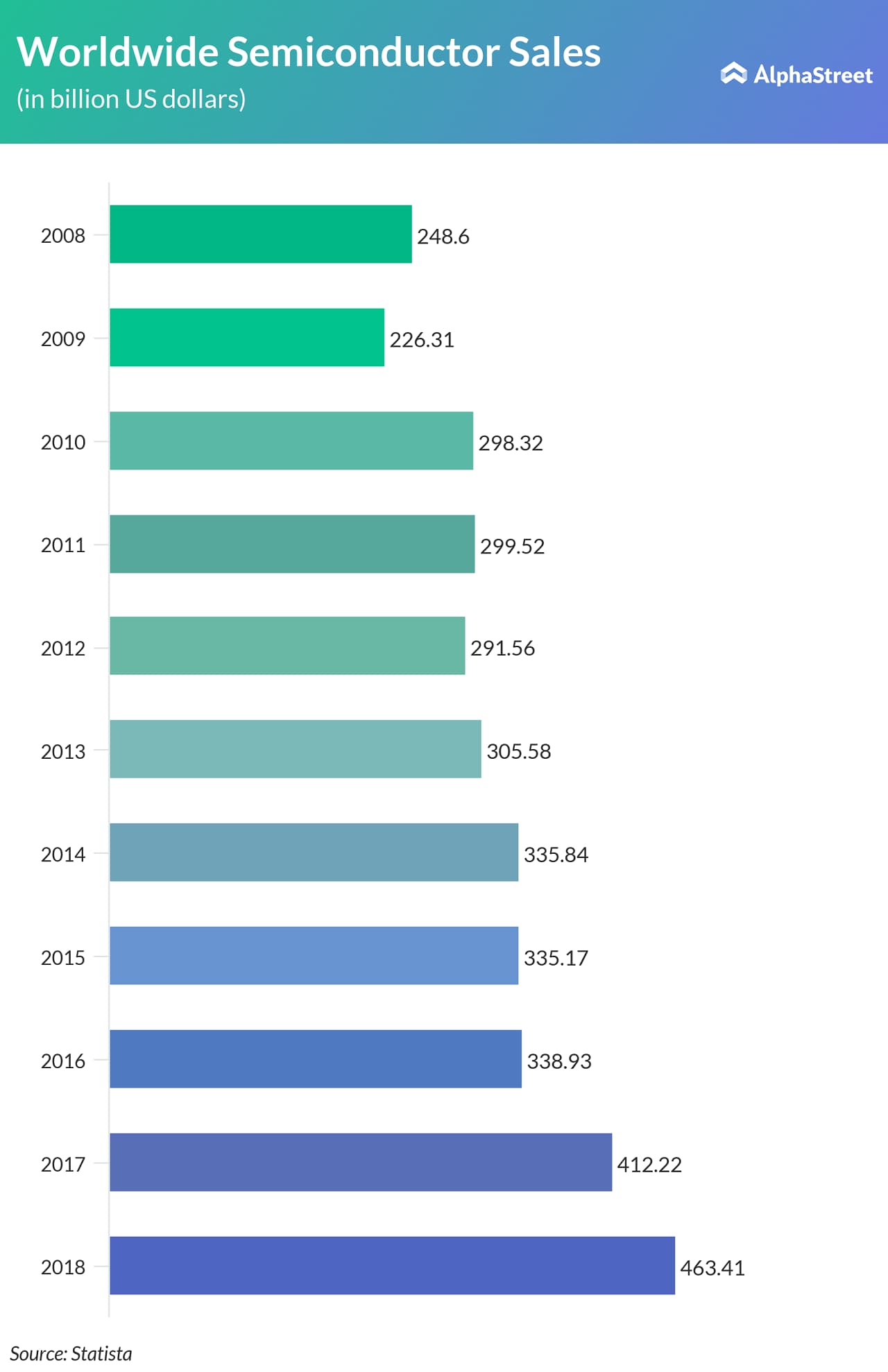

The envious run

witnessed by the global semiconductor market over the past three years is

coming to an end, International Data Corporation (IDC) has projected. After

three consecutive years of growth, the industry is set for a 7.2% decline in

2019, as both DRAM and NAND chips are expected to see weakness, IDC said.

According to the report, worldwide semiconductor revenues will decline from $474 billion in 2018 to $440 billion in 2019. Meanwhile, the weakness is expected to be temporary, and revenues are slated to improve from 2020. By 2023, the market is projected to touch $524 billion.

The weakness may

be attributed to oversupply of DRAM and NAND around the latter end of last

year, as well as demand weakness in China. Both DRAM and NAND are expected to

decline in 2019 and 2020.

Mario Morales, program vice president, Semiconductors at IDC said, “We expect the market to bottom by end of the third quarter this year as we work through inventories and demand begins to gradually return. Cloud infrastructure investment, 5G mobile devices, WiFi 6 adoption, Smart NICs, automotive sensors, powertrain technologies, AI training accelerators, and edge inference SoCs will be instrumental in our growth expectations for 2020 and beyond.”

READ: THIS TIME ELON MUSK GETS AN AWARD FOR HIS TWEETS

IDC expects to see

more consolidation activities this year as the industry gets in grips with the

outcomes of the US-China trade war. There have already been six major M&A

deals this year, besides a divestiture by Intel (NASDAQ:

INTC).

Research manager for Semiconductors Nina Turner said, “Our long-term thesis remains intact. The automotive market remains one of the strong growth drivers over the forecast horizon as semiconductor content and design activity for autonomous enabling technologies will continue to drive 3-4 times more growth than the overall market.”

Listen to on-demand earnings calls and hear how management responds to analysts’ questions