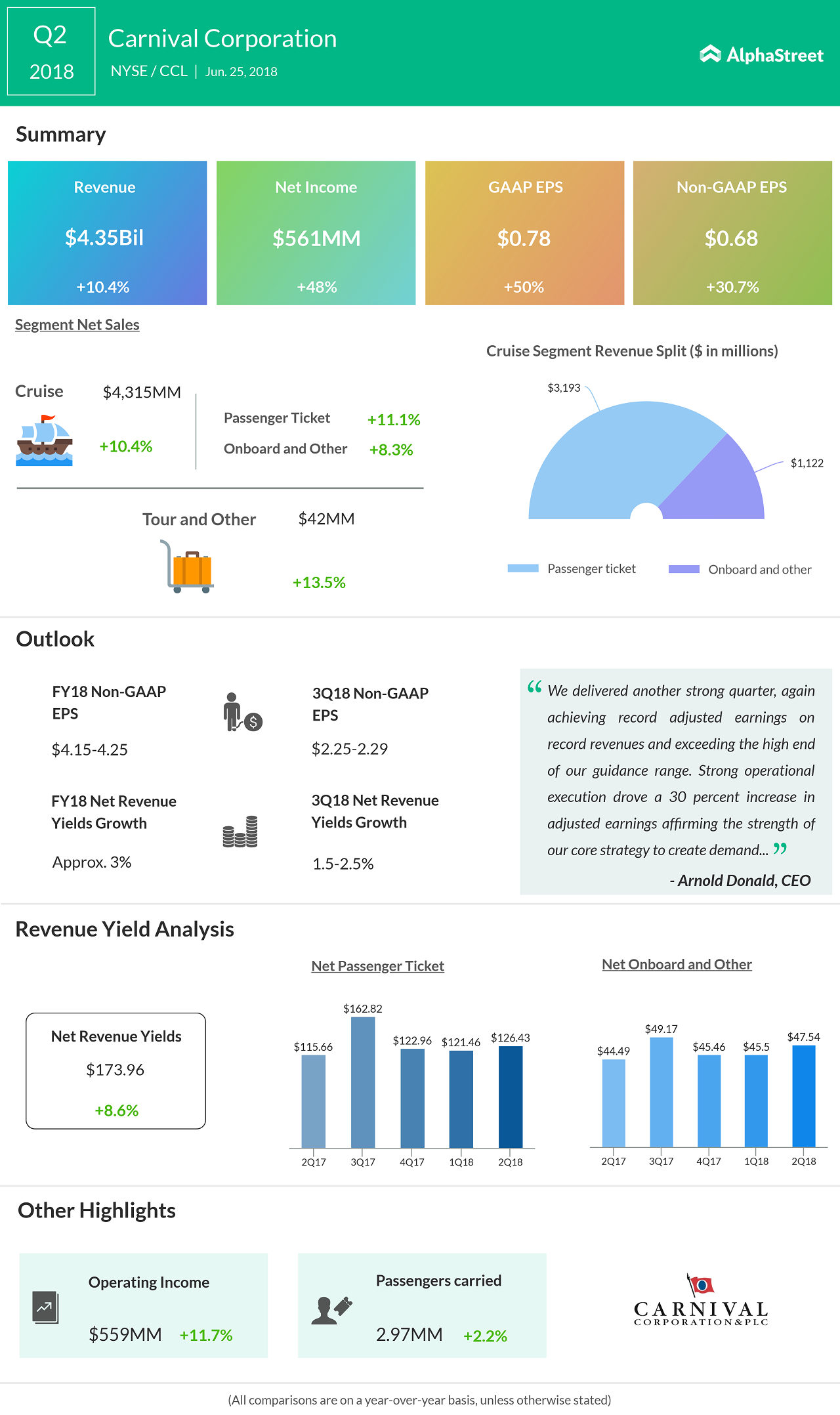

Carnival Corporation (CCL/CUK) reported revenues and earnings that beat consensus estimates but the weak outlook made the stock trade in red. Revenue grew 10% year-over-year to $4.4 billion for the second quarter of 2018. Net income surged 48% to $561 million and climbed 50% on a per share basis to $0.78. Adjusted net income was $489 million or $0.68 per share.

Gross revenue yields rose 8.8% while net revenue yields, in constant currency, grew 4.8%. The cruise operator increased its dividend by 11% to $0.50 and replenished its share repurchase program to $1 billion.

Passenger ticket revenues grew 11% to $3.1 billion while Onboard and other revenues remained relatively flat. The occupancy percentage increased to 105.7% from 104.1% last year.

Carnival’s President and CEO Arnold Donald said, “We delivered another strong quarter, again achieving record adjusted earnings on record revenues and exceeding the high end of our guidance range. Strong operational execution drove a 30% increase in adjusted earnings affirming the strength of our core strategy to create demand that outpaces measured capacity growth through outstanding guest experience efforts coupled with innovative actions to increase consideration for cruising across all global markets.”

Carnival expects net revenue yields for 2018 in constant currency to be up about 3% from last year, based on current booking trends. The company trimmed down its 2018 adjusted EPS target to $4.15 to $4.25 from the previous estimate of $4.20 to $4.40. The company remains on track to deliver double digit return on invested capital in 2018.

For Q3 2018, constant currency net revenue yields are expected to be up about 1.5% to 2.5% from the prior-year period. Adjusted EPS is expected to be $2.25 to $2.29. During the first hour of the trading, the shares of the leisure travel company plunged 10% due to the cut in 2018 outlook. The stock had lost 4.3% so far this year and 3.7% in the past one year.