Shares of Conagra Brands Inc. (NYSE: CAG) have dropped 9% over the past three months and 4% in the past one month. The company reported its second quarter 2021 earnings results a day ago, surpassing market expectations but provided earnings guidance that was lower than what analysts had been expecting.

Quarterly numbers

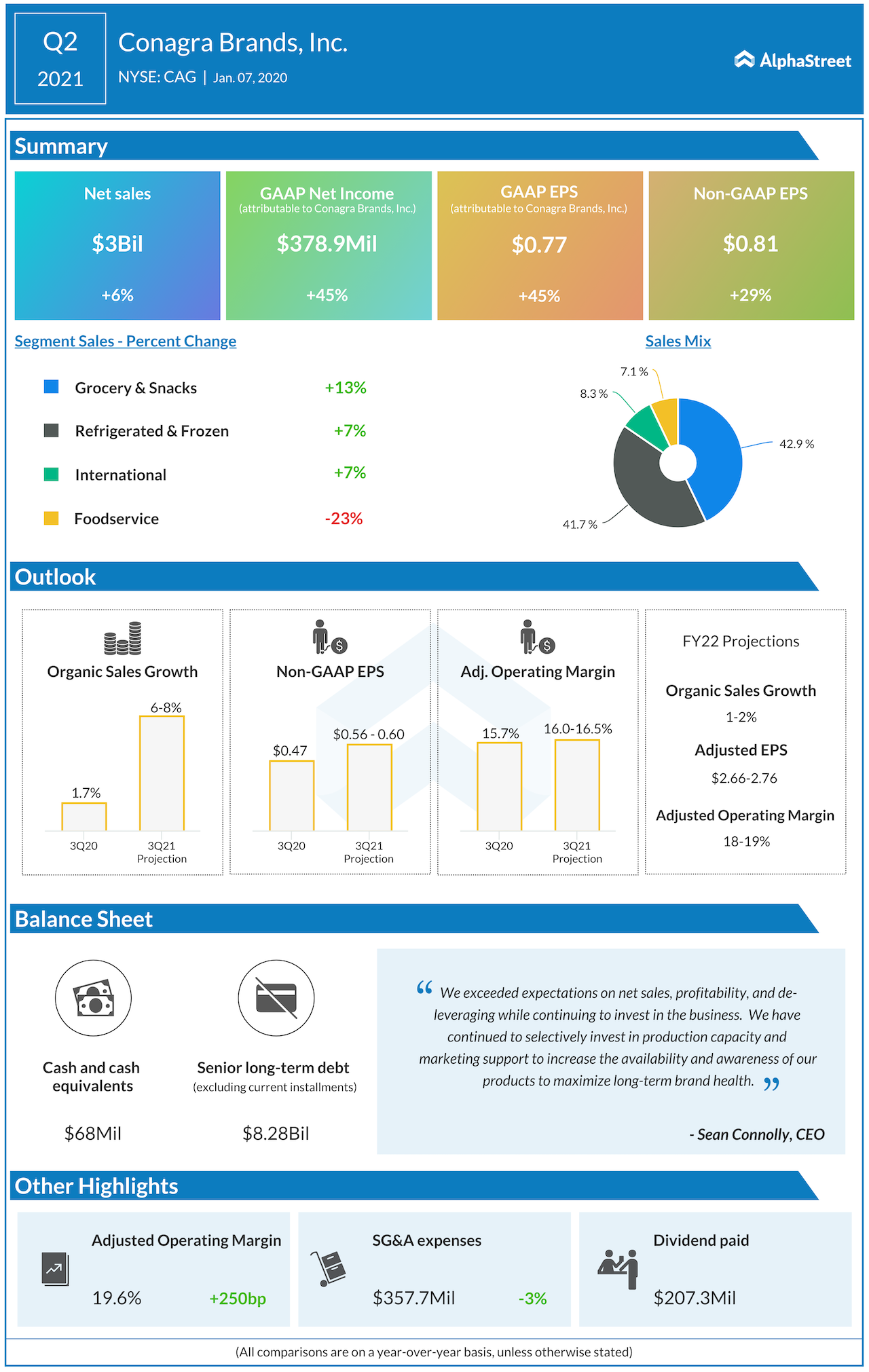

Net sales increased 6.2% to $3 billion, driven mainly by an 8.1% growth in organic net sales. Organic net sales benefited from volume increases and favorable price/mix impacts. The growth in volume was driven by higher at-home food consumption due to the COVID-19 pandemic. While the company’s retail business has seen strong growth during the pandemic period, the foodservice business remains challenged. Adjusted EPS increased nearly 30% to $0.81 per share.

Category performance

Conagra saw sales increases across all its segments except Foodservice. The Grocery & Snacks and the Refrigerated & Frozen segments benefited from an increase in at-home food consumption with strong organic growth across brands like Act II, Snack Pack, Libby’s, PAM, Hungry-Man and Birds Eye. Within the International segment, the company saw strong growth in Canada and Mexico.

Frozen retail sales rose 8.3% year-over-year. The frozen vegetables business saw strong growth helped by capacity investments. In frozen vegetables, the Birds Eye brand saw retail sales growth of 7.2% during the quarter. Plant-based meat alternatives recorded an increase of nearly 16% from the prior-year period. Frozen single-serve meals also witnessed strong growth, rising 10.5% during Q2.

Conagra’s snacks and staples business saw strong growth during the second quarter. The company’s retail sales grew nearly 11% on a year-over-year basis and 15.5% on a two-year basis in snacks. Within this category, popcorn saw the highest growth at 21.3%, followed by sweet treats and meat snacks at 10% and 9% respectively.

The staples category saw retail sales growth of 12.7% driven by an increase in cooking amid the pandemic. Within this category, Hebrew National, which is Conagra’s brand of kosher hot dogs and other sausages, registered the highest growth of nearly 30%. Other brands such as PAM, Reddi-wip, and Hunts also saw double-digit growth.

Outlook

For fiscal year 2021, the company expects retail channels to see strong demand while foodservice is expected to face challenges. For the third quarter of 2021, organic net sales are estimated to grow 6-8% while adjusted EPS is expected to be $0.56-0.60.

Click here to read the full transcript of Conagra Brands Q2 2021 earnings conference call