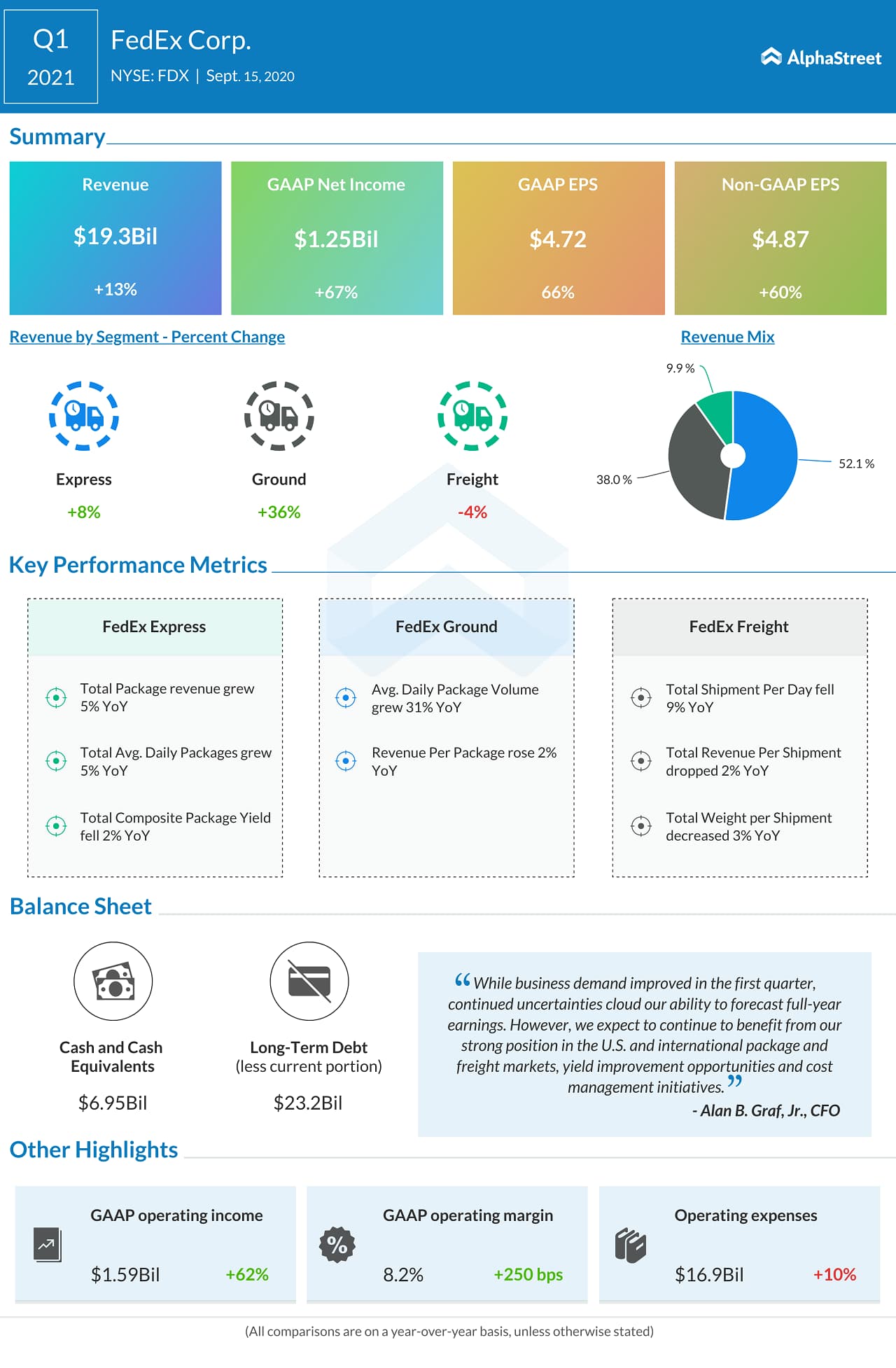

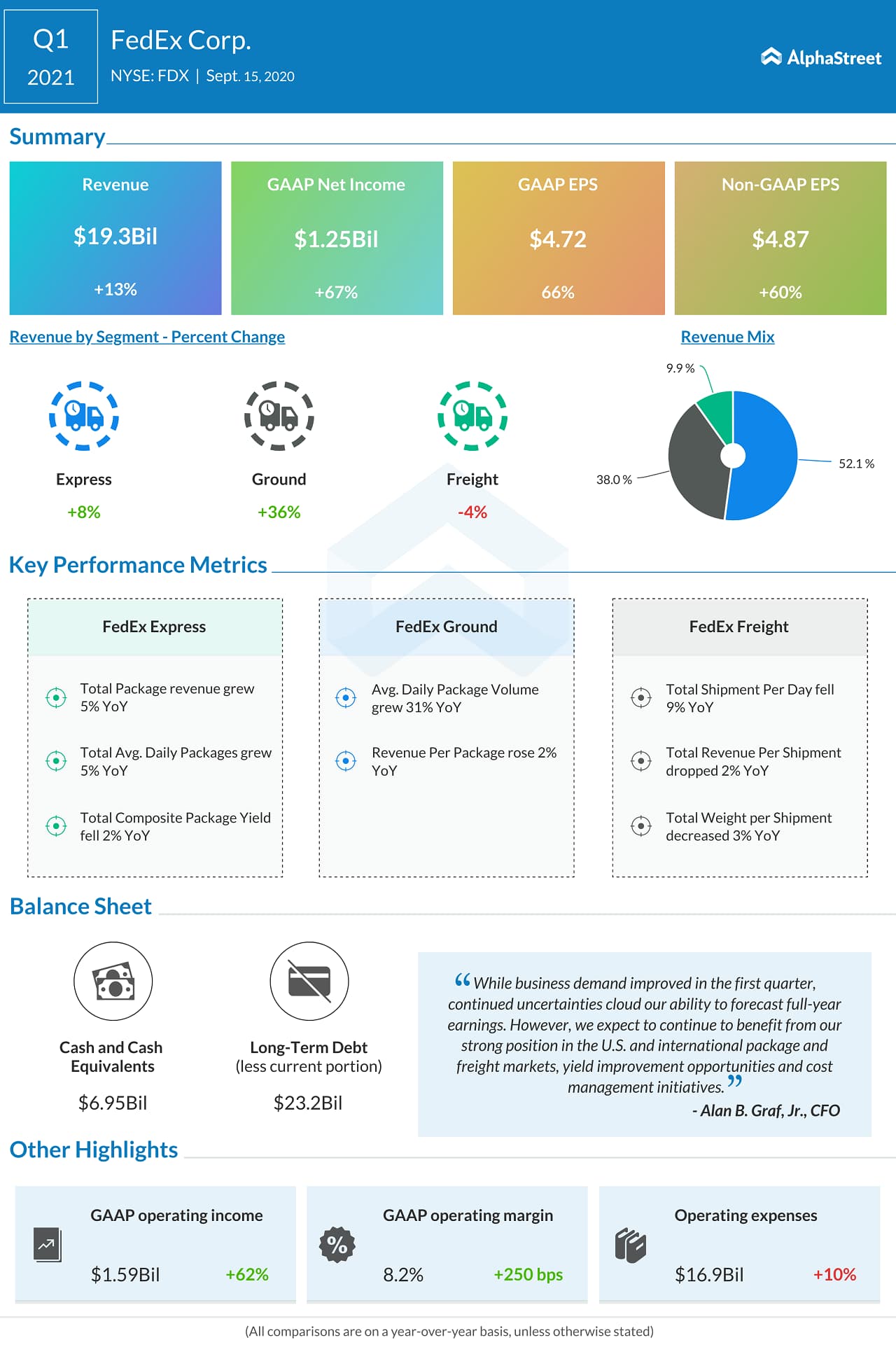

FedEx (NYSE: FDX) crushed the market’s earnings and revenue targets as the growth in e-commerce boosted the shipping volume in the first quarter of fiscal 2021. The logistics giant stated in the earnings call, “The growth that we expected to see over a period of three to five years happened in a period of three to five months”. FDX stock was trading up above 10% in the pre-market trading hours today.

E-commerce growth forecast

Pre-COVID, FedEx projected that the US domestic market would hit 100 million packages per day by the calendar year 2026. The company now projects the US domestic parcel market to hit this mark by the calendar year 2023, pulling volume projections forward by three years from the previous expectations. 96% of US growth is expected to come from e-commerce. While e-commerce as a percentage of total retail has declined from its apex in April, it remains elevated. E-commerce as a percentage of total retail for Q2 calendar year 2020 is estimated at 21% compared to 15% in Q2 calendar year 2019.

Economic outlook

FedEx stated that until the vaccine is available globally and the virus is contained, forecasting on the economic recovery remains a challenge. In the US, spending shifted from services to goods with goods spending boosted further by pent-up demand. Retail sales are growing again year-over-year and e-commerce is booming at holiday levels. The service sector was severely impacted by the pandemic and high unemployment rates continue to weigh on growth.

Outside of the US, recovery has taken hold as well as coronavirus-related restrictions have been loosened. Manufacturing output is improving off the April low and trade activity is on demand. Global trade volumes, which declined 10% in the first half of the calendar year 2020, have resumed sequential growth. However, given the depth of the downturn, FedEx expects global GDP and trade growth on a year-over-year basis to remain negative for the remainder of this calendar year.

Fiscal 2021 outlook

Despite the improved business demand, FedEx didn’t provide the earnings outlook for its fiscal 2021. However, the company anticipates increased demand to result in higher revenue and operating income at FedEx Ground and FedEx Express segments for the remainder of fiscal 2021.

In his last conference call as CFO, Alan Graf said,

“If our current trends continue, FedEx expects certain expenses, including higher variable incentive compensation accruals and increased supplies and other costs related to the COVID-19 pandemic, to remain headwinds in fiscal 2021.“

Speaking on Q2 holiday season, COO Rajesh Subramaniam said, “We enter what we expect to be a peak holiday shipping season like no other in our company’s history.”

FedEx has planned to add more than 70,000 positions in key markets across the US. The new and expanded ground facilities planned prior to the peak is expected to provide additional strategic capacity. 50 existing facilities are being expanded with additional material handling equipment and automation.

Stock performance

FDX stock, which reached a new 52-week high ($241.00) on Monday, is anticipated to surpass that today. FedEx shares have gained 57% since the beginning of this year.