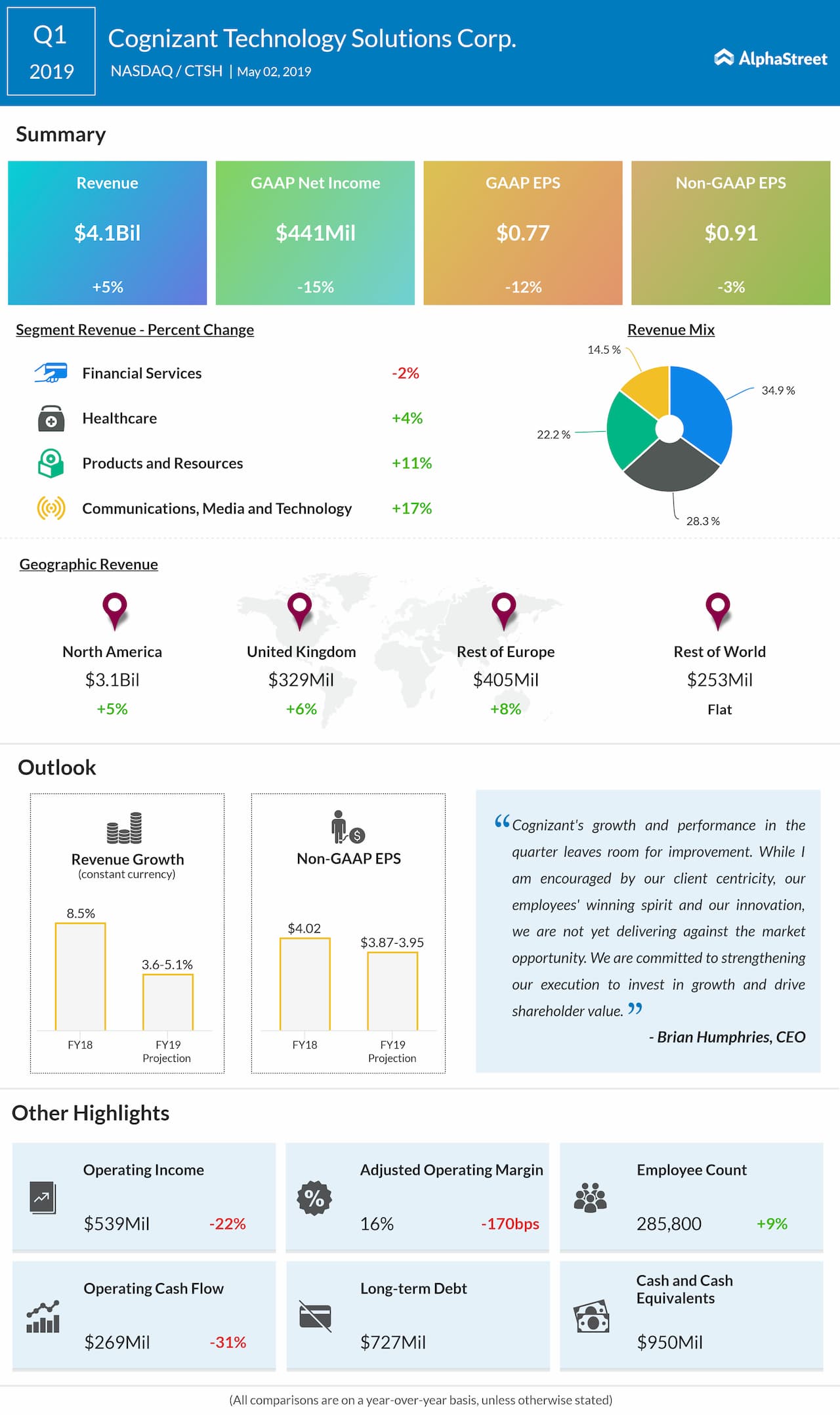

Shares of Cognizant (NASDAQ: CTSH) fell 1.6% after the IT services firm reported first-quarter earnings of $0.91 per share, missing the street view of $1.03 per share. Revenues came in at $4.11 billion, up 5% year-over-year. However, analysts had projected revenues of $4.17 billion.

On a reported basis, the company posted a net profit of $441 million, or $0.77 per share, compared to $520 million, or $0.88 per share in the year-over period.

The stock has declined 11% in the trailing 52 weeks. Since the start of this year though, the stock has somewhat recovered, gaining 14%.

Brian Humphries, who took charge as Cognizant CEO on April 1, said, “While I am encouraged by our client centricity, our employees’ winning spirit, and our innovation, we are not yet delivering against the market opportunity.”

The company expects the ongoing execution of its long-term strategy to drive revenue and earnings growth in the current fiscal year. However, a weak first quarter forced the company to slash its full-year guidance.

READ: IMMUNOGEN IS CHEAP AHEAD OF EARNINGS, BUT IS IT WORTH?

The outlook for full-year revenue growth was slashed to 3.6% to 5.1%, from the prior guidance range of 7% to 9%. Full year adjusted EPS is now expected in the range of $3.87-$3.95, compared to the earlier projection of $4.40.

Meanwhile, the growth forecast for the second quarter was projected between 3.9% and 4.9%.

CFO Karen McLoughlin said, “Our revised full-year outlook reflects the first-quarter underperformance and expectations of slower growth in Financial Services and Healthcare for the remainder of 2019.”