After a challenging season marked by weather-related disruptions, Duke Energy (DUK) will be publishing its fourth-quarter results Thursday before the market opens. The expectations are mixed this time as the energy utility company had a tough time managing the restoration activities after the recent hurricanes that caused widespread outages.

Analysts’ consensus earnings estimate for the fourth quarter is $0.89 per share, which is higher by 5% compared to the year-ago period. The adverse weather, including the recent wind storm, and the additional costs associated with power outages might have had a negative impact on the top-line performance. Factoring in the disruptions, analysts currently see fourth-quarter revenues falling about 4% annually to $5.61 billion.

However, the negative factors, which also include the progressive decline in electricity consumption in the US due to higher energy efficiency and softness in the economy, will likely be offset by the steady growth in customer numbers and higher retail electricity rates.

As per the latest estimates, Duke’s customer base will continue to grow in the coming years aided by the company’s aggressive investment in infrastructure, an area where it has outperformed rivals. Moreover, experts believe the demand for electricity will increase in the future, in line with the rebound in the economy, ending the long-drawn lull.

Duke’s customer base will likely continue to grow in the coming years aided by the company’s investment in infrastructure

The majority of the analysts covering the stock have given it a hold rating. Despite the impressive dividend growth and shareholder returns in recent years, buying the stock at the current valuation might not be a viable option.

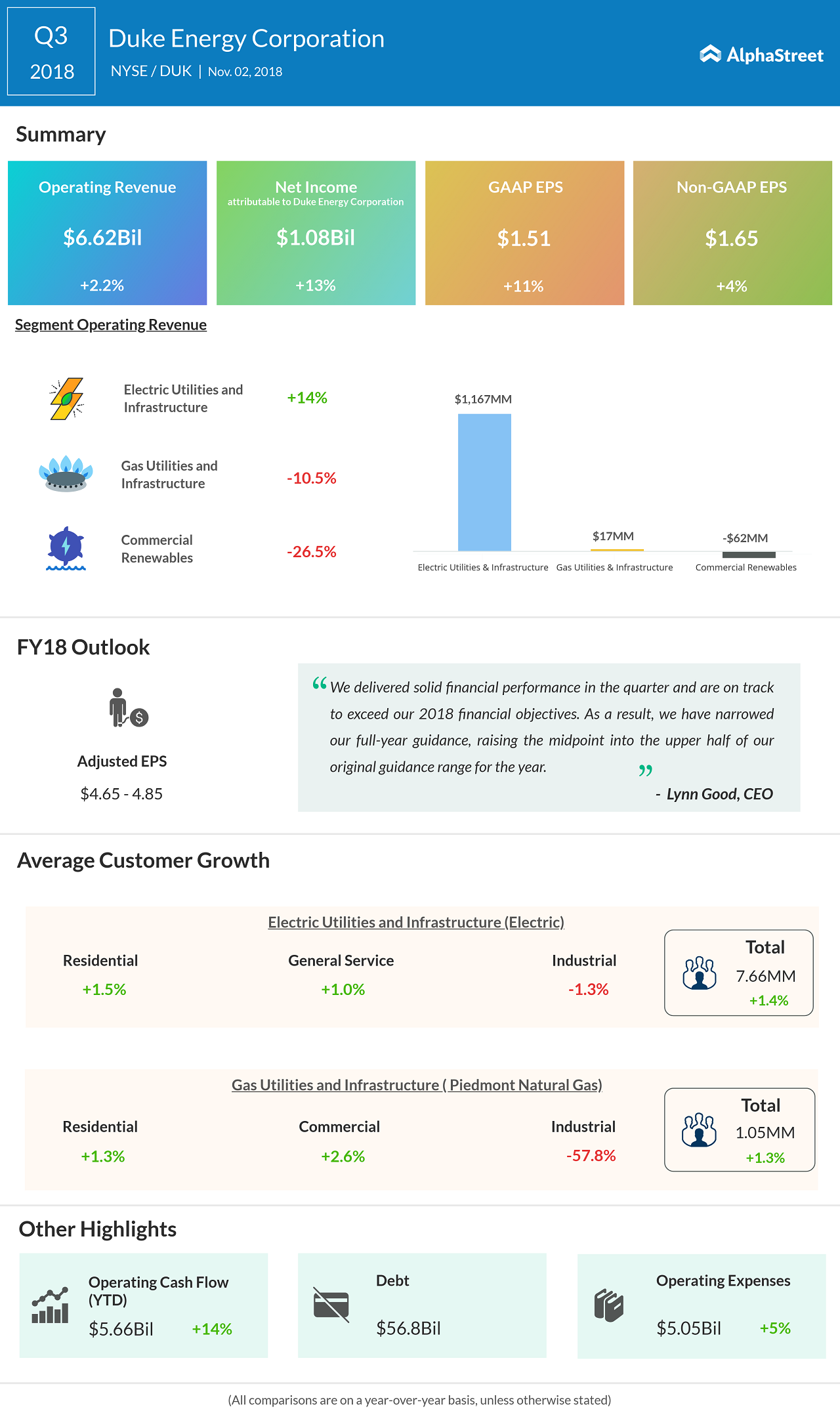

Helped by the higher prices and an income tax benefit, adjusted earnings rose 4% to $1.65 per share in the third quarter, when revenues moved up 2% to $6.6 billion. In three out of the four trailing quarters, the company’s earnings exceeded analysts’ expectations.

Also see: Duke Energy Corp. Q3 2018 Earnings Conference Call Transcript

American Electric Power, another leading energy firm, last month reported in-line earnings of $0.72 per share for the fourth quarter – a sharp decline from the prior-year quarter. Revenue was flat at $3.8 billion.

Duke’s shares are currently trading near the record highs seen a few months ago. Having started 2019 on a positive note, the stock gained 7% so far this year. Over the past twelve months, it grew by 18%.