Payroll processing firm Automatic Data Processing (NASDAQ: ADP) reported better-than-expected results for the Q2 2019 period aided by the ongoing transformation efforts and operational improvement initiatives.

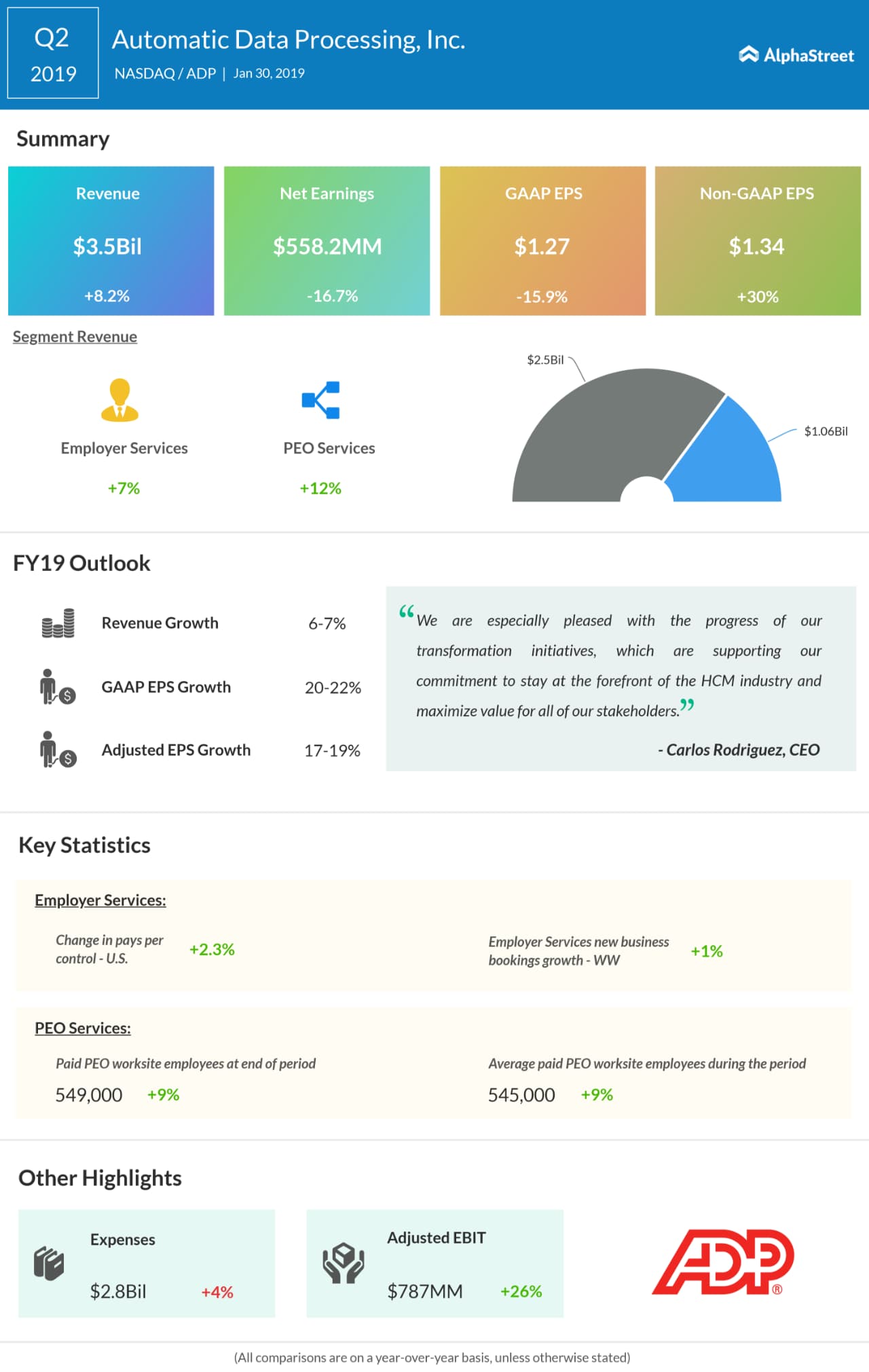

ADP’s top line saw 8% improvement touching $3.5 billion helped by broad-based growth from all its divisions. Earnings saw a 17% drop due to one-time tax benefits recorded last year. However, adjusted earnings jumped 30% to $1.34 per share due to the transformation strategies started yielding results, along with the reduction in share count.

The company’s results topped street estimates on revenue and earnings front. For the second quarter, analysts were expecting earnings of $1.18 per share on sales of $3.44 billion. Last year, the company reported EPS of $0.99 on sales of $3.24 billion.

Segment Update

Revenue from the Employer Services side rose 7% as new business bookings saw modest growth of 1%. However, profits jumped 26% over last year due to improved margins. PEO Services revenue grew 12% driven by 9% growth in average worksite employees serviced by the division.

Going Forward

ADP has lifted its outlook for fiscal 2019 period backed by strong growth expected to be reported from all its segments. The company expects revenue to improve 6% to 7% while adjusted earnings to see a growth of 17% to 19%, an increase from 15% to 17% range outlook provided earlier.

On the segment front, the HRO firm is confident of expanding its client base. New business bookings from the Employer Services division is expected to see a growth of 6% to 8% and client retention to improve 25 to 50 basis points.

On the PEO front, average worksite growth of employees to see 8% to 9% improvement, but margins are expected to remain flat. ADP has factored in the Celergo acquisition and other foreign currency impacts into the 2019 outlook.

Related: ADP Q1 2019 Earnings Call Transcript

ADP’s share price increased above 2% trading at $137.5 levels during the pre-market trading session post the earnings announcement. The company saw an 11% improvement in share price over the last 12 months touching a new 52-week high of $153.51 in October 2018.