Professional services company Cognizant Technology Solutions Corp. (NASDAQ: CTSH), which has been on an acquisition spree, Wednesday reported stronger-than-expected results for the fourth quarter of 2019. The market responded positively to the report and the stock gained during Wednesday’s after-hours trading session. The company also raised its quarterly dividend by 10% and provided guidance for fiscal 2020.

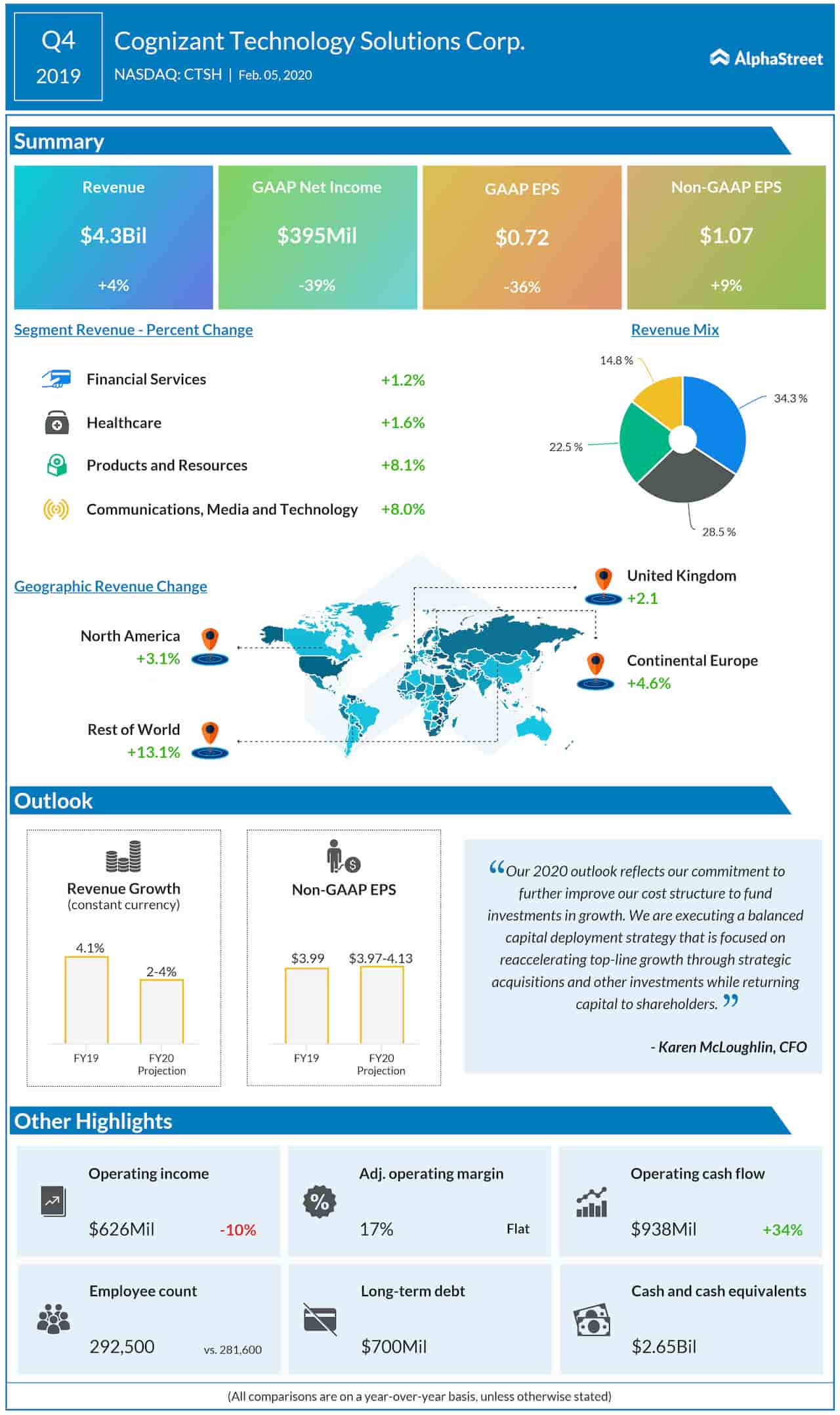

The Teaneck, New Jersey-based tech firm reported adjusted earnings of $1.07 per share for the December-quarter on revenue of $4.3 billion. All the business segments registered growth during the quarter, with the Products and Resources unit recording the highest gain of 8.1%.

Results Beat

Both earnings and revenues increased from the year-ago period and surpassed analysts’ forecast. Unadjusted profit, meanwhile, dropped to $395 million or $0.72 per share from $648 million or $1.12 per share in the fourth quarter of 2018.

Commenting on the fourth-quarter results, Cognizant CFO Karen McLoughlin said, “Our 2020 outlook reflects our commitment to further improve our cost structure to fund investments in growth. We are executing a balanced capital deployment strategy that is focused on reaccelerating top-line growth through strategic acquisitions and other investments while returning capital to shareholders .”

Outlook

The company expects its performance in 2020 to be affected by the exit of certain content service businesses. Accordingly, the management predicts first-quarter revenues to grow between 2.8% and 3.8%. In the whole of 2020, the top-line is seen growing between 2% and 4%. Full-year adjusted operating margin is currently estimated to be in the 16-17% range. The forecast for 2020 adjusted earnings is $3.97-4.13 per share.

Dividend Hike

Meanwhile, the board of directors raised Cognizant’s quarterly dividend by 10% to $0.22 per share. It also declared a fresh dividend, to be paid to shareholders of record on February 18, 2020.

Cognizant

lost significant market share last year and the stock lost about 11%

in the past twelve months. However, the shares entered 2020 on a

positive note and gained 5% so far.