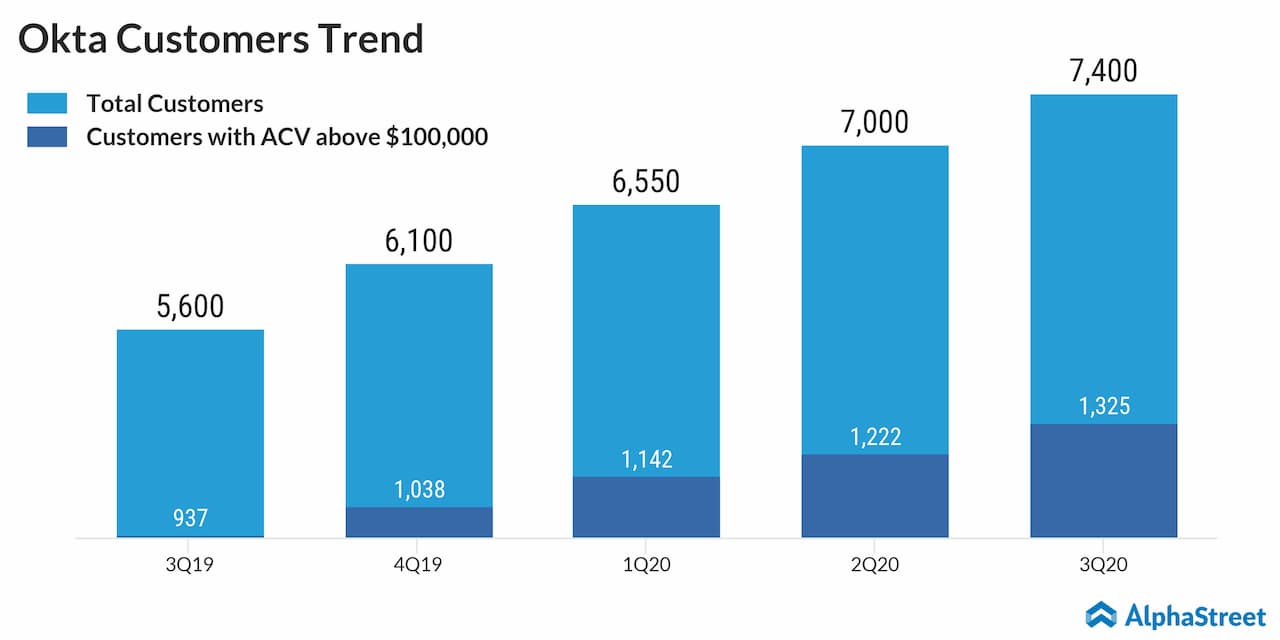

After achieving double-digit revenue growth consistently, Okta Inc. (NASDAQ: OKTA) has not been able to come out of the red in terms of profitability. The company, however, created value for shareholders all along as it continued expanding the business and winning new customers.

The cloud software company, specialized in identity and access management, is expected to release fourth-quarter earnings Thursday at 4:05 pm ET. Market watchers predict that the losing streak would extend into the December-quarter. They expect net loss to be $0.05 per share, which is wider by one cent compared to the year-ago quarter.

Like in the past, margins might come under pressure from elevated research & development expenses as the company continues to invest in Integration Network and Identity Platform. Also, customer acquisition costs, as part of expanding the business to overseas markets, could be a drag on the bottom-line.

Revenue Growth

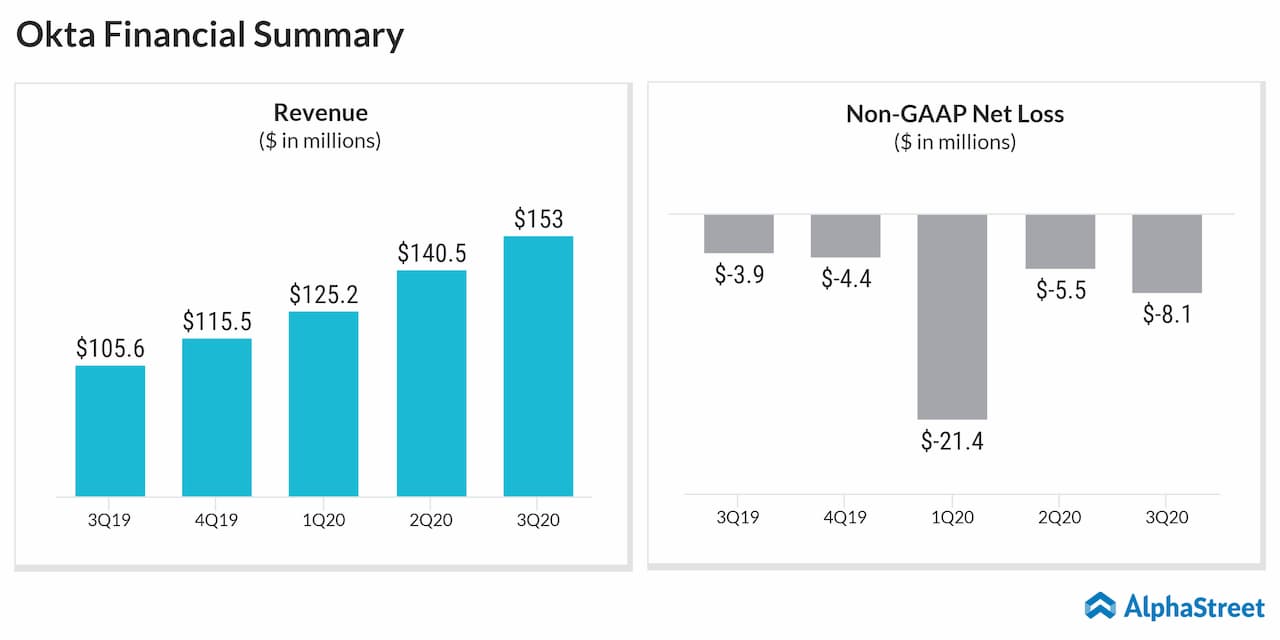

The estimate for revenue is $155.85 million, which represents 35% year-over-year increase. The forecast matches the management’s prediction and is in line with the recent trend. Okta’s identity solutions have witnessed steady demand-growth over the years, reflecting the constant innovation and portfolio revamp.

It is estimated that Okta might not return to profitability in the near term due to heavy investment in growth initiatives, which typically takes several months to yield results. Moreover, there are plans to expand the workforce to complement the growth drive.

Q3 Results

In the third quarter, loss widened to $0.07 per share from $0.04 per share a year earlier, hurt by higher expenses. The top-lined rose by 45% to $153 billion, aided by strong subscription growth that surpassed the industry. While the bottom-line beat the Street view, revenues missed.

Also read: Acuity Brands Stock: Tariff, demand woes call for caution

Okta shares are yet to fully recover from the selloff that followed the company’s lackluster third-quarter results. However, the stock has gained about 72% in the past twelve months, and is trading close to last year’s peak when it crossed the $140-mark for the first time.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.