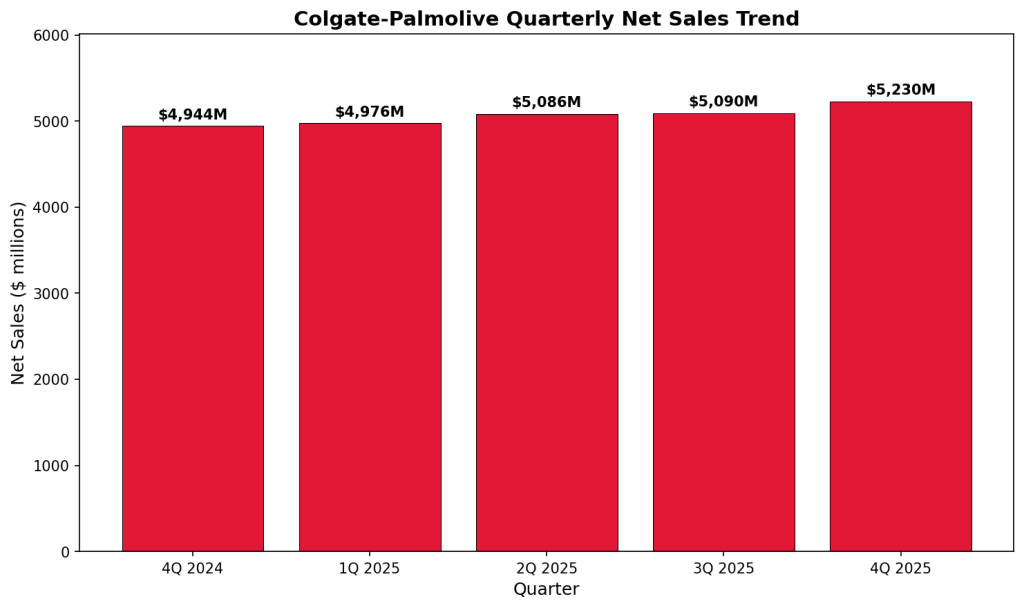

Colgate-Palmolive Company (NYSE: CL) reported fourth-quarter and full-year 2025 financial results on January 30, 2026. Q4 net sales increased 5.8% to $5.23 billion with organic sales growth of 2.2%. Full-year net sales reached a record $20.38 billion.

Market Capitalization

Colgate-Palmolive had a market capitalization of approximately $68-70 billion as of January 30, 2026.

Q4 2025 Results

Colgate-Palmolive reported consolidated net sales of $5.23 billion for Q4 2025, representing 5.8% year-over-year growth. Organic sales increased 2.2%, including a 0.9% negative impact from the exit of the private label pet food business. Foreign exchange provided a 3.1% benefit to net sales.

Gross profit was $3.15 billion with gross profit margin of 60.2%, down 10 basis points year-over-year. On a GAAP basis, operating profit was $92 million. On a Base Business (non-GAAP) basis, operating profit was $1.11 billion, up 3% year-over-year.

The company recorded a non-cash, after-tax impairment charge of $794 million related to goodwill and intangible assets for the skin health business, primarily Filorga, due to lower than expected category growth and performance in China.

Segment Performance

By division in Q4 2025: Latin America net sales increased 12.8% with organic sales up 6.5%. Europe net sales grew 9.8% with organic sales up 1.8%. Africa/Eurasia net sales increased 15.0% with organic sales up 10.3%. Asia Pacific net sales declined 0.3% with organic sales up 0.1%. North America net sales declined 1.5% with organic sales down 1.8%. Hill’s Pet Nutrition net sales grew 4.9% with organic sales up 1.5%.

Full-Year 2025 Results

For full-year 2025, Colgate-Palmolive reported record consolidated net sales of $20.38 billion, up 1.4% year-over-year. Organic sales also increased 1.4%, including a 0.7% negative impact from lower private label pet volume. Gross profit was $12.25 billion with gross profit margin of 60.1%.

Net income attributable to Colgate-Palmolive was $2.13 billion for full-year 2025, compared to $2.89 billion in 2024. The decline reflects the skin health impairment charge. Net cash provided by operations reached a record $4.20 billion. Free cash flow before dividends was $3.63 billion. The company returned $2.9 billion to shareholders through dividends and share repurchases.

Quarterly Net Sales Trend

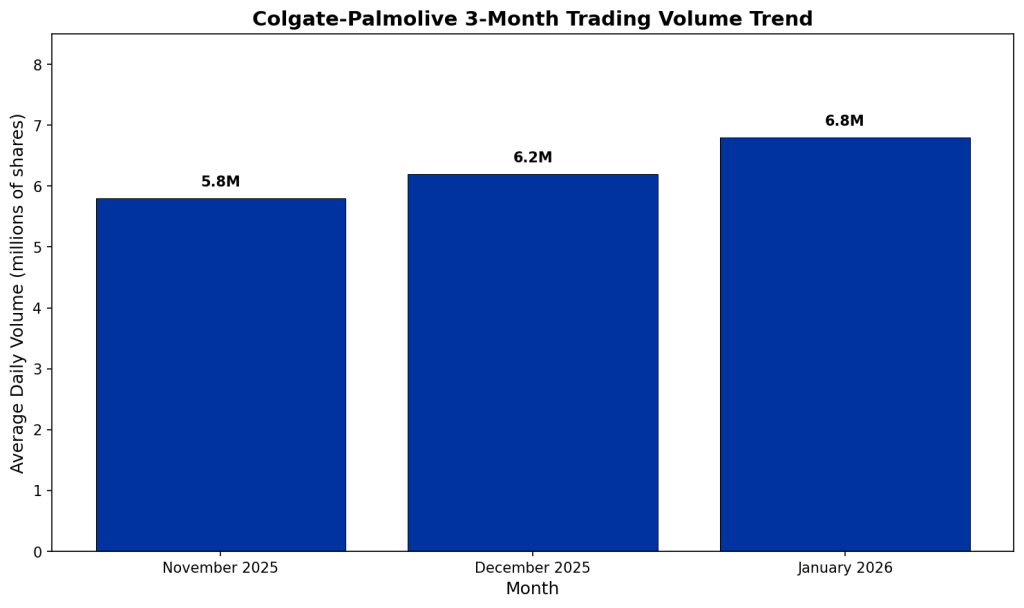

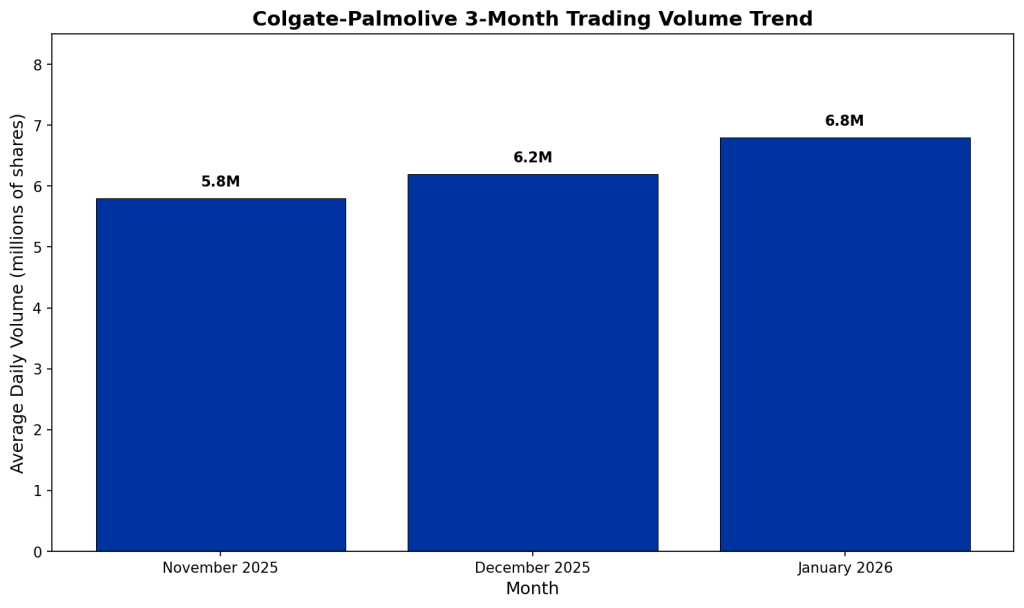

3-Month Trading Volume Trend

Business and Operations Update

Colgate maintained global toothpaste market share leadership at 41.3% year-to-date and manual toothbrush market share at 32.4% year-to-date. In the United States, the company’s toothpaste market share was 33.3% and manual toothbrush market share was 41.3% year-to-date.

The company announced its Strategic Growth and Productivity Program (SGPP) in 2025, enabling organizational modifications to increase efficiency and provide resources for executing the 2030 strategic plan.

Strategic Developments

Colgate-Palmolive completed the acquisition of the Prime100 pet food business in Australia during 2025. The company increased its dividend for the 63rd consecutive year. The company’s annual meeting of stockholders is scheduled for May 8, 2026.

Guidance and Outlook

For 2026, Colgate-Palmolive issued the following guidance: net sales growth of 2% to 6%, including a low-single-digit positive impact from foreign exchange; organic sales growth of 1% to 4%, including an approximately 20 basis point impact from the private label pet food exit; gross profit margin expansion on both GAAP and Base Business basis.

On a GAAP basis, the company expects double-digit growth. On a Base Business basis, the company expects low to mid-single-digit growth. Advertising is expected to increase on both a dollar basis and as a percentage of net sales. The guidance assumes category growth rates of 1.5% to 2.5% and is based on tariffs announced and finalized as of January 28, 2026.

Performance Summary

Colgate-Palmolive reported Q4 2025 net sales of $5.23 billion, up 5.8% year-over-year. Full-year 2025 net sales reached a record $20.38 billion. Net income for full-year 2025 was $2.13 billion. The company recorded a $794 million after-tax impairment charge related to the skin health business. Net cash provided by operations reached a record $4.20 billion. The company maintained market leadership in toothpaste at 41.3% global market share.