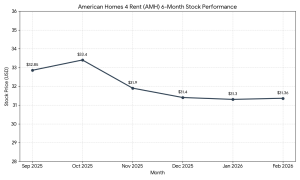

Shares of American Homes 4 Rent (NYSE: AMH) rose 1.39% to $31.30 in Friday afternoon trading after the single-family rental real estate investment trust (REIT) reported fourth-quarter results that matched analyst expectations for core funds from operations (FFO).

The intraday move remains within the company’s 52-week range of $28.85 to $39.49. The stock has trended lower over the past month, losing approximately 1.8% of its value as investors weigh the impact of sustained interest rates on housing affordability and mortgage markets.

Quarterly and Full-Year Financial Results

For the quarter ended Dec. 31, 2025, American Homes 4 Rent reported Core FFO of $199.3 million, or $0.47 per share, matching the Zacks Consensus Estimate. This represents a 4.1% increase from $0.45 per share in the fourth quarter of 2024.

Total revenues increased 4.2% year-over-year to $455.0 million, slightly missing the analyst consensus of $462.4 million. Revenue growth was primarily driven by higher rental rates. In the company’s “Same-Home” portfolio, core revenues rose 3.0% to $351.6 million, fueled by a 3.0% increase in average monthly realized rent.

For the full year 2025, total revenues grew 7.0% to $1.85 billion compared to $1.73 billion in 2024. Core FFO for the full year reached $1.87 per share, up from $1.77 per share in the previous year. Net income attributable to common shareholders was $439.0 million, or $1.18 per diluted share.

Key Developments and 2026 Guidance

The company announced several capital allocation moves alongside its results:

- Dividend Increase: The board of trustees authorized a 10% increase in the quarterly common share distribution to $0.33 per share, payable March 31, 2026.

- Share Repurchase: A new $500 million share repurchase program was authorized, following the exhaustion of previous capacity.

- Portfolio Activity: During the fourth quarter, the company sold 646 properties, generating $192.9 million in net proceeds.

Looking ahead, American Homes 4 Rent provided full-year 2026 guidance for Core FFO in the range of $1.89 to $1.95 per share. Management also projected 2026 net income per diluted share between $1.20 and $1.30.

Sector Outlook

The performance of residential REITs like AMH occurs against a backdrop of broader macroeconomic pressure. While SaaS and software stocks have faced valuation compression due to high borrowing costs and slowing enterprise digital transformation spending, residential property owners continue to face headwinds from elevated property taxes and operational costs. However, the sector remains a primary alternative for investors rotating out of high-growth tech as rental demand persists amid low single-family housing inventory.