Five Below (FIVE) reported a 160% jump in earnings for the first quarter helped by new stores performance, healthy comparable sales, strong gross margin performance, SG&A leverage and tax rate favorability. The high-growth value retailer’s stock rose more than 6% in the aftermarket as its earnings and revenue exceeded market expectations, and it guided second quarter above Street’s view.

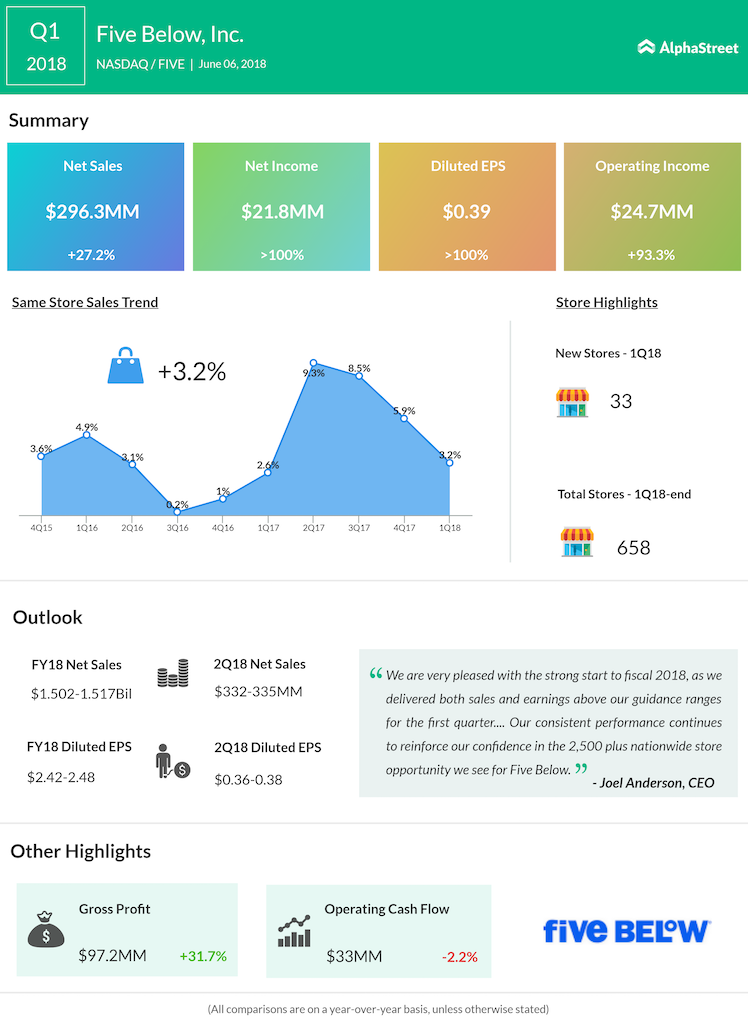

With revenue climbing by 27.2% to $296.3 million, the company’s earnings soared 159.8% to $21.8 million or $0.39 per share. EPS included a $0.04 benefit in the latest quarter due to the accounting for employee share-based payments. Comparable sales increased by 3.2%.

Looking ahead into the second quarter, the company expects net sales of $332-$335 million, net income of $20-$21.2 million, and EPS of $0.36-$0.38. The sales outlook is based on the opening of about 33 new stores and assuming about flat comparable sales.

For fiscal 2018, Five Below sees net sales of $1.502-$1.517 billion, net income of $136.5-$139.9 million, and EPS of $2.42-$2.48. The sales forecast is based on the opening of about 125 new stores and assuming a 1-2% rise in comparable sales.

Shares of Five Below ended Wednesday’s regular trading session up 3.07% at $81.28 on the Nasdaq. The stock had been trading between $44.30 and $81.77 for the past 52 weeks.