Earnings of web-hosting firm GoDaddy (NYSE: GDDY) rose slightly in the first quarter, supported by a 12% increase in revenues amid strong booking growth. The results, meanwhile, fell short of expectations and the company’s stock dropped during Thursday’s after-hours session. The management also provided guidance for the second quarter and fiscal 2019.

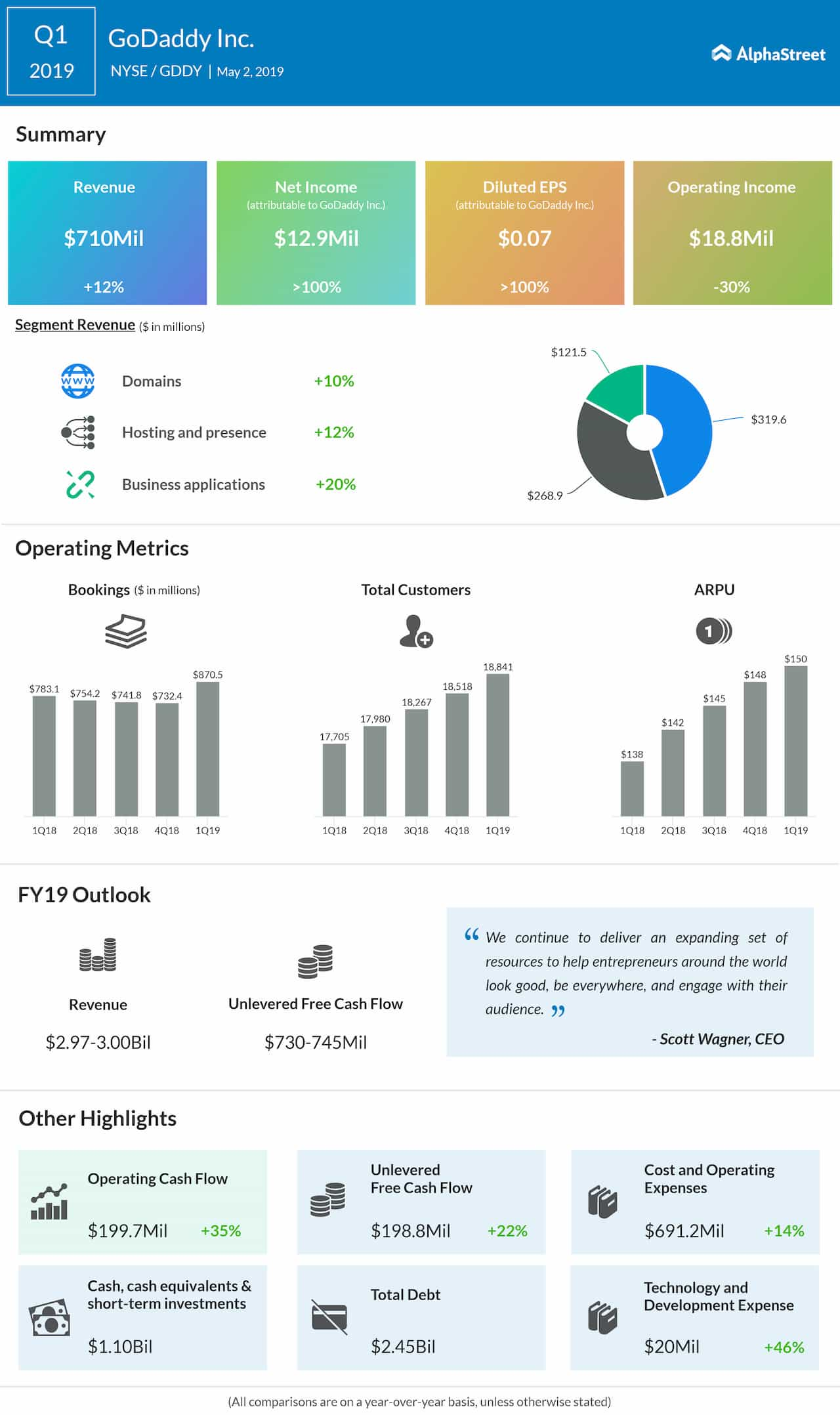

During the March-quarter, net income rose to $12.9 million or $0.07 per share from $3.3 million or $0.02 per share a year earlier. Analysts were expecting a higher number.

Revenue grew by 12% annually to $710 million, helped by a sharp increase in total bookings, but fell short of the market’s projection. Segment-wise, Domains revenue climbed 9.6% year-over-year, while Hosting/Presence revenue and Business Applications revenue moved up 12.1% and 19.5%, respectively.

All the three core business segments registered double-digit growth during the quarter, driving the top-line higher

Driving the top-line growth, total bookings rose 11.2% to $870.5 million. At the end of the quarter, the tech firm had 18.8 million customers, up 6.4% from last year. Also, there was an 8.5% growth in average revenue per user to $150.

“We continue to deliver an expanding set of resources to help entrepreneurs around the world look good, be everywhere, and engage with their audience. This has supported not only our consistent execution, but also our vision as we continually evolve with our customers’ expanding needs,” said CEO Scott Wagner.

Continuing the recent trend, the GoCentral website builder and Managed WordPress witnessed solid subscription growth this time. As part of enhancing its investment in the WordPress ecosystem, GoDaddy acquired CoBlocks and ThemeBeans during the first quarter.

Looking ahead, the management expects full-year 2019 revenues to be in the range of $2.97 billion to $3 billion, representing an increase of 12.5%. The estimate for free cash is in the $730-$745 million range, which represents a double-digit year-over-year increase. For the second quarter, the company currently forecasts revenues between $730 million and $740 million.

GoDaddy’s stock has advanced steadily since December, after slipping to a one-year low, and is currently trading near last year’s peak. The shares, which gained 28% since the beginning of the year, lost 4% in Thursday’s extended trading session.