AI-based news feed app Qutoutiao Inc (NASDAQ: QTT) is slated to report first-quarter 2019 earnings results after the closing bell on Monday, May 20. Analysts expect the Chinese firm to report a loss of 41 cents per share on revenues of $161.9 million.

Qutoutiao, which went public in September last year, has so far shown exceptional operational growth for such a young company. In 2018, the company reported a 485% year-over-year jump in revenues to $440 million.

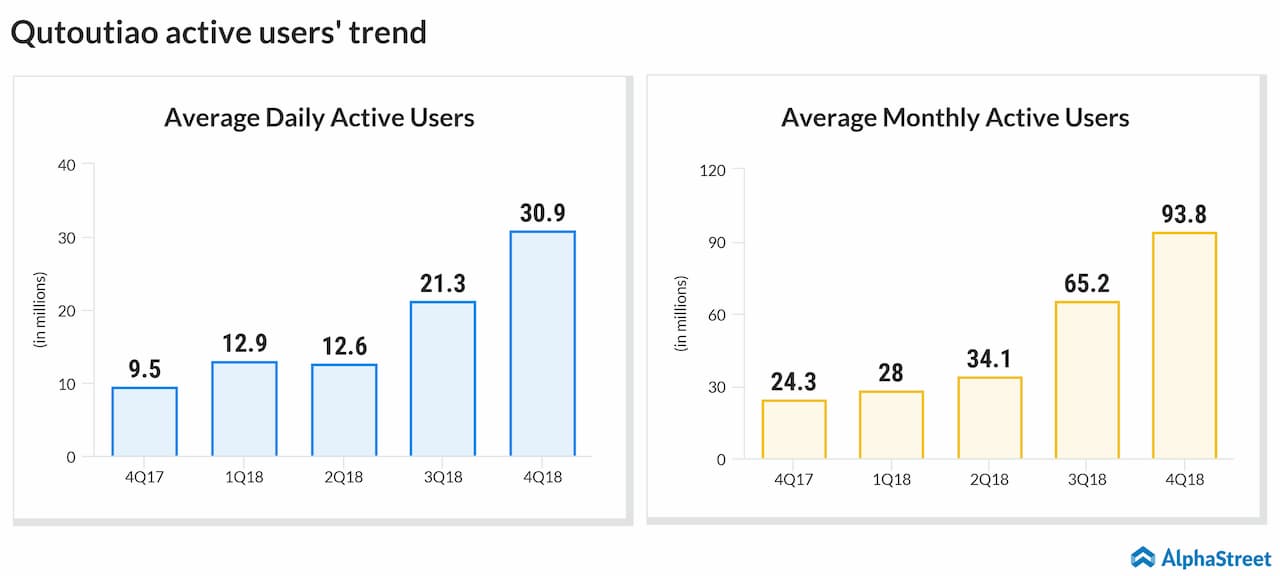

The top-line growth was backed by steady and consistent user

engagement. In the last-reported quarter, average daily active users soared

224% to 30.9 million, while average monthly active users jumped 286% to 93.8

million.

However, owing to the rising expenses required to improve the budding platform, net loss widened more than ten times to $145 million. Shares fell 14% on the mixed Q4 results.

The highly volatile stock is down 20% in the year-to-date period. After hitting a 2019-high in mid-March the stock fell as much as 64% after the company announced plans to offer new stock for $10 per share. Investors did not take lightly the stock offer coming only half a year after its IPO.

READ: IQIYI BEATS ON BOTTOM-LINE IN Q1, KEEPS ADDING USERS

Qutoutiao has not yet been able to recover from the fall. The management is likely to provide more clarifications during the earnings conference call.

QTT has a 12-month

average price target of $12.20, suggesting 115% upside from its last close.

Founded in 2016, Qutoutiao aggregates articles and short videos and presents customized feeds to users.