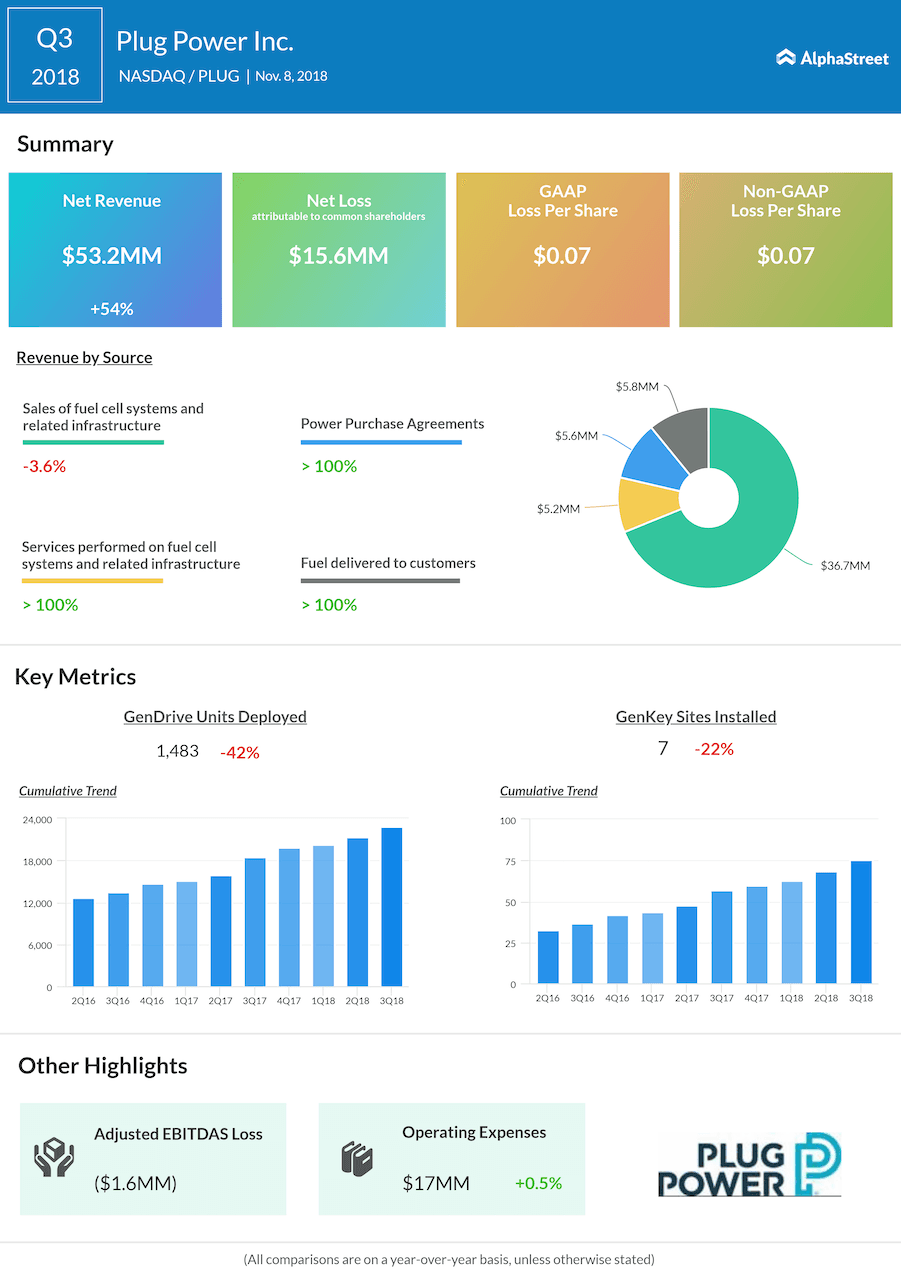

Hydrogen fuel cell maker Plug Power Inc (PLUG) posted its third-quarter earnings result before the opening bell on Thursday, November 8. Net revenue for the period soared 54% to $53.2 million, beating the Street estimate of $48.56 million. The stock rose 1.55% in premarket trade following the results.

Net loss shrunk to $15.56 million or $0.07 per share, vs. last year’s loss of $40.98 million or $0.18 per share. The company, however, posted a gross profit of $4.4 million for the third quarter of 2018, compared to a $19.4-million loss a year ago.

In the quarter of 2018, Plug Power sold more 1,400 GenDrive fuel cell units and seven GenFuel hydrogen stations, and delivered products to nine different customers.

Due to this topline growth, the company recently lifted its gross revenue targets to $175-190 million for fiscal 2018. At quarter-end, Plug Power had a total cash of $62.1 million, including cash and cash equivalents of $13.8 million and restricted cash of $48.3 million.

To adhere to the demand, Plug Power also launched a new manufacturing facility in Clifton Park, with the support of NY State’s Empire State Development. The company also announced that as of Nov 8, Plug Power has the capacity to produce about 20,000 fuel cell products annually.