The coronavirus crisis had a heavy impact on the shares of Broadcom Inc. (NASDAQ: AVGO), which plunged to a three-year low this week. The semiconductor company reported weaker-than expected earnings and revenues for the first quarter of 2020.

January-quarter revenues increased modestly, while earnings dropped year-over-year. The company also withdrew the full-year guidance issued earlier, in view of the uncertainties prevailing in the market due to the Copid-19 epidemic.

Mixed Top-line

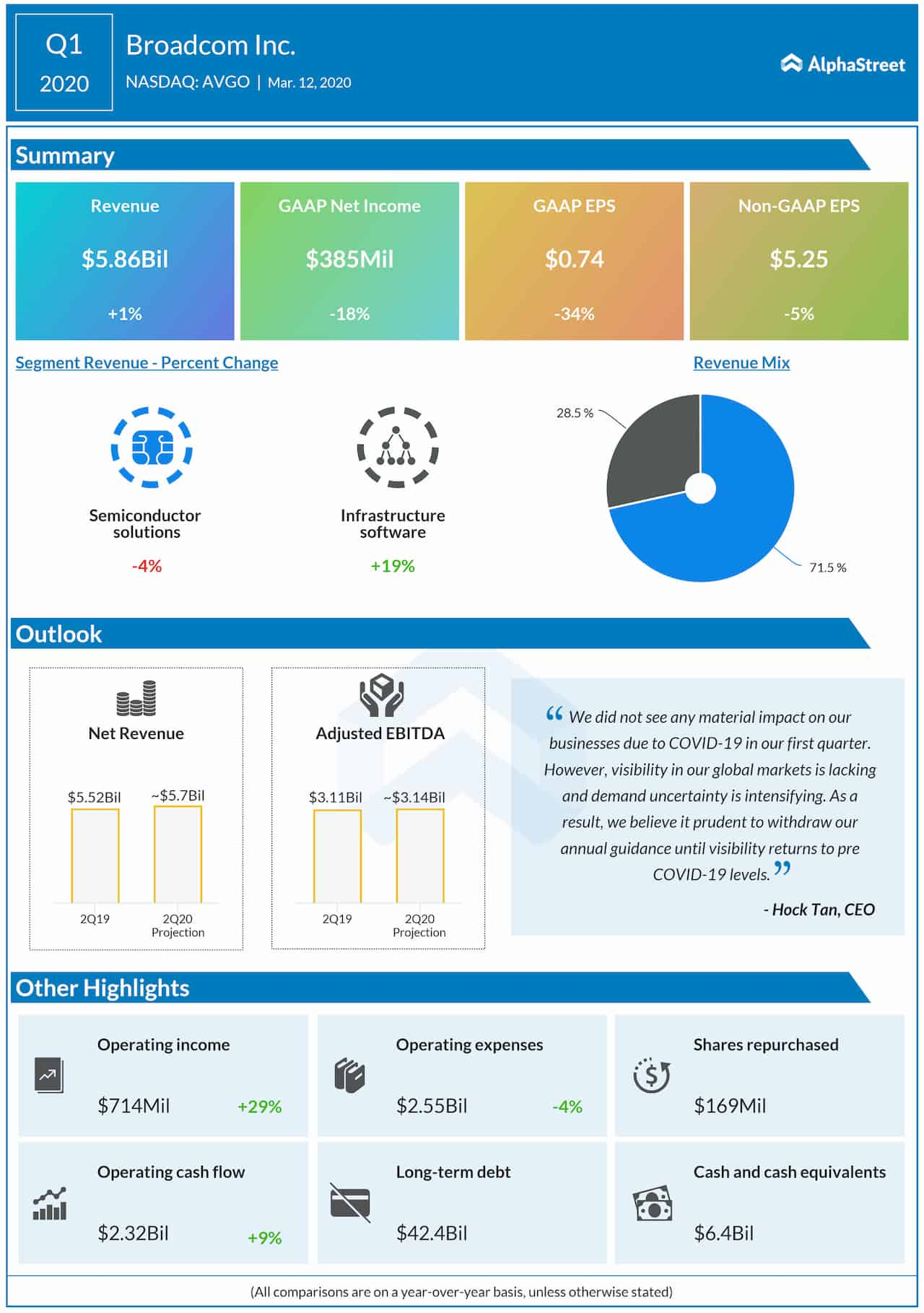

The continued weakness in the core Semiconductor Solutions segment was more than offset by strong performance by Infrastructure Software, and total revenues moved up 1% annually to $5.86 billion. Analysts were looking for a faster top-line growth.

Earnings Dip

At $5.25 per share, adjusted earnings, excluding special items, was down 5% from last year and slightly below the consensus estimate. Reported profit dropped to $385 million or $0.74 per share from $471 million or $1.12 per share in the first quarter of 2019.

Also see: Broadcom Q4 2019 Earnings Conference Call Transcript

ADVERTISEMENT

Hock Tan, President and CEO said, “The fundamental semiconductor backdrop has been improving, and we did not see any material impact on our businesses due to COVID-19 in our first quarter. However, visibility in our global markets is lacking and demand uncertainty is intensifying.”

Guidance

The company said it is withdrawing the full-year guidance issued earlier, in view of the impact of the Covid-19 outbreak on the global business environment. For the second quarter of 2020, Broadcom expects revenues to be $5.7 billion, plus of minus $150 million. Adjusted EBITDA is expected to be $3.14 billion in the April-quarter, plus or minus $75 million, which is 55% of revenue.

In December, the company had paid a cash dividend of $3.25 per share, totaling $1.30 billion.

Broadcom’s shares closed Thursday’s regular trading lower and continued to lose during the extended session, following the announcement. The stock dropped around 30% since the beginning of 2020, paring most of last year’s gains.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.