The Procter & Gamble Company (NYSE: PG) is scheduled to report fourth quarter 2019 earnings results on Tuesday, July 30, before market open. Analysts expect the company to report earnings of $1.05 per share on revenue of $16.8 billion. Both revenue and earnings are expected to increase on a year-over-year basis.

In the trailing four quarters, the company has consistently topped earnings estimates. P&G has a strong product portfolio which is an advantage. A favorable product mix coupled with pricing and volumes are expected to generate higher organic sales in the fourth quarter. The company is seeing healthy growth in the domestic market which could benefit the topline.

Organic

sales growth and a lower effective tax rate are likely to help the top and

bottom line numbers in the fourth quarter. However, higher costs and negative currency

impacts could dampen the quarterly results.

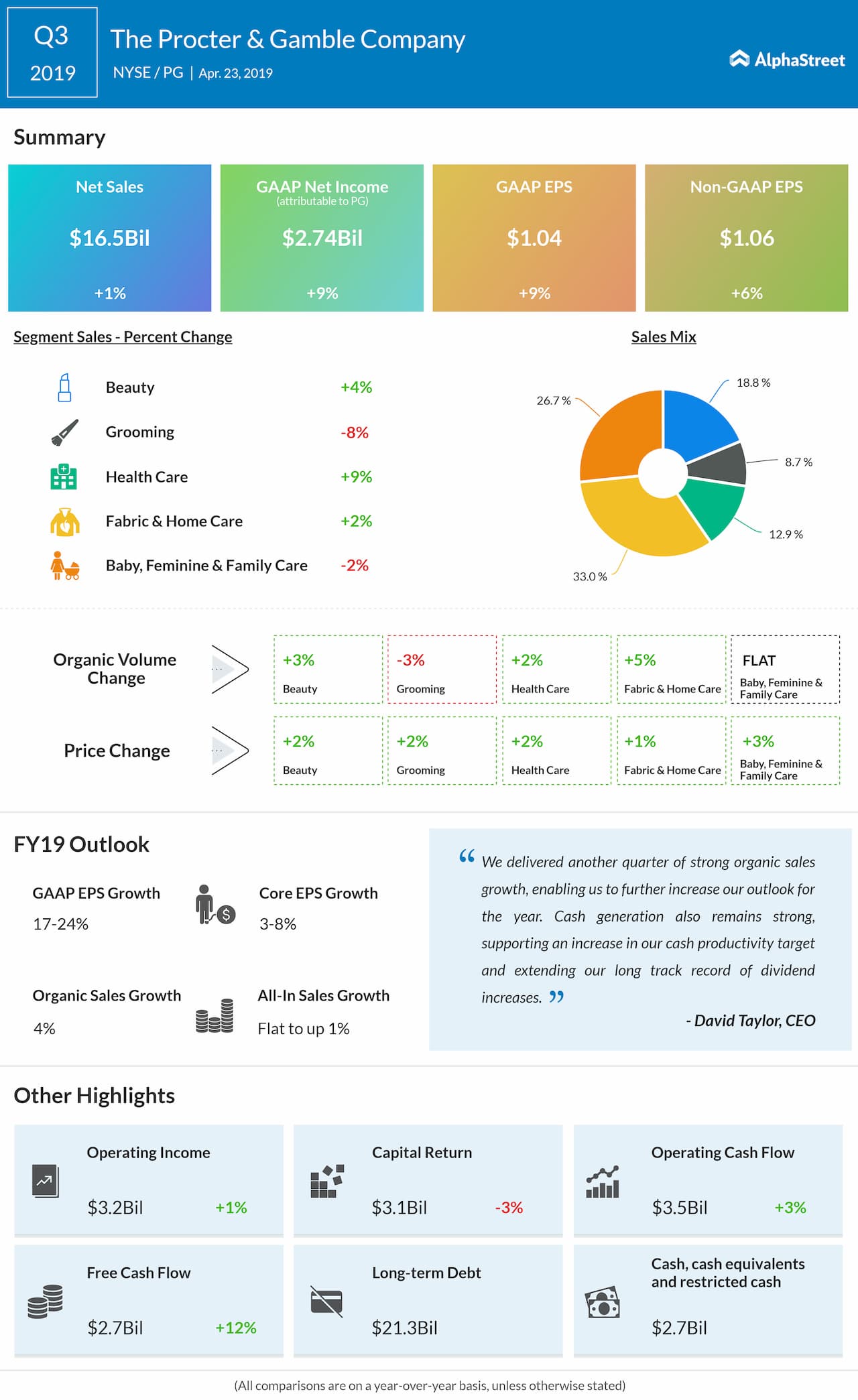

In the third quarter of 2019, P&G topped market expectations on revenue and earnings, with a 1% growth in net sales and a 6% increase in adjusted EPS. Organic sales rose 5%, driven by a 2% increase in organic shipment volume. Sales grew across all its segments, with the exception of grooming and baby care.

For fiscal-year

2019, P&G has guided for total sales to be flat to up 1% versus 2018. Organic

sales is expected to grow 4%. GAAP

EPS is expected to increase 17-24% versus last year while core EPS is expected

to grow 3-8%.

In the trailing 52 weeks, P&G’s shares have gained 43%. Year-to-date, the stock has risen 25%. The majority of analysts have rated the stock a Buy while none have rated it Sell. TipRanks has given the stock an average price target of $115.25.