The Boeing Company (NYSE: BA) disappointed the market on Wednesday by reporting a net loss for the fourth quarter, contrary to expectations for profit. The bottom-line was negatively impacted by a 37% fall in revenues. The dismal outcome represents the impact of the 737 Max crisis on the aircraft maker’ss finances.

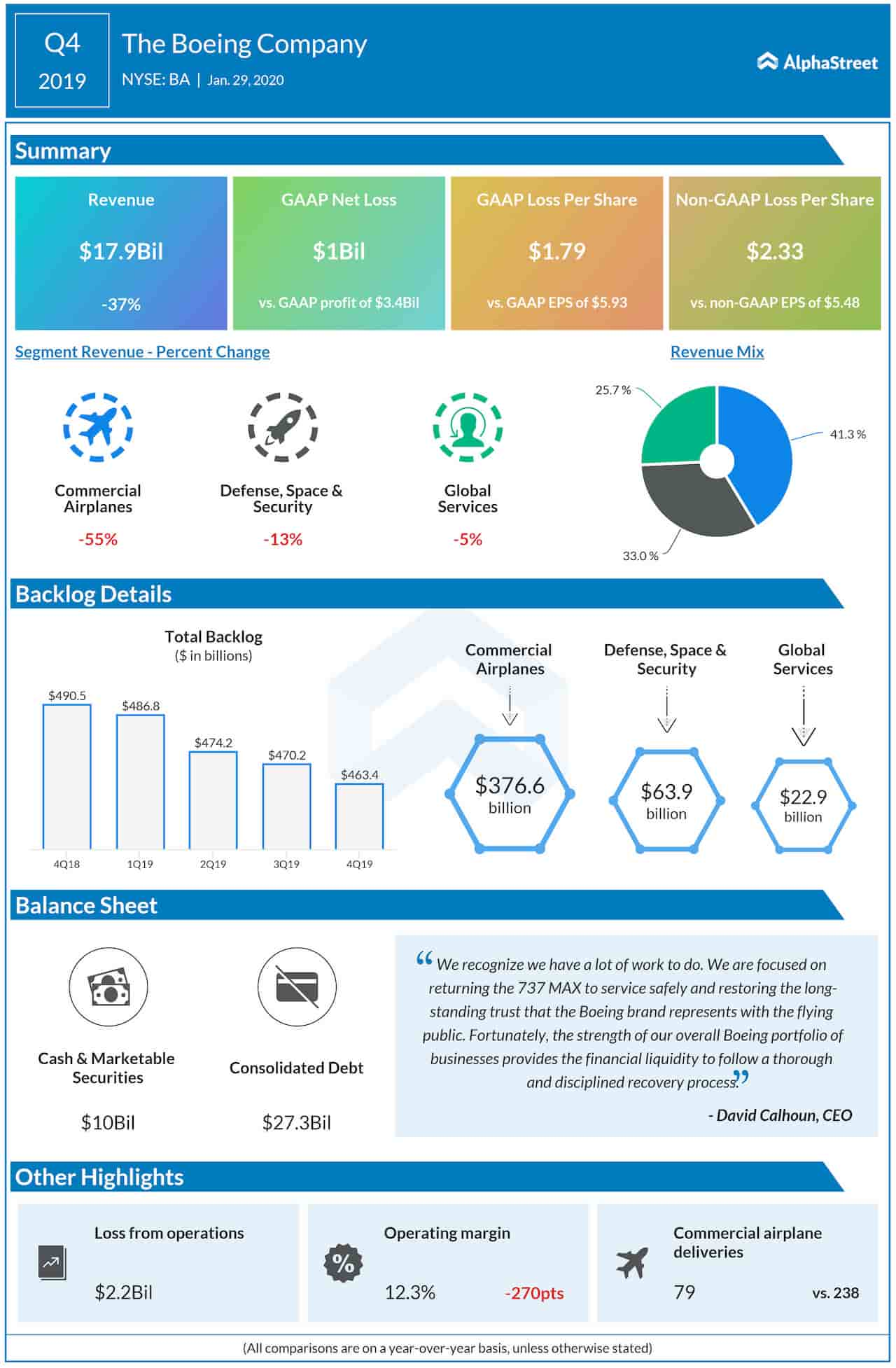

The company reported an adjusted net loss of $2.33 per share for the December-quarter, compared to a profit of $5.48 per share last year. Analysts had predicted profit for the latest quarter.

On an unadjusted basis, net loss was $1.0 billion or $1.79 per share, compared to profit of $3.4 billion or $5.93 per share in the fourth quarter of 2018. The company is reporting an annual loss for the first time in nearly 20 years.

Top-line Crashes

Revenues plunged 37% annually to $17.9 billion, with all the three business segments registering negative growth. Analysts had forecast a higher top-line number.

“We are focused on returning the 737 MAX to service safely and restoring the long-standing trust that the Boeing brand represents with the flying public. Fortunately, the strength of our overall Boeing portfolio of businesses provides the financial liquidity to follow a thorough and disciplined recovery process,” said CEO David Calhoun.

The persistent uncertainty over the resumption of grounded 737 Max flights has left the market apprehensive. The sentiment deteriorated further last week after the management said regulators are unlikely to give green signal for resuming the flights until mid-year.

737 Max Debacle

Aviation firms across the globe grounded their 737 Max fleets last March after several people were killed in two deadly crashes that occurred within a span of six months, due to technical glitch.

Market Watchers recommend holding Boeing stock in view of the extended delay in 737 Max resumption. After making a modest start to the year, the stock witnessed a selloff last week and underperformed the market.