BioXcel Therapeutics, Inc. (NASDAQ: BTAI) reported a wider net loss for the fourth quarter, owing to an increase in research and development expenses.

Being a clinical-stage biopharmaceutical company, which is yet to start marketing its products commercially, BioXcel did not record revenues in the fourth quarter. Net loss widened to $8.3 million from $7.1 million in the fourth quarter of 2018.

R&D Expenses up 8%

Research and development expenses increased 8% year-over-year to $6.5 million during the three-month period, reflecting costs associated with the various drug development programs currently underway. At $1.9 million, general and administrative expenses were up 46% year-over-year.

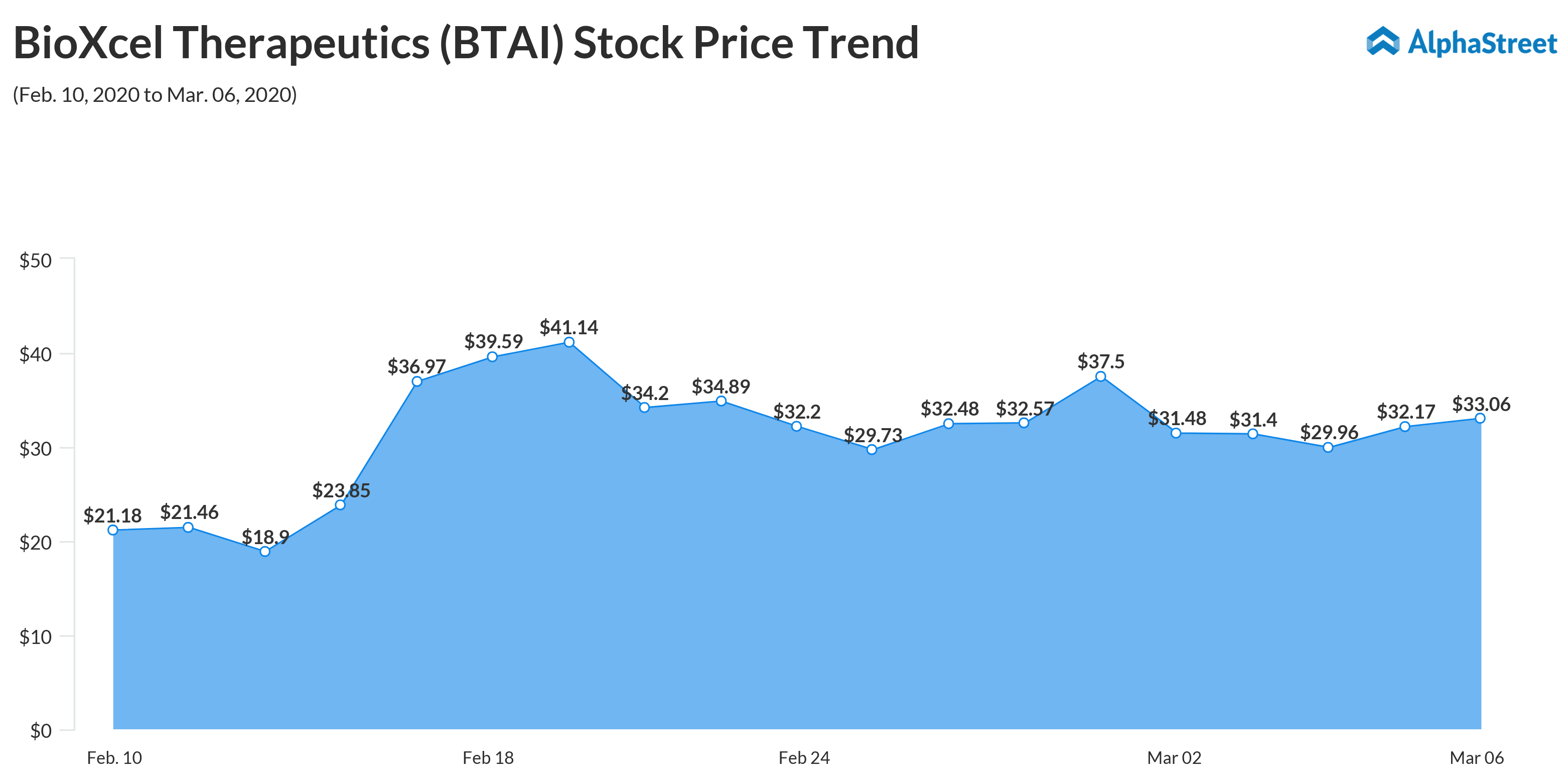

Shares of BioXcel closed the last trading session higher. The stock’s value more than tripled in the past twelve months. In February, it climbed to an all-time high.

“In neuroscience, we have made momentous advancements in the clinical development of BXCL501 and look forward to announcing topline results from our SERENITY program and our Phase 1b/2 TRANQUILITY trial in dementia-related agitation in mid-2020,” said CEO Vimal Mehta.

Key Studies

During the quarter, BioXcel commenced advanced stage clinical trials on its development stage drug candidate BXCL501 for the treatment of agitation in patients with schizophrenia and bipolar disorder. Important data from the trials are expected to come in mid-2020.

Also read: BioXcel Q3 2019 Earnings Conference Call Transcript

The company also received the green signal from the FDA for an investigational new drug application for BXCL501 for the treatment of opioid withdrawal symptoms, which would be an additional indication for the drug.

BXCL701 Evaluation

Also, the clinical evaluation of BXCL701, through the initiation of an open-label phase-II basket trial, was advanced in the final months of 2019. BXCL701 is being evaluated in patients suffering from advanced stage cancers, in combination with Pembrolizumab.

The management intends to use the $60-million proceeds received from the recent common stock offering to fund the company’s clinical, regulatory and operational milestones this year and next year.