Caterpillar, Inc. (NYSE: CAT) reported broad-based sales growth and higher earnings for the first quarter of 2019, beating analysts’ predictions, helped by strong demand for both equipment and services. The company’s stock gained early Wednesday after the announcement.

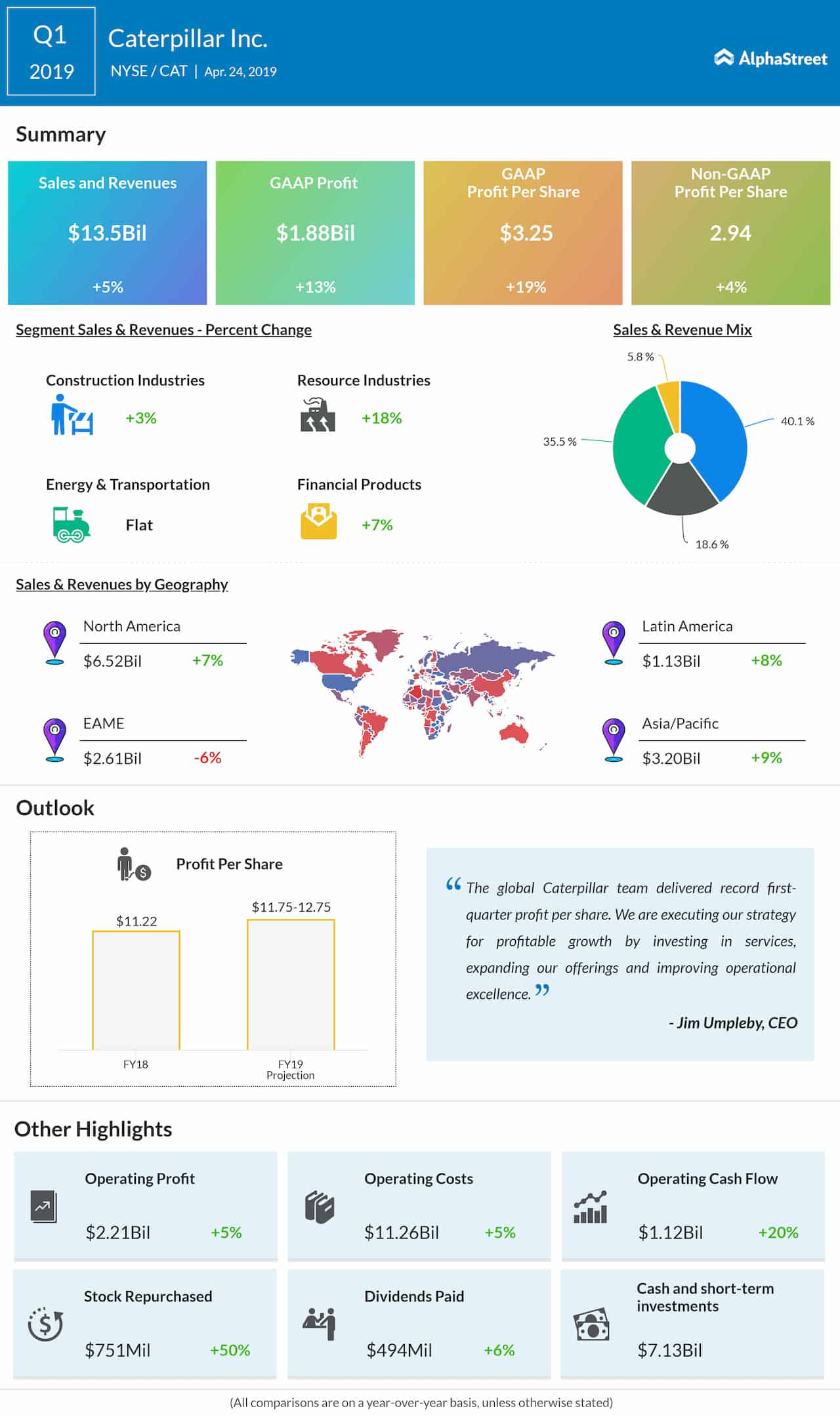

For the March quarter, the Illinois-based construction equipment maker reported sales and revenues of $13.5 billion, up 5% from last year and above the estimates. The growth was driven mainly by higher sales volume amid improved demand for both equipment and services, with the Resource segment being the primary contributor. Meanwhile, growth was partially offset by unfavorable currency impacts due to a stronger US dollar.

Revenues of the Construction and Resource segments grew 3% and 18% respectively, while Energy Transportation revenue remained unchanged. There was a 7% increase in the sales of Financial Products. All the geographical areas, except the EAME region, registered higher revenues during the three-month period.

Earnings, excluding one-off items, moved up 4% annually to $2.94 per share and surpassed the estimates. Reported profit was $1.88 billion or $3.25 per share, compared to $1.67 billion or $2.74 per share in the first quarter of 2018.

Jim Umpleby, CEO of Caterpillar, said, “The global Caterpillar team delivered record first-quarter profit per share. We are executing our strategy for profitable growth by investing in services, expanding our offerings and improving operational excellence.”

Also see: Caterpillar Inc. Q4 2018 Earnings Conference Call Transcript

The management revised up its full-year 2019 earnings per share outlook to the range of $12.06 to $13.06 from the previous forecast of $11.75-$12.75, primarily to reflect a discrete tax benefit of $0.31 per share. Meanwhile, the outlook for adjusted earnings per share was reaffirmed between $11.75 and $12.75. During the first quarter, the company repurchased $751 million of its shares and paid dividends of about $494 million.

For the fourth quarter, the company had reported a double-digit increase in revenues and earnings as all the business segments and geographical regions registered growth.

Caterpillar shares gained about 12% since the beginning of 2019 but underperformed the market. The stock closed Tuesday’s trading session lower but gained in the pre-market session Wednesday.