Chinese e-sports giant DouYu International Holdings has set a price range of $11.50 to $14 per share for its US listing and plans to raise about $944 million. The live streaming platform plans to list on the New York Stock Exchange under the ticker symbol DOYU. DouYu is scheduled to list on the bourses on July 17.

Even though DouYu filed its prospectus in April, the company delayed its listing due to the ongoing trade war between the US and China. After a hiatus, it has now decided to go ahead with its IPO next week. However, due to the ongoing tariff battle, Chinese firms which have plans to debut in the US stock market is playing a wait-and-watch game for now.

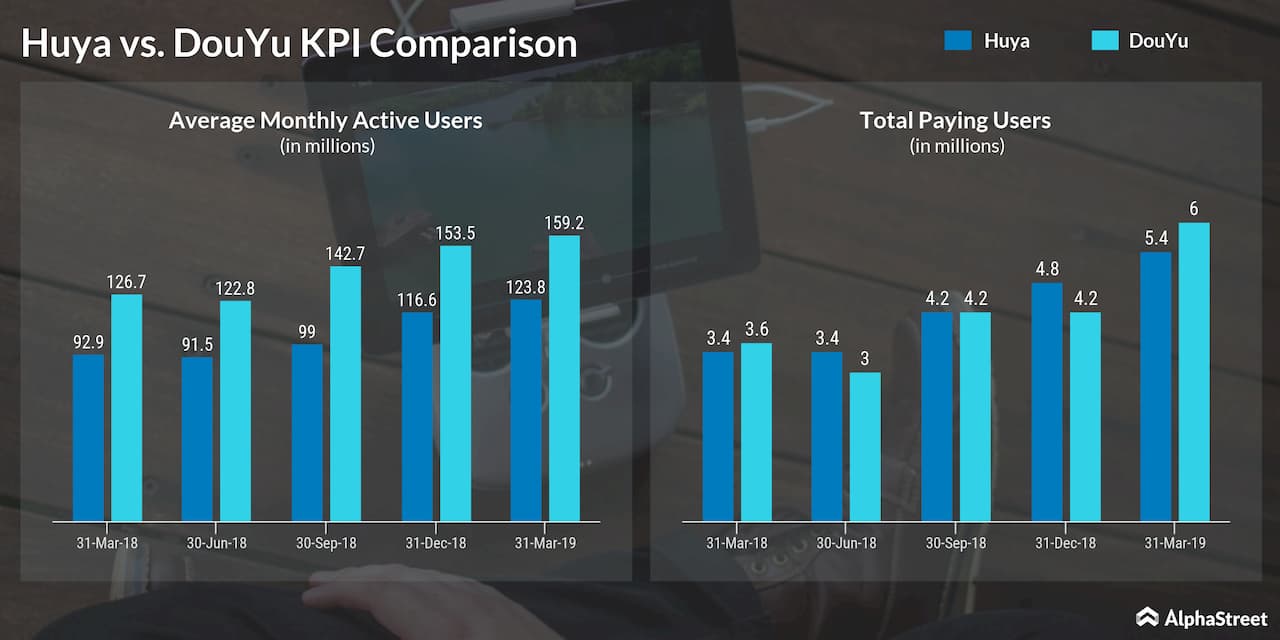

DouYu claims to be the largest game-streaming platform in China followed by its peer Huya (NYSE: HUYA). The interesting point to note is both the companies are backed by Tencent Holdings. Huya’s stock is up about 60% this year recovering sharply from the 52-week low level of $14 touched last December. Investors would be closely watching how DouYu’s shares are going to perform post listing.

How

the proceeds would be used?

DouYu plans to utilize the money raised for the following:

- 35% for adding more content

- 30% for research and development

- 15% for marketing

- 20% for acquisitions and partnerships

Huya

vs. DouYu: How they stack up?

From the headline metrics standpoint, DouYou ended the March quarter with revenue of $221.9 million and a modest profit of $2.7 million. On the flip side, Huya reported $243.1 million as revenues with profit coming in at $9.5 million.

Both the firms get lion’s share of revenues

from the live streaming side where users buy virtual gifts from its platform

and the rest comes from advertising. However, expenses are expected to increase

as the streaming platform continues to invest in adding more content to the

platform to improve user engagement and time spent by them.

Chinese Gaming Market

It’s worth noting that the gaming market in China is the largest in the world and is projected to increase at 10.5% annually in the next five years. According to iResearch, the Chinese gaming market is estimated to touch $41 billion in 2019.

The market research firm also noted that China has the most number of gamers (683 million) last year and is anticipated to touch 878 million by 2023. Another important point to take note is, from the total gaming population, more than half of them are esports gamers and revenue contribution from esports domain in China has grown 37.5% in the last three years.

Backed by the huge market potential and growing gamer base, Huya and DouYu are expected to benefit in the near future through sustainable revenues and increased profitability. When it comes to headwinds, regulatory hurdles may dampen the growth. Due to censorship issues, Twitch is already banned in China.

Get access to timely and accurate verbatim transcripts that are published within hours of the event