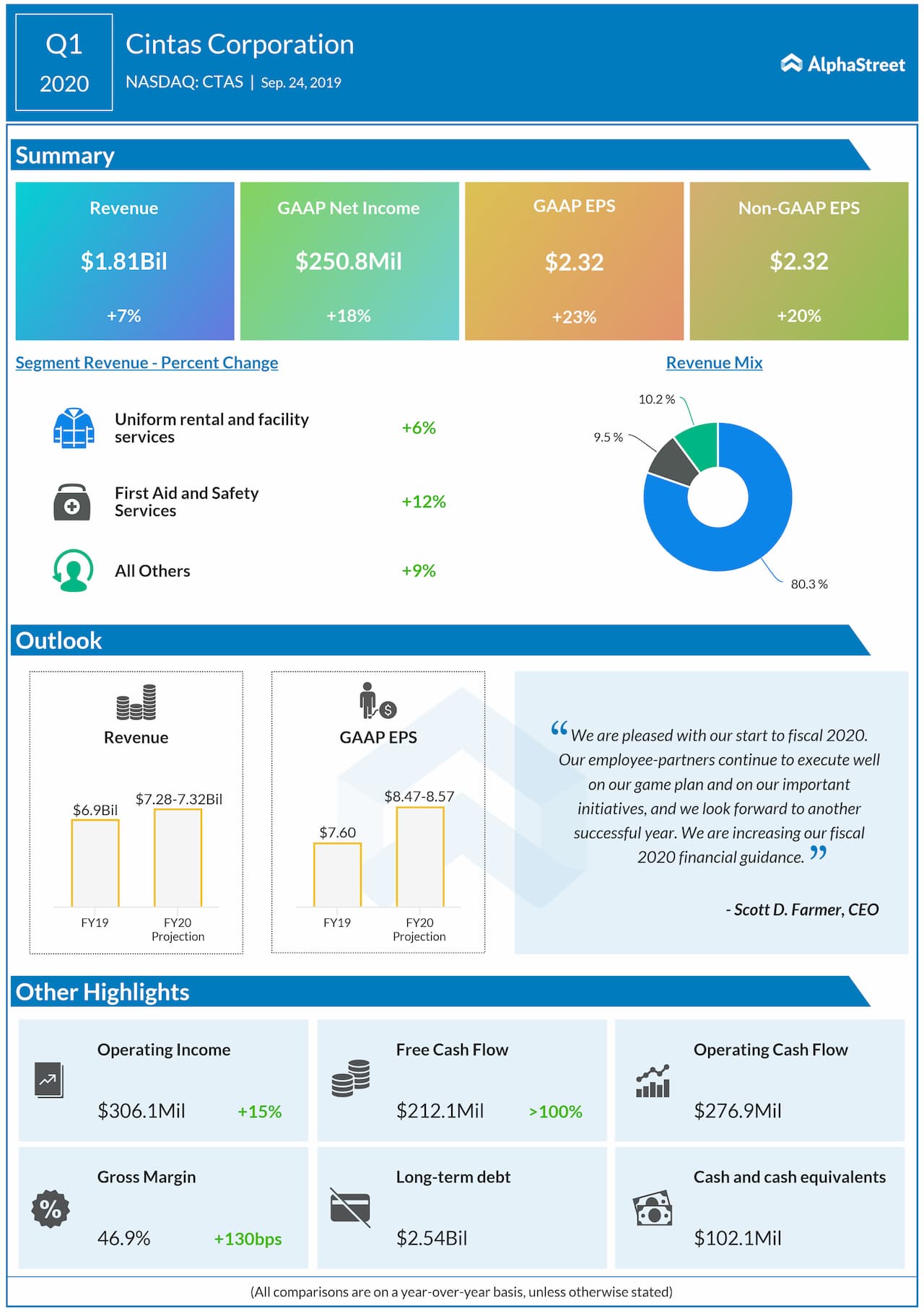

Cintas (NASDAQ: CTAS) reported an 18% jump in earnings for the first quarter of fiscal 2020 helped by higher revenue as well as strong sales across all the business segments. The results exceeded analysts’ expectations. Further, the corporate uniform maker raised its earnings and revenue guidance for the full year 2020.

Net income from continuing operations jumped by 18% to $250.8 million or $2.32 per share. G&K acquisition integration expenses negatively impacted EPS in the first quarter of 2019 by $0.04. Adjusted earnings increased by 20.2% to $2.32 per share.

Revenue rose by 7% to $1.81 billion. The organic revenue growth rate, which adjusts for the impacts of acquisitions, foreign currency exchange rate fluctuations, and differences in the number of workdays, was 8.3%. The Uniform Rental and Facility Services segment registered a 7.5% organic sales growth, while First Aid and Safety Services recorded a 13.8% gain.

Looking ahead into the full year 2020, the company lifted its revenue outlook to the range of $7.28 billion to $7.32 billion from the previous range of $7.24 billion to $7.31 billion. The earnings from continuing operations guidance are raised to the range of $8.47 to $8.57 per share from the prior range of $8.30 to $8.45 per share.

The financial guidance does not include any potential deterioration in the US economy or future share buybacks. It does incorporate the impact of having one less workday in fiscal 2020 compared to fiscal 2019.

Read: Ovid Therapeutics stock gains 8-month high

The company plans to expand its presence in existing markets and enter new markets by opening new operating facilities. This is necessary to gain the capacity required for expansion. Also, the company continues to evaluate opportunities for acquiring businesses that may supplement its internal growth.

As of August 31, 2019, Cintas had a total debt of $2.85 billion while its cash and cash equivalents stood at $102.13 million. The company has a cash flow from operations of $276.9 million. Following this, it is known that Cintas will take about 10 years to repay its debt since it would be able to repay 10% each year.