Chipmaker Analog Devices (Nasdaq: ADI) Q2 earnings and revenue beat analysts expectations. However, the stock fell about 2% in the early hours of pre-market trading due to weak Q3 outlook and recovered later.

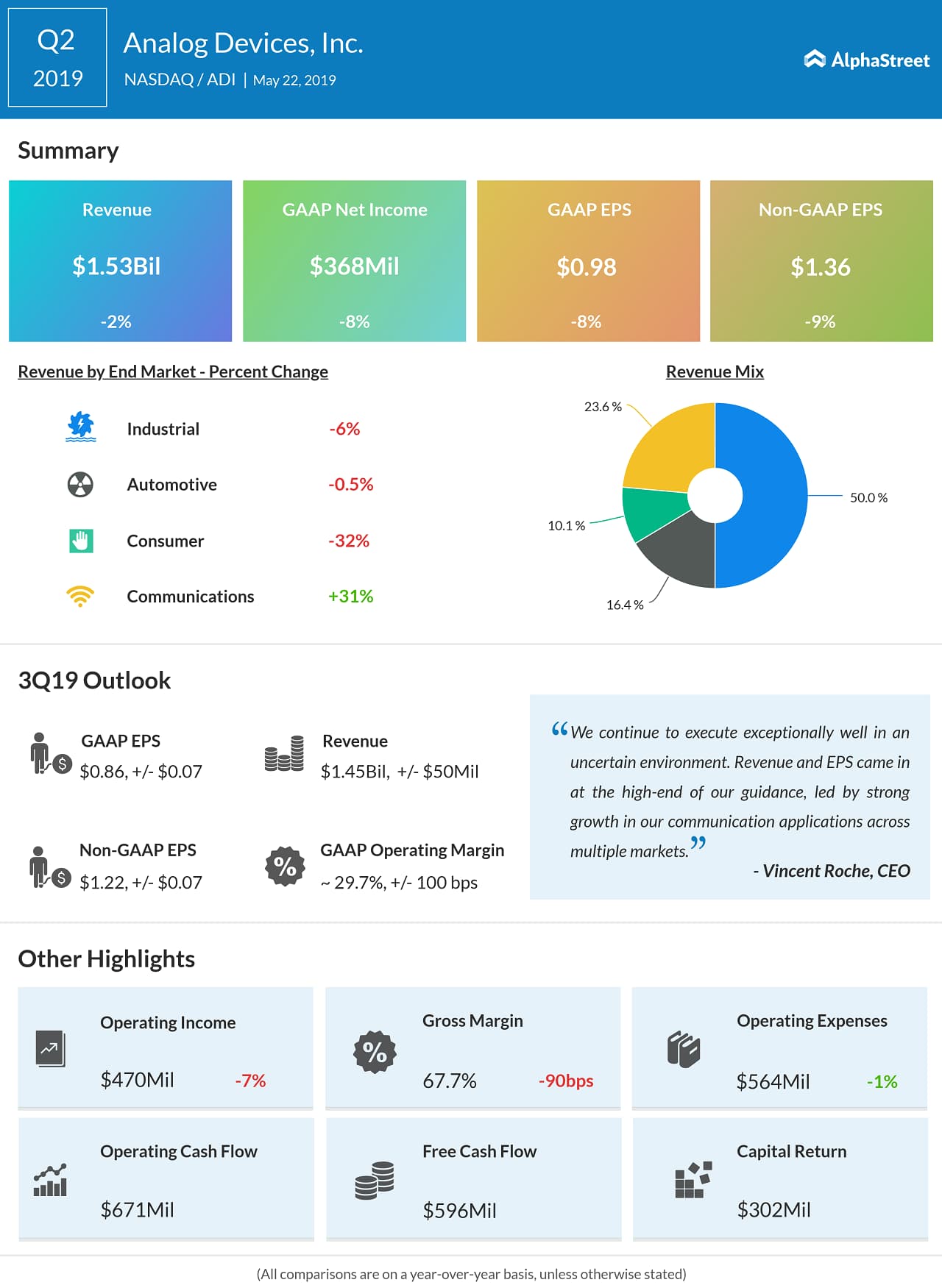

Adjusted earnings per share declined 9% year-over-year to $1.36 and revenue dropped 2% to $1.53 billion for the second quarter ended May 4, 2019. Analysts had projected the company to post earnings of $1.30 per share on revenue of $1.5 billion.

For the third quarter of 2019, Analog Devices expects GAAP EPS to be $0.86, +/- $0.07, and adjusted EPS to be $1.22, +/- $0.07. Revenue for the third quarter is forecasted to be $1.45 billion, +/- $50 million.

Analog Devices stated that this guidance considers the estimated impact on ADI from the U.S. Government’s recently announced export restrictions on Huawei Technologies. As of now, Analog Devices had ceased shipments of products to Huawei, and is reviewing the ability to resume shipments under the recently announced temporary general license.

Also read: Texas Instruments Q1 earnings results

“We continue to execute exceptionally well in an uncertain environment. Revenue and EPS came in at the high-end of our guidance, led by strong growth in our communication applications across multiple markets,” said CEO Vincent Roche.

Shares of Analog Devices, which closed up 2.44% at $99.88 on Tuesday, have gained 16% so far this year and 5% in the past 12 months.