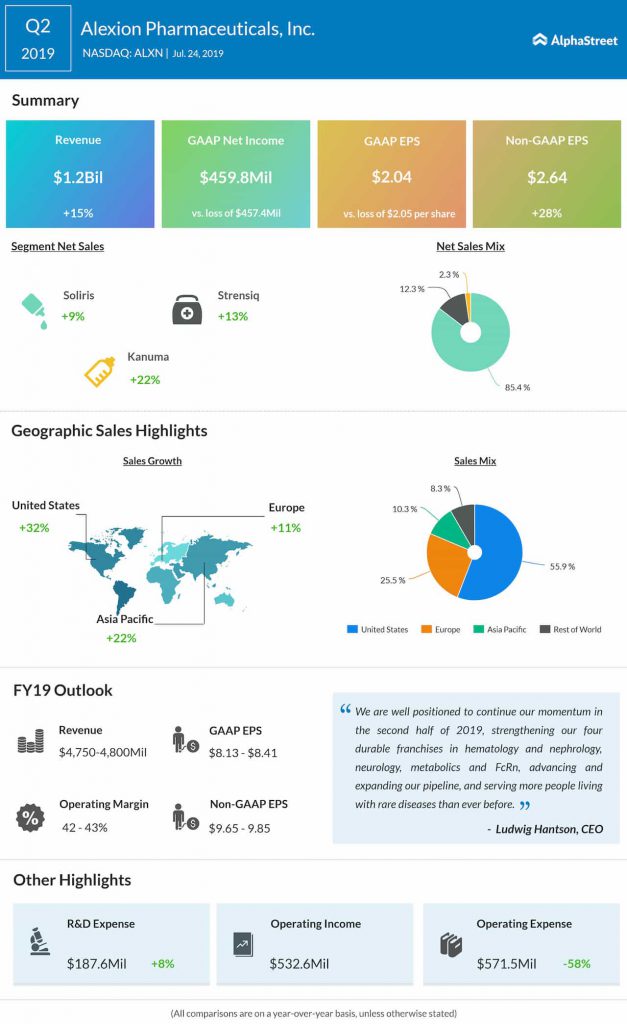

In spite of these headwinds, Alexion could be a valuable addition to your portfolio, given the headstart it has achieved in rare diseases. Soliris is a best-selling drug not because of more sales, but mostly due to its high price tag. In the first half of 2019, Soliris revenues came in at around $2 billion.

READ: Lundbeck to acquire Alder BioPharmaceuticals for $1.95 billion

The high price tag also ensures Alexion has a net margin of about 29.60%, suggesting it is more profitable than most of its peers. High institutional ownership makes the stock stable and focused as well.

Even though Alexion has missed out on sealing a deal with Amgen, the company’s progress with rare diseases continues to make it a good takeover target. Novartis (NYSE: NVS), Pfizer (NYSE: PFE) and Roche could be the companies that may forge a deal with Alexion sometime in the future.

The continued prospects of a takeover and cheap valuation spurred by the recent turn of events make ALXN an attractive option that could be considered in the biotech space.

DISCLAIMER: The article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.

Most Popular

PG Earnings: Procter & Gamble Q3 profit climbs, beats estimates

Consumer goods behemoth The Procter & Gamble Company (NYSE: PG) announced financial results for the third quarter of 2024, reporting a double-digit growth in net profit. Sales rose modestly. Core

AXP Earnings: All you need to know about American Express’ Q1 2024 earnings results

American Express Company (NYSE: AXP) reported its first quarter 2024 earnings results today. Consolidated total revenues, net of interest expense, increased 11% year-over-year to $15.8 billion, driven mainly by higher

Netflix (NFLX) Q1 2024 profit tops expectations; adds 9.3Mln subscribers

Streaming giant Netflix, Inc. (NASDAQ: NFLX) Thursday reported a sharp increase in net profit for the first quarter of 2024. Revenues were up 15% year-over-year. Both numbers exceeded Wall Street's