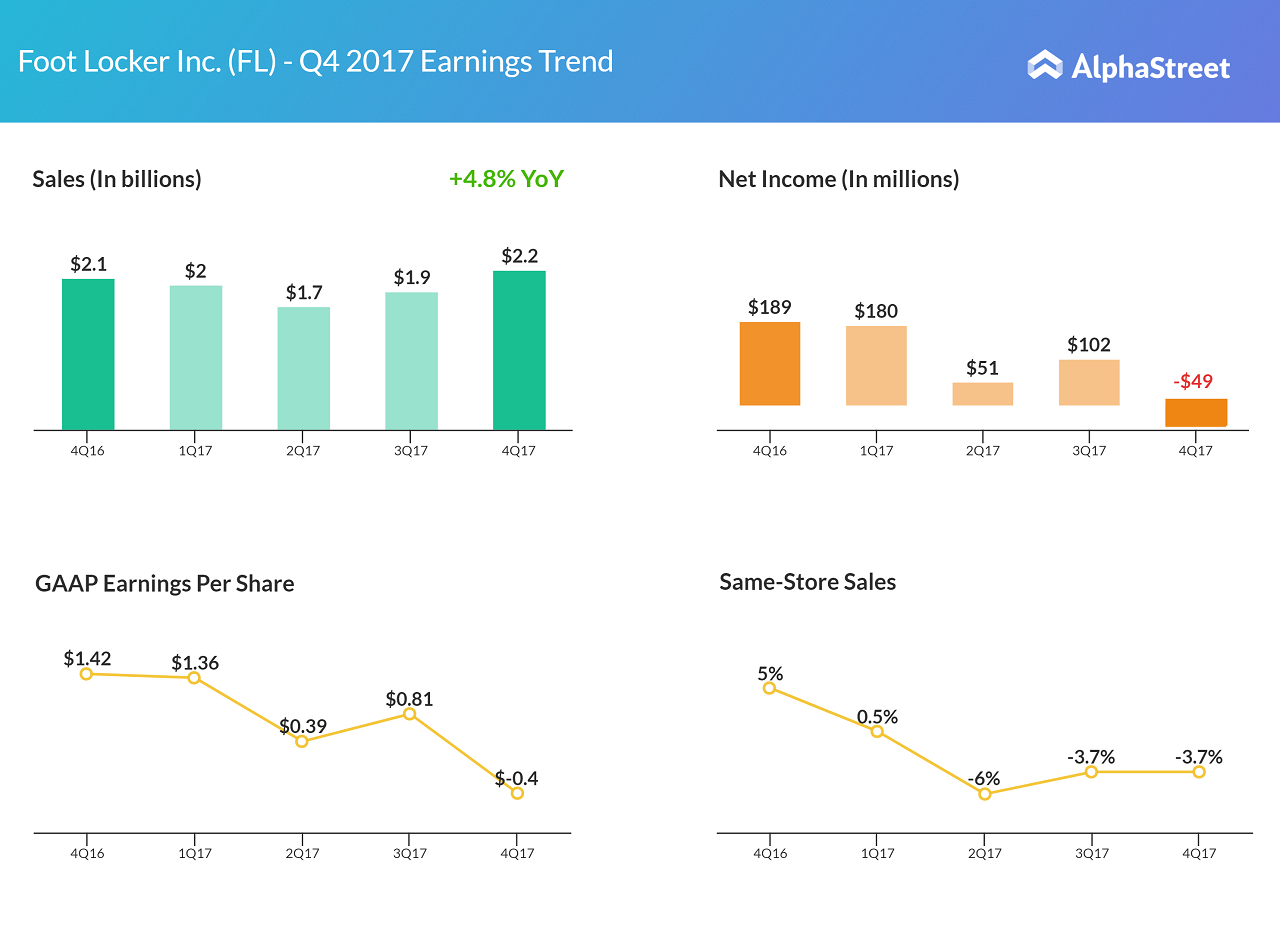

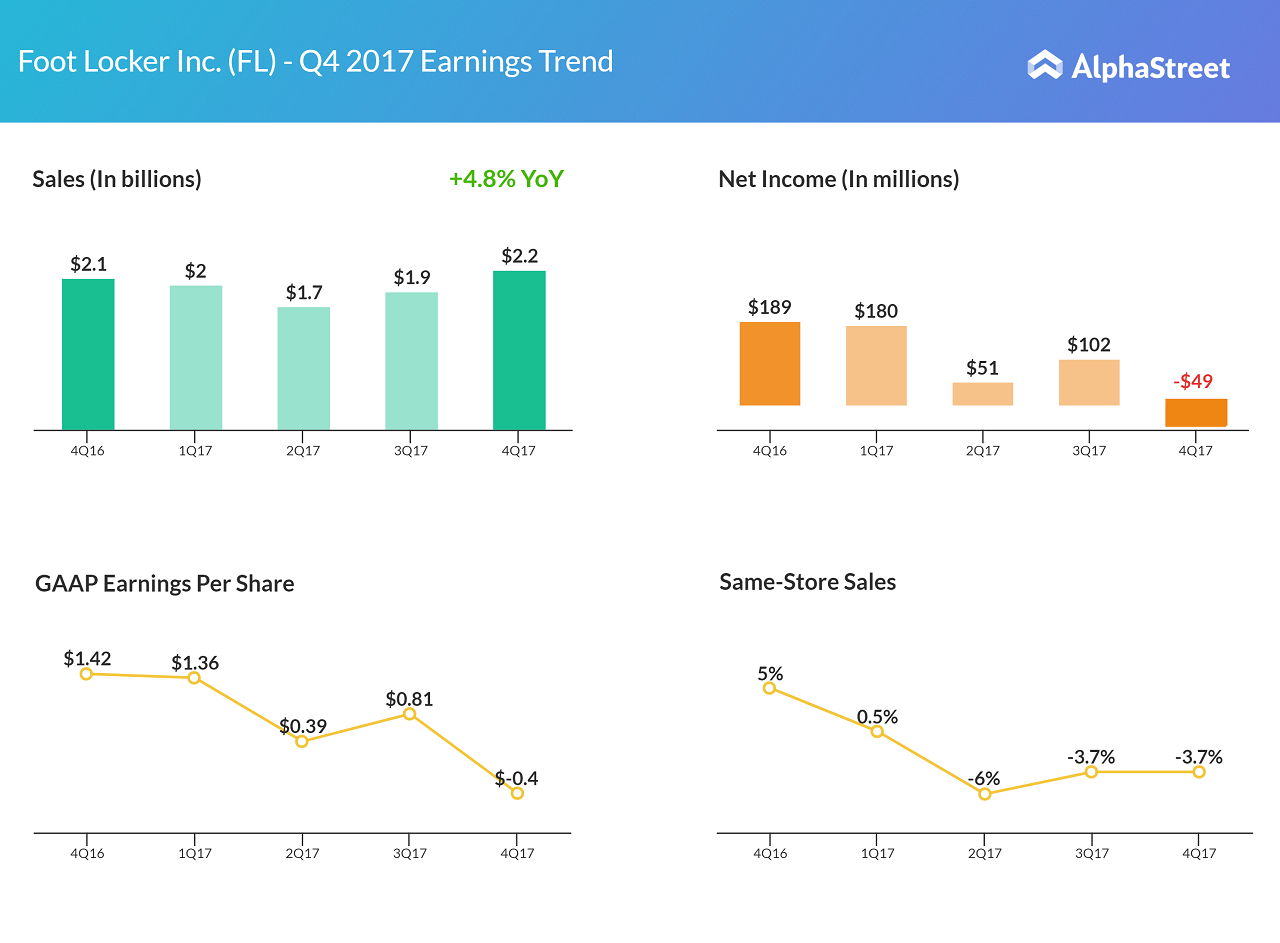

Athletic footwear and apparel retailer Foot Locker (FL) reported a loss of $49 million in the fourth quarter. The company’s bottom line was hurt by the recent tax reforms and the ongoing pension-related litigation costs. However, sales rose 5% to $2.2 billion.

Same-store sales continued its negative growth from the third quarter, nosediving 3.7%. Gross margins reduced more than 200 basis points to 31.4% in the quarter due to heavy markdowns announced during the holiday season along with increase in expenses.

The silver lining in the quarter was the reduction in inventories. At the end of the quarter, inventories reduced 2.2% compared to the prior-year period. Old inventory cleanup is expected to augur well for the firm in 2018 as it can sell now products which are in great demand in line with customer expectations.

Dividends

During the quarter, Foot Locker paid dividends of $0.31 per share to shareholders and repurchased $105 million worth of common stock. For the fiscal 2018, the footwear retailer increased its quarterly dividend payout to $0.345 per share.

Outlook

For fiscal 2018, same-store sales are expected to be flat to up low-single digits. Due to the investments on the digital side of the business, SG&A expenses would increase 100 basis points in 2018.