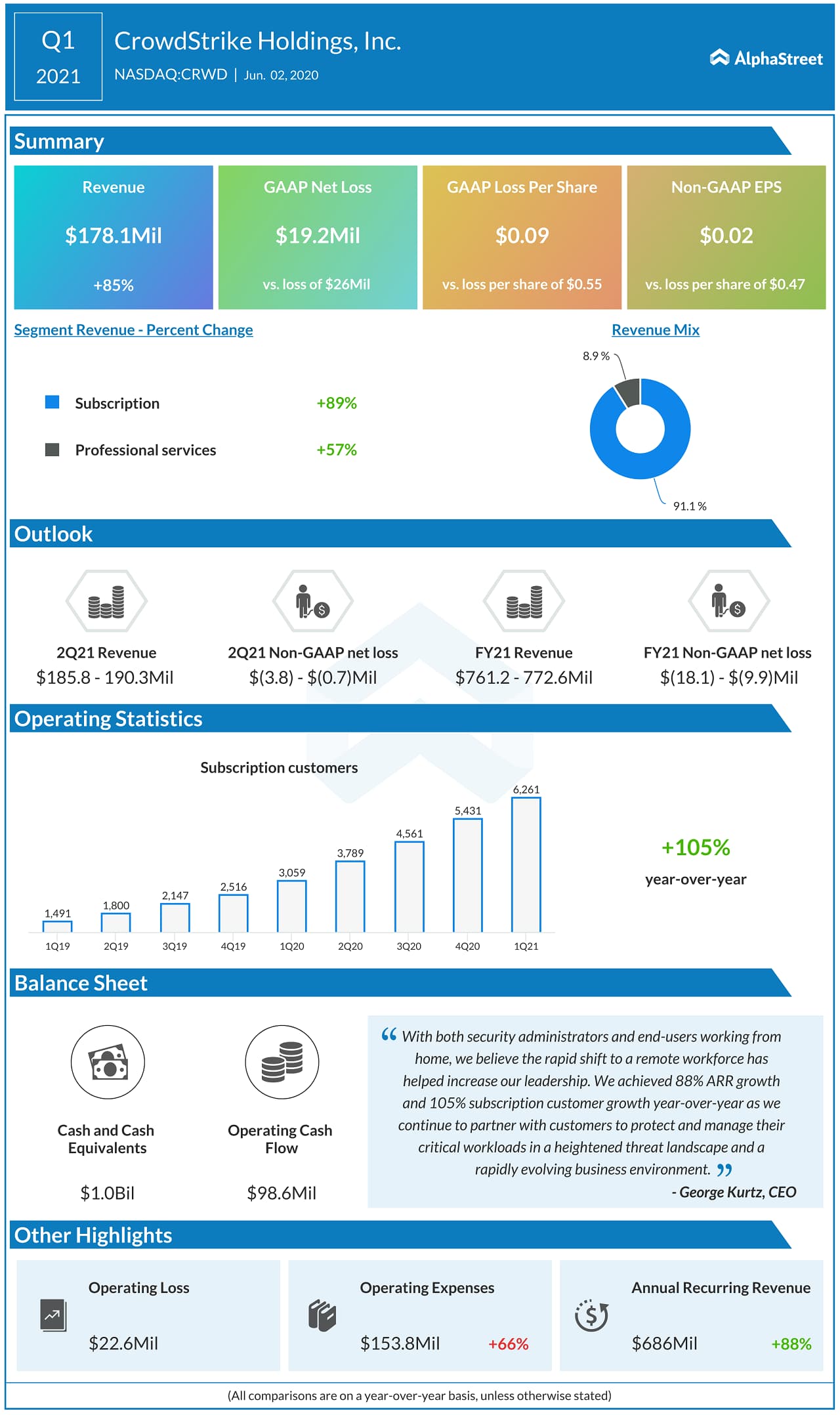

CrowdStrike Holdings Inc. (NASDAQ: CRWD) has witnessed strong momentum with the stock gaining over 96% since the beginning of the year. The company delivered strong results for the first quarter of 2021 with an 85% jump in total revenue and a growth in net new subscription customers of 105%.

Remote work

The shift to remote work brought on by the pandemic has

benefited CrowdStrike over the past few months and this momentum continued into

the first quarter allowing it to expand its footprint. The company believes the

trends of digital transformation and working remotely are here to stay and the

necessity to protect workloads, irrespective of their location, will lead to further

demand for its offerings.

“An increasing number of organizations recognize the power of CrowdStrike’s cloud-native Falcon platform to effectively stop breaches as well as simplify their security and I.T. operations stack with a single, lightweight agent. Cybersecurity is mission critical and in the quarter our customers continued to prioritize their cybersecurity investments. With both security administrators and end-users working from home, we believe the rapid shift to a remote workforce has helped increase our leadership.” – George Kurtz, Co-founder and CEO

The moving away from on-premise technologies and the increased adoption of cloud by companies is also giving a boost to CrowdStrike’s business. The company continues to win deals with large enterprises and expanded its module adoption with new and existing customers.

CrowdStrike closed a major chunk of seven-figure deals in

the back-half of the quarter after the shelter-in-place orders were in effect,

consistent with prior quarters. The percentage of subscription customers that

adopted five or more cloud modules grew to over 35% of the customer base. The addition

of modules gives the opportunity to introduce new offerings to customers and allows

expansion from a security point of view.

Decreasing competition

The company is seeing increased demand as Symantec forsakes a large portion of the market and more customers look to CrowdStrike to meet their cybersecurity needs. Accepted deal registrations for partners rose over 200% in the first quarter giving a boost to the pipeline. The company is looking to invest more in and build deeper relationships with existing partners as opposed to having a lot of partners that do not contribute much.

Looking ahead, CrowdStrike believes cybersecurity is an important aspect and companies are investing significantly in this space. The company expects to see tailwinds from digital transformation, cloud adoption, work-from-home trends and the capture of market share from competitors and believes it is well-positioned to take advantage of the opportunities ahead.

Click here to read the full transcript