Amgen Inc. (NASDAQ: AMGN) topped revenue and earnings estimates for the fourth quarter of 2019. However, shares fell 2.7% in aftermarket hours as the outlook came below expectations.

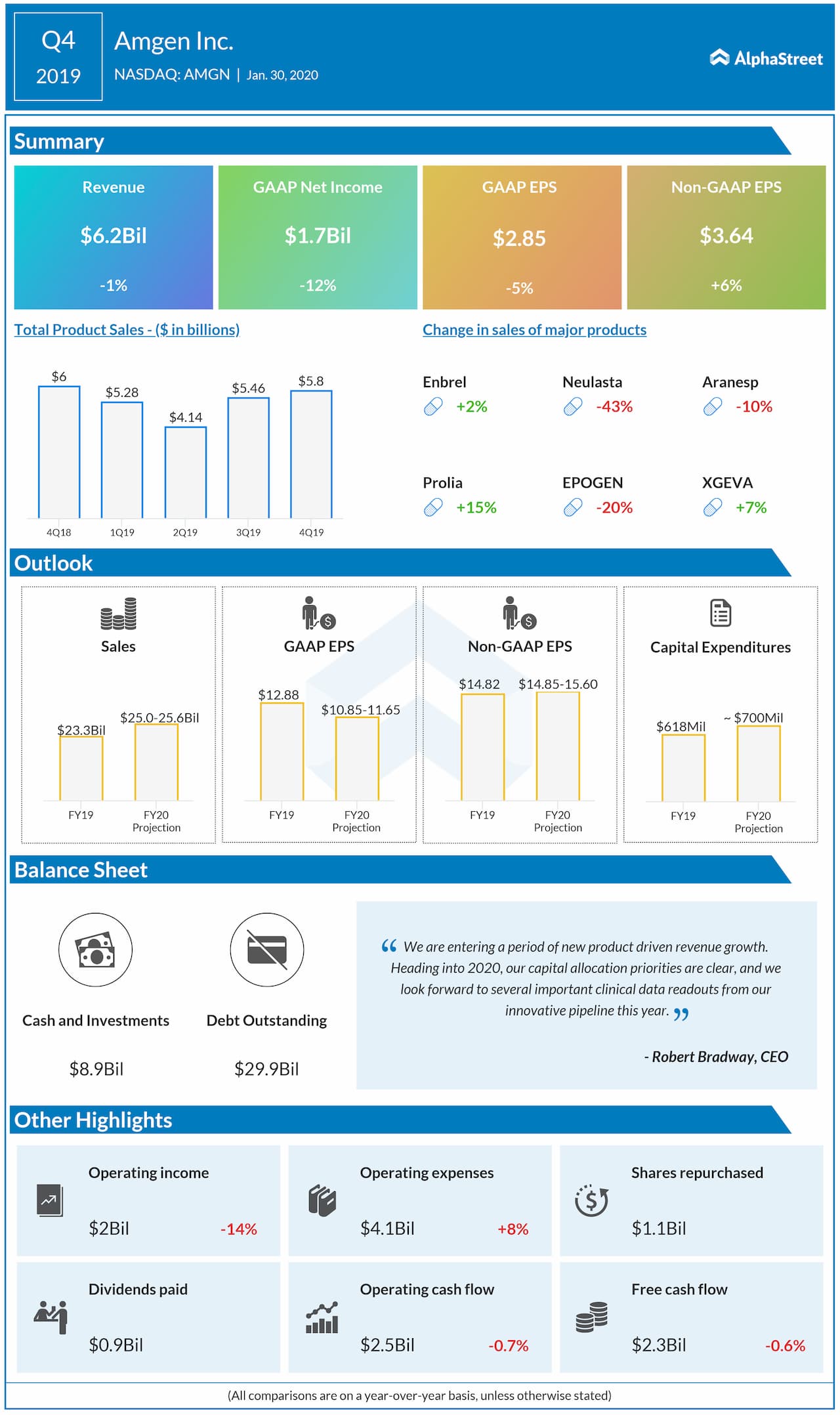

Total revenue fell 1% year-over-year to $6.2 billion, due to the impact of biosimilar and generic competition against select products, but surpassed expectations of $6.06 billion.

GAAP net income fell 12% to $1.7 billion while EPS dropped

5% to $2.85 hurt by higher operating expenses. Adjusted EPS rose 6% to $3.64,

beating forecasts of $3.46.

Total product sales fell 2% year-over-year. During the

quarter, sales for Prolia, Repatha, and Parsabiv increased double-digits driven

by higher unit demand. Aimovig sales increased 3%.

Total operating expenses increased 8% in the quarter. R&D expenses rose 11% due to higher spending in research and early pipeline in support of oncology programs.

Also read: Western Digital Q2 2020 Earnings Snapshot

For full year 2020, total revenues are expected to be $25.0 billion to $25.6 billion. GAAP EPS is expected to be $10.85 to $11.65 while adjusted EPS is expected to be $14.85 to $15.60. Analysts had estimated adjusted EPS of $16.14 for the full year.

In December, the European Commission (EC) granted marketing authorization for EVENITY for the treatment of severe osteoporosis in postmenopausal women at high risk of fracture. For Otezla, the company expects data from the Phase 3 study in patients with mild-to-moderate psoriasis by mid-year 2020.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.