AstraZeneca Plc (NYSE: AZN) topped market estimates for revenue and earnings in the second quarter of 2019, giving shares a lift of 4.7% in premarket hours on Thursday. The consensus estimate was for earnings of $0.29 per share on revenues of $5.5 billion.

Total revenue increased 13% year-over-year to $5.8 billion. Reported EPS fell 64% year-over-year to $0.09 while core EPS rose 5% to $0.73.

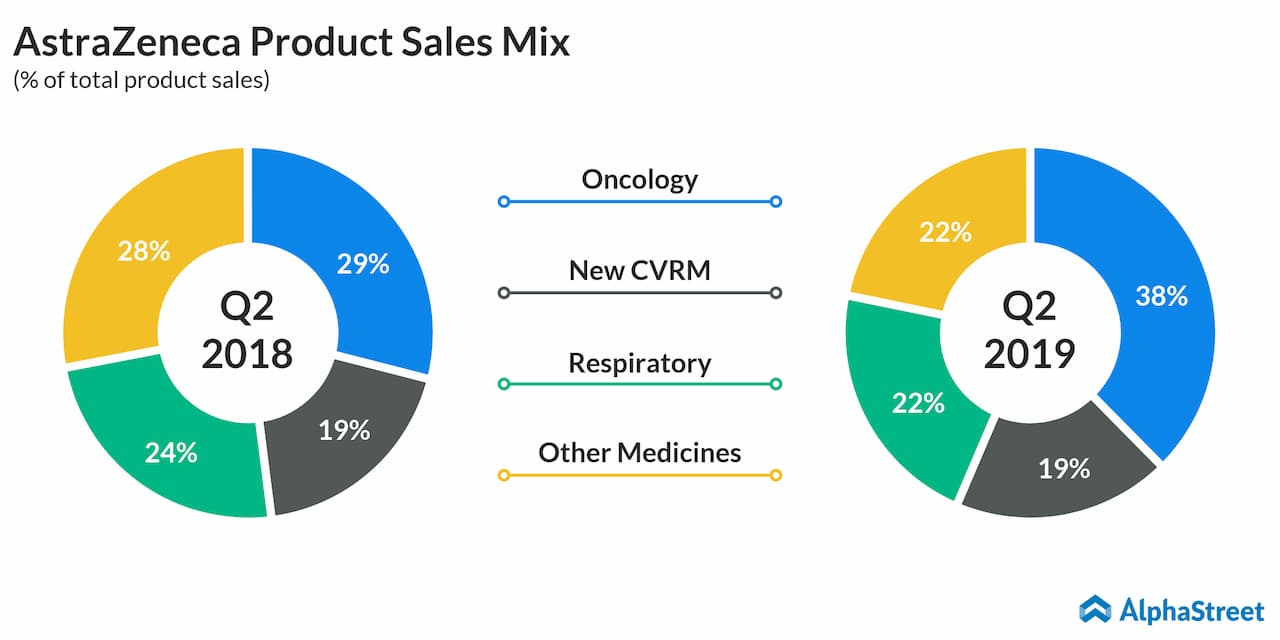

Product sales grew 14% to $5.7 billion while collaboration

revenue dropped 17% to $105 million. Oncology saw the highest sales growth at

51% to $2.16 billion. BioPharmaceuticals sales grew 5% to $2.3 billion, helped

by single digit increases in New CVRM and Respiratory. Other Medicines fell 11%

to $1.2 billion.

Within Oncology, Lynparza and Tagrisso delivered the highest rates of sales growth at 89% and 86% respectively. Symbicort, Nexium and Crestor all recorded sales declines.

Pascal Soriot, CEO, said, “The momentum generated last year continued into the first half, consolidating AstraZeneca’s return to growth based on the strength of our new medicines. Five of these new medicines are anticipated to be blockbusters this year, supporting sales across both Oncology and BioPharmaceuticals. Emerging Markets, the US and Japan all grew strongly, and we delivered an encouraging turnaround in Europe in the second quarter.”

Product sales in the US grew 16% to $1.87 billion while

sales in Europe inched up by 1% to $1.04 billion. Sales in Emerging Markets grew

17% to $1.94 billion.

For fiscal year 2019, the company expects product sales to increase by a low double-digit percentage versus the prior guidance of a high single -digit percentage increase. AstraZeneca reiterates its core EPS guidance of $3.50 to $3.70 over the full year.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.