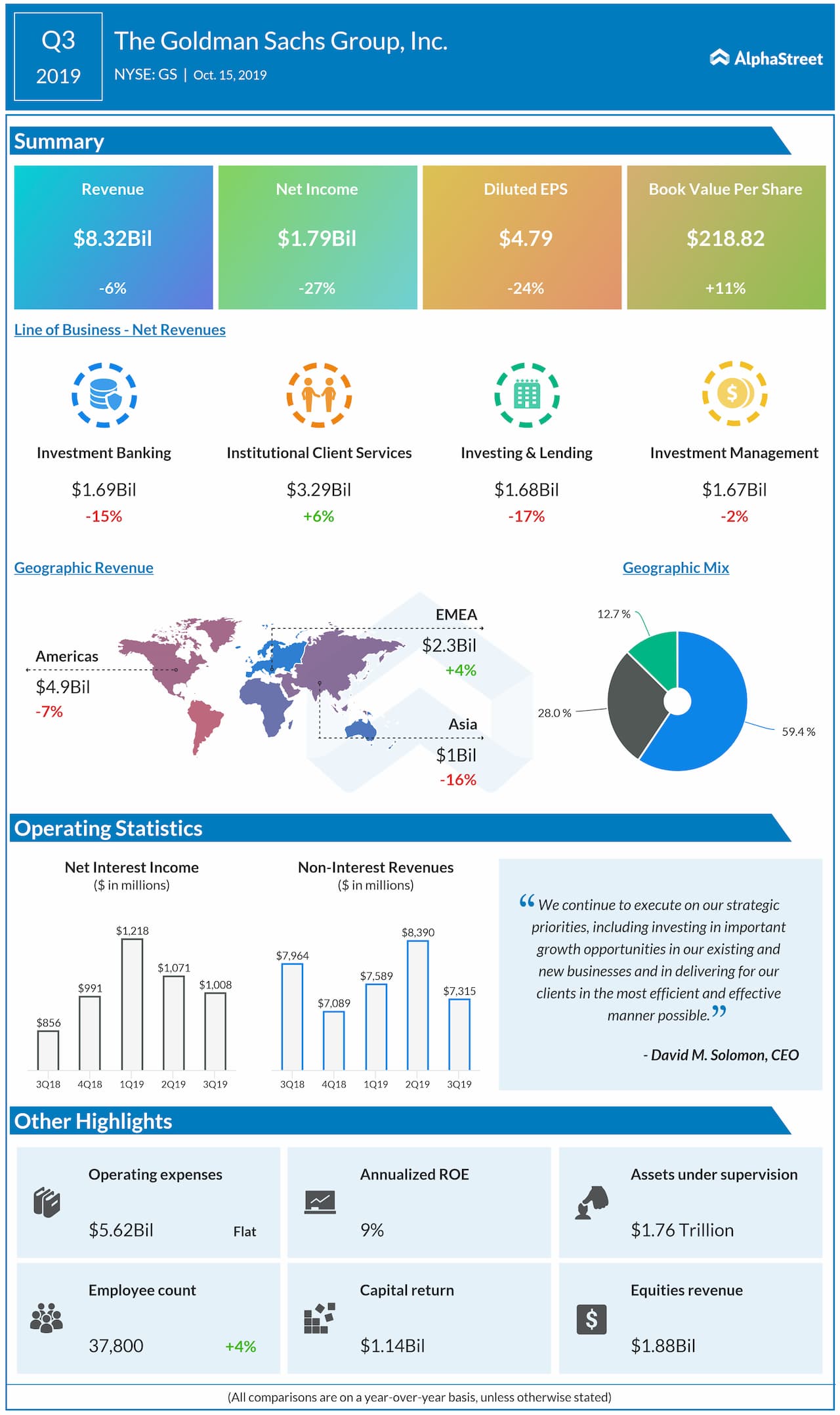

The Goldman Sachs Group Inc. (NYSE: GS) reported better-than-expected revenues for the third quarter of 2019 while earnings missed forecasts. Shares were down 1.9% in premarket hours on Tuesday. The consensus estimate was for earnings of $4.81 per share on revenue of $8.31 billion.

Total revenues of $8.32 billion fell 6% year-over-year due to lower revenues in Investing & Lending and Investment Banking.

Net earnings applicable to common shareholders decreased 27%

year-over-year to $1.79 billion while EPS fell 24% to $4.79.

Book value per common share was $218.82, 10.9% higher

compared to the end of Q3 2018. Provision for credit losses rose 67% to $291

million from last year, mainly due to higher impairments.

Net revenues in Investment Banking fell 15% year-over-year to

$1.69 billion, hurt by declines in Financial Advisory and Underwriting. Revenues

in Financial Advisory dropped 22% due to a decrease in M&A transactions. Declines

in IPOs and leveraged finance transactions hurt underwriting revenues during

the quarter.

Revenues in Institutional Client Services rose 6% year-over-year to $3.29 billion, helped by growth in FICC and Equities. Strength in commodities and credit products coupled with higher commissions and fees helped drive revenue growth in FICC and Equities.

Investing & Lending revenues fell 17% year-over-year to

$1.68 billion, hurt by a 40% drop in equity securities revenues. Revenues in debt

securities and loans rose 10% from last year. Investment Management revenues

dipped 2% to $1.67 billion, due to lower incentive fees.

On October 14, 2019, the Board of Directors declared a dividend of $1.25 per common share, payable on December 30, 2019 to common shareholders of record on December 2, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.