Cronos Group Inc. (NASDAQ: CRON) is set to release its third-quarter earnings results on Tuesday before the market opens. The results will be benefited by the cannabis production, cannabis oil sales, cannabidiol oil, and dry flower sales while the company could experience an increase in costs and expenses due to R&D and investments in production.

The company is likely to turn beneficial from its R&D capabilities expansion, innovation expertise, and global infrastructure network. Also, the acquisition of Redwood Holding’s hemp-based CBD platform for entering into the US market is likely to yield the benefits during the third quarter.

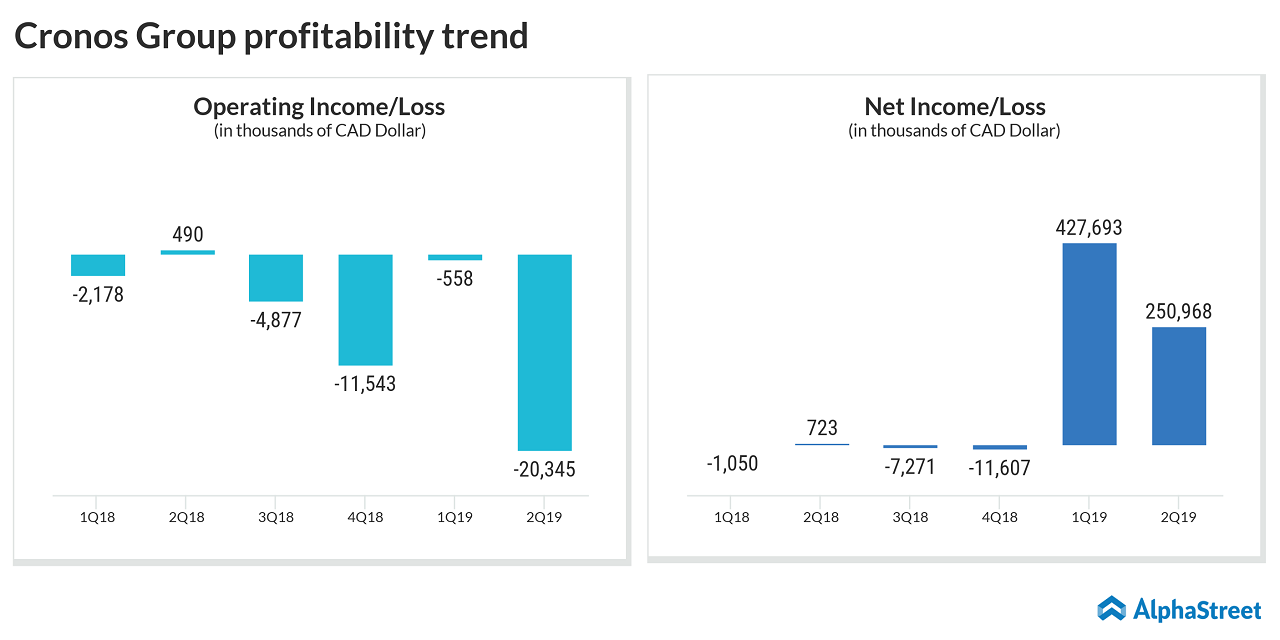

Meanwhile, investors remained concerned about the company’s misleading profitability picture as there remained differences in the net income and operating profit growth since 2018. Also, traders believe that the non-operating items are overshadowing the operating results.

Cronos achieved an operating loss of $20.35 million during the second quarter of 2019 but the gain on revaluation of derivative liabilities turned the loss to a net income of $250.97 million. This has been the second time the company has shown bottom-line growth this year.

Analysts expect the company to report a loss of $0.03 per share on revenue of $11.08 million for the third quarter. In comparison, during the previous year quarter, Cronos posted a loss of $0.03 per share on revenue of $2.83 million. The company has surprised investors by beating analysts’ expectations twice in the past four quarters.

For the second quarter, Cronos Group reported a 202% jump in total revenues driven by the launch of the adult-use market in Canada. The bottom-line growth was benefited by the gain on the revaluation of derivative liabilities despite an increase in the operating expenses.

The company sold 1,584 kilograms during the second quarter, which was up 232% year-over-year, mainly driven by increased cannabis production and the launch of the adult-use market in Canada. Net product revenue/gram sold fell 8% to CAD6.44.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.