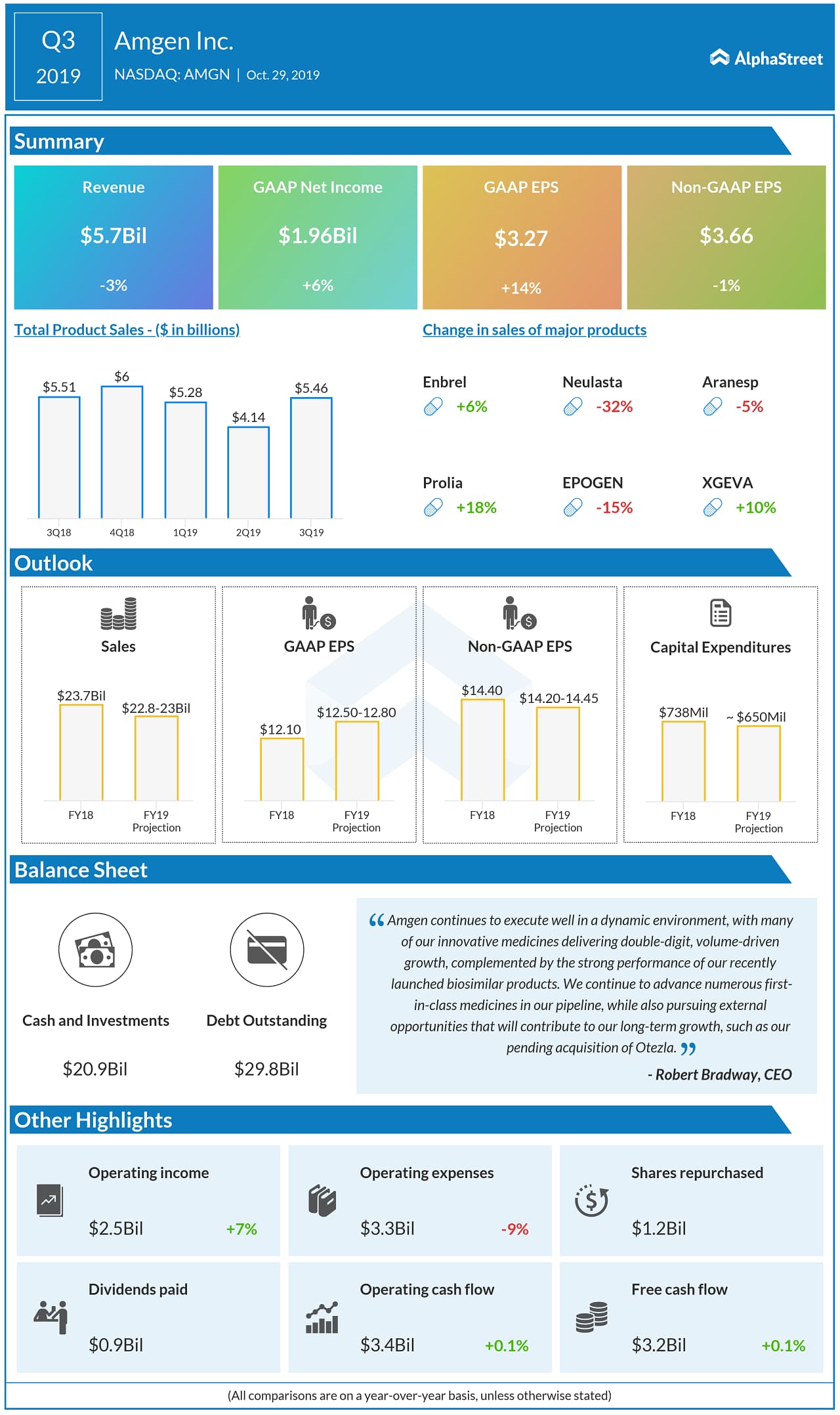

Amgen Inc (NASDAQ: AMGN) reported third-quarter 2019 adjusted EPS of $3.66 on revenue of $5.74 billion. This was better than analysts’ prediction of earnings of $3.53 per share on revenues of $5.63 billion. Amgen stock advanced about 0.2% during the after-hours.

Revenues for the quarter reflected a 3% decline over last year, due to the impact of biosimilar and generic competition against key products. Total product sales edged down 1%.

CEO Robert Bradway said, “We continue to advance numerous first-in-class medicines in our pipeline, while also pursuing external opportunities that will contribute to our long-term growth, such as our pending acquisition of Otezla.”

Amgen raised its outlook on full-year 2019 revenue to a range of $22.8 billion – $23.0 billion, from the earlier range of $22.4 billion – $22.9 billion. The company also raised the guidance on GAAP and Non-GAAP earnings.

Amgen currently expects full year adjusted EPS of $14.20 to $14.45, versus the prior estimate of $13.75 to $14.30. On a GAAP basis, Amgen is projected to earn $12.50 to $12.80 in fiscal 2019, higher than the initial projection of $12.10 to $12.71

READ: After a 2-month stock slide, Q3 could bring Alteryx’s deflection point

Rival drugmaker Pfizer (NYSE: PFE) yesterday reported lower revenues and earnings for the third quarter. The results, however, topped the market’s expectations. Merck (NYSE: MRK) also surpassed analysts’ expectations yesterday helped by oncology and vaccines.

The quarterly results come two months after Amgen announced that it would acquire Celgene’s (NASDAQ: CELG) Otezla business for $13.4 billion in a cash transaction. Amgen expects the addition of OTEZLA to positively impact its financial results, including an immediate accretion to its non-GAAP EPS.

AMGN shares have gained 8% since the beginning of this year and 11% in the past 12 months.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.