Dave & Buster’s Entertainment (NASDAQ: PLAY), an operator of leisure and event venues, reported higher earnings and revenues for the second quarter of 2019. While the bottom-line topped the Street view, revenues came in line. The company’s stock dropped sharply during Tuesday’s extended trading session after it lowered the full-year guidance.

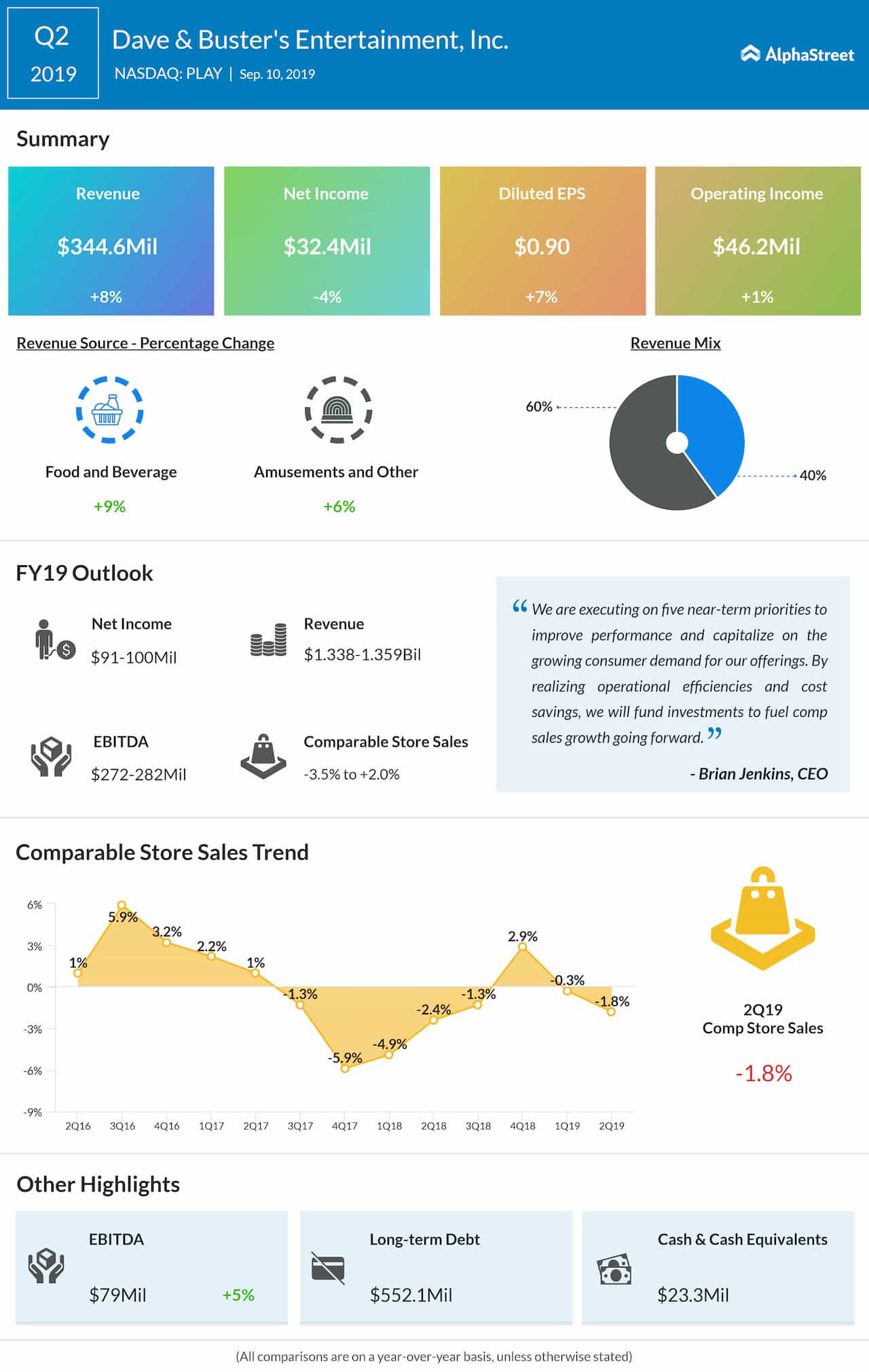

Net income dropped to $32.4 million in the second quarter from $33.8 million in the year-ago quarter. On a per-share basis, however, earnings rose to $0.90 from $0.84 and surpassed analysts’ forecast.

The Top Line

Total revenues advanced 8% annually to $344.6 million and matched Wall Street’s prediction. The top-line growth reflects a 9.4% increase in Amusements and Other revenue and a 5.9% rise in Food and Beverage revenue.

Meanwhile, comparable store sales decreased 1.8% during the three-month period. A 2% decline in walk-in sales was partially offset by a 0.1% rise n special events sales.

Also read: Apple Special Event 2019 Live Update

ADVERTISEMENT

“We are executing on five near-term priorities to improve performance and capitalize on the growing consumer demand for our offerings. By realizing operational efficiencies and cost savings, we will fund investments to fuel comp sales growth going forward,” said Brian Jenkins, Chief Executive Officer.

Outlook Revision

Meanwhile, the management lowered its full-year 2019 revenues outlook to the range of $1.338 billion to $1.359 billion from the previous forecast in the $1.365-$1.390 billion range. Comparable store sales are now expected to be down between 3.5% and 2%, compared to the previous estimate range of down 1.5% to up 0.5%. Earnings guidance has been lowered to the range of $91 million to $100 million from the previous range of $103 million to $113 million.

The full-year EBITDA outlook has been slashed to $272-$282 million from the previous estimate of $283 million to $295 million. Dave & Buster’s plans to open 15-16 new store locations in fiscal 2019, representing a 12% unit growth.

Store Count

The total number of stores increased by 11.1% to 130 units during the July-quarter, when the company repurchased 3.4 million shares for about $137 million and paid a quarterly cash dividend of $0.15 per share.

Related: Dave & Buster’s Q1 2019 Earnings Call Transcript

ADVERTISEMENT

Dave & Buster’s shares are yet to fully recover from the huge loss they suffered after the management issued dismal full-year guidance in June. The stock, which lost about 13% in the past six months, plunged 13% during Tuesday’s after-hours trading session.