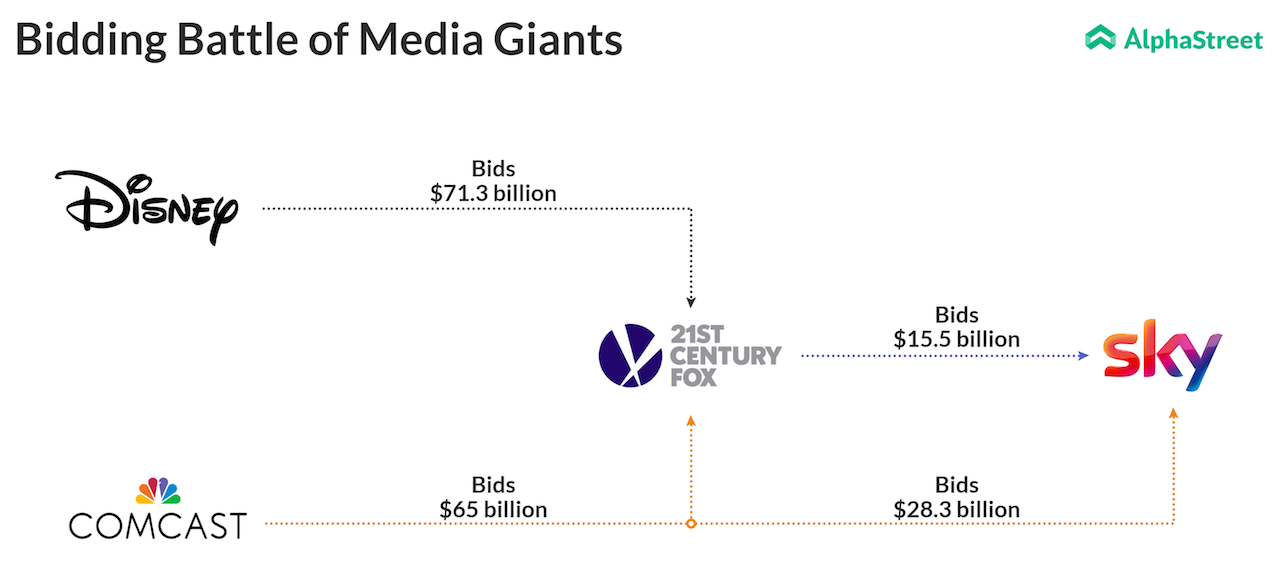

While Comcast looked like it was about to spoil the dream of every Marvel fan to see the Avengers teaming up with X-Men with their $65-billion bid for 21st Century Fox last week, Disney has channeled its inner Thanos by offering a whopping $71.3 billion for Rupert Murdoch’s media powerhouse. But will Apple or Google step in?

The new $38-a-share bid by Walt Disney Co (DIS) is $3 higher than Comcast’s – and $10-a-share over Disney’s proposal last December.

In a fierce battle for one of the media industry’s coveted prizes, Comcast is expected to come back with a much sweeter deal soon. Fox’s assets also include media series/movie brands such as ‘X-Men’ and ‘The Simpsons’, and a stake in Hulu – all these would help the eventual owner fend off the threat of streaming giants Netflix and Amazon Prime Video.

RELATED: Murdoch vs. FOX shareholders could be the new ‘Avengers vs. X-Men’

The entity that wins the Fox bid will also get access to the international portfolio and reach of the network’s assets.

Given the mammoth nature of the outcome, it can also be expected that tech giants – Alphabet’s $103-billion reserve and Apple with $267 billion in cash – might also jump into the bidding war. Many analysts have forecast a major tech giant making a claim, which will make this entire thing quite entertaining in itself. However, it is unlikely that Amazon would be among them.

Last week, MoffettNathanson analyst Craig Moffett hinted that even if Disney does or does not outbid Comcast to win the 21CF assets, another tech giant could very well try to get its hands on Fox. Whatever the case, it is now good to be a Murdoch.