Social media firm Momo Inc. (NASDAQ: MOMO) is scheduled to publish its fourth-quarter earnings Thursday early morning. Analysts are looking for earnings of $0.76 per share for the quarter, when the China-based dating platform is expected to have generated revenues of $655 million. The estimates represent double-digit growth from the year-ago period.

The management’s efforts to woo customers by offering multiple products – like online dating and social discovery – and monetize the traffic have been successful. That, combined with the encouraging response to the virtual gift feature and live video streaming, is expected to have contributed to the top-line in the to-be-reported quarter.

Growth Plan

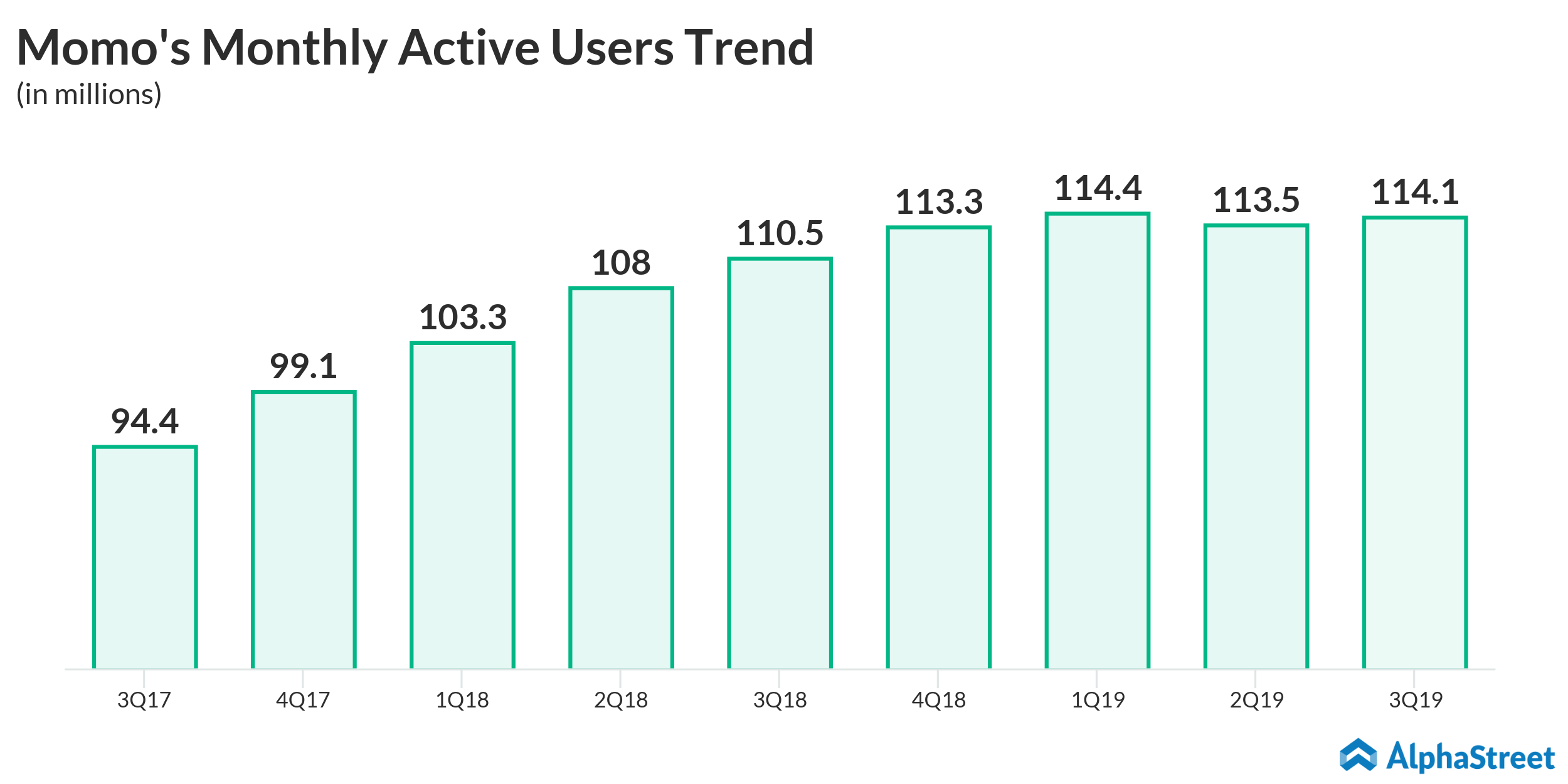

Momo has a stable cash flow that is better than most of its competitors, which allows the company to pursue its expansion program with focus on product revamp. For retaining the current momentum, the company needs to execute the initiatives effectively, considering the recent slowdown in user growth.

Like most of its peers, Momo is currently facing a high level of uncertainty. It is likely that disruptions caused by the covid-19 outbreak would weigh on its first-quarter results. Taking a cue from the recent dip in its value, analysts recommend buying the stock and forecast a strong recovery later this year.

Q3 Performance

In the third quarter, the number of monthly active users climbed to more than 114 million. There was a 22% annual growth in revenues, which also surpassed the market’s prediction. The top-line growth was supported by a further uptick in the number of paying users, which translated into an increase in earnings.

Competition

Last week, Momo’s competitor Weibo Corp. (WB) said its fourth-quarter earnings dropped, hurt by a decline in advertising and marketing revenues. The bottom-line was also impacted by higher costs.

This week, Momo’s shares slipped below the $20-mark for the first time in more than three years as investors withdrew from the market en masse due to the coronavirus scare. The stock dropped 45% since the beginning of 2020, paring most of last year’s gains.