The upcoming earning report of Nvidia Corp. (NASDAQ: NVDA) will be one of the most closely followed events this season as the chipmaker is widely expected to report earnings and revenue growth, after posting declines for several quarters. There is optimism in the market that Nvidia is finally recovering from the slump caused by weakness in the data center and gaming businesses.

Related: Micron Q1 profit dips 85%

The positive sentiment primarily reflects an improvement in the key business segments, from last year’s record lows. The market will also be looking for updates on Nvidia’s proposed acquisition of Mellanox Technologies, a company that provides data networking products.

Outlook

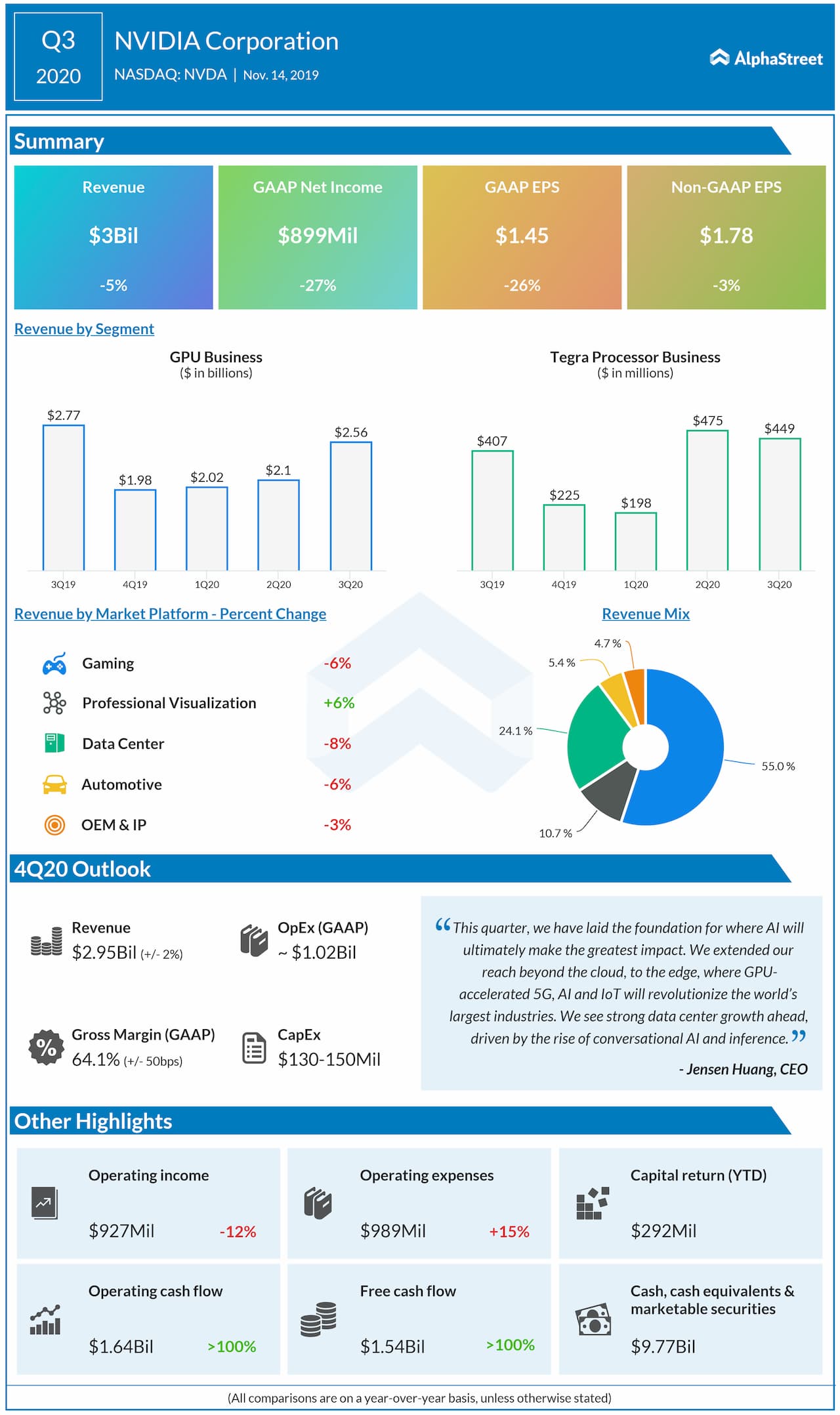

A few months ago, the company predicted that weakness in the non-core areas of the business would be more than offset by strong demand for its AI-based chips and GPUs. The management’s $2.95-billion revenue forecast for the fourth quarter is in line with analysts’ view, representing a 35% annual increase. It is estimated that earnings more than doubled to $1.66 per share in the December-quarter. The report will be published on February 13, after the market’s close.

Of late, the company has been busy expanding its portfolio with focus on advanced technologies like artificial intelligence and the Internet of Things, in an effort to stay ahead of rivals in the highly competitive industry.

Q3 Outcome

In the third quarter, Nvidia’s revenues dropped 5% year-over-year to $3 billion but came in above the market’s prediction. Consequently, adjusted earnings declined 3% to $1.78 per share, far exceeding the estimates.

Last month, Advanced Micro Devices (AMD) said its fourth-quarter earnings more than doubled on strong revenue growth, supported by growth in the Computing & Graphics business. Among others, Intel (INTC) reported a double-digit increase in fourth-quarter earnings aided by broad-based revenue growth.

Stock Performance

Nvidia shares have been on an upward spiral ahead of the earnings report, and the trend is expected to continue. Most of the analysts covering the company recommend buying the stock, with an average price target of $257.

Also see: NVIDIA Q3 2019 Earnings Conference Call Transcript

The shares, which gained about 62% in the past twelve months, Monday traded the highest level since then and outperformed the S&P 500 index. The stock had a positive start to 2020, extending last year’s momentum. It is up 7.5% since the beginning of the year.