For most financial service companies, which are reporting their latest quarterly results, the main concern is the ongoing softness in the trading segment, especially fixed-income securities. Goldman Sachs Group (GS) will be reporting its fourth-quarter earnings Wednesday before the market opens. The investment management company is expected to report earnings of $5.5 per share for the quarter, marking a slight decline from $5.68 per share reported a year earlier.

While the volatility in capital markets has impacted trading revenues in the most recent quarter, there are other unfavorable factors like the US-China trade war, political uncertainty in Europe due to Brexit and rising interest rates. Initial projections indicate that Goldman’s investment banking division was also hurt by unfavorable fee structure in the December quarter. However, it is estimated that the impact of the negative factors was partially offset by stable demand for loans.

The investment banking division experienced weakness due to an unfavorable fee structure in the December quarter

Research firm Barclays, which started coverage of Goldman recently, reiterated its equal weight rating on the stock. Earlier, Credit Suisse confirmed its outperform rating on it. The consensus outlook issued by brokerage firms indicates that most of the leading US banks will report unimpressive results this season, mainly due to the slump in equity trading.

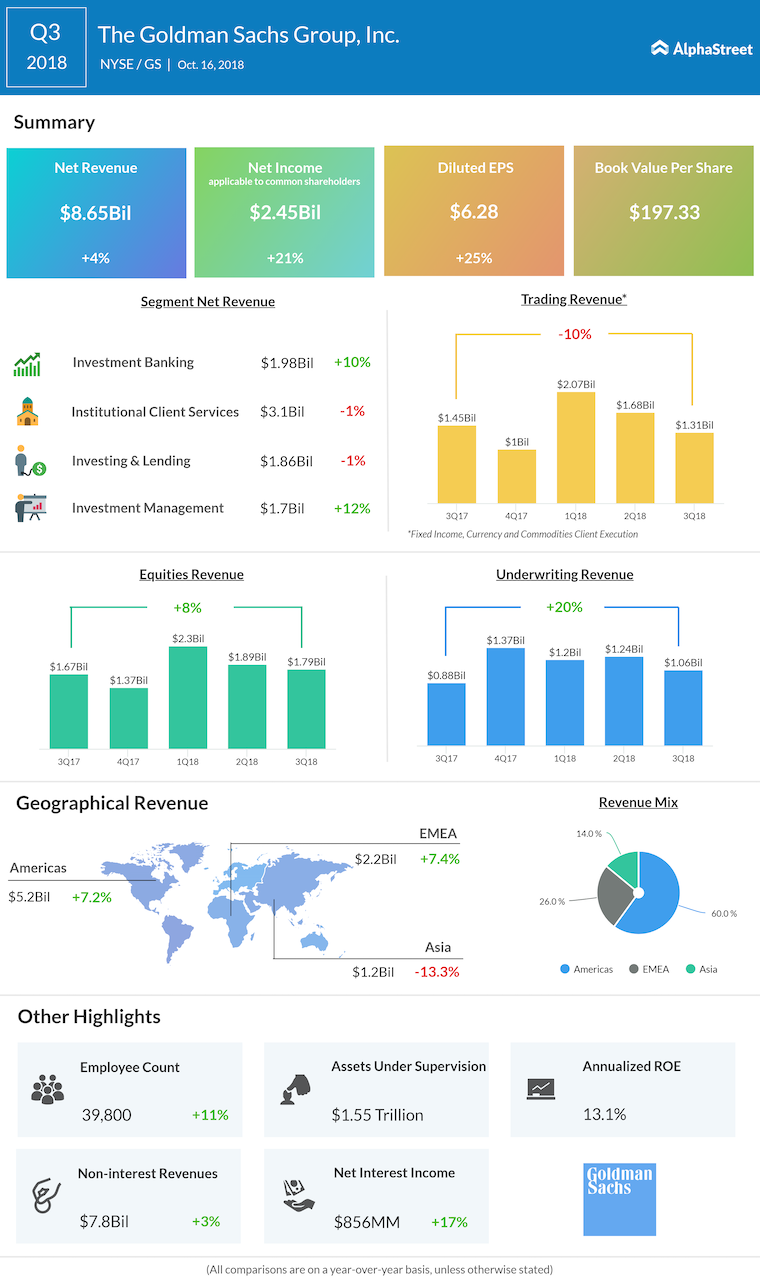

In the third quarter, Goldman’s revenues rose 4% to $8.6 billion, aided by strong performance by both the investment banking and investment management segments. Consequently, earnings jumped 25% annually to $6.28 per share. At $856 million, net interest income was up 17% compared to the prior-year period.

Also see: The Goldman Sachs Group Q3 2018 Earnings Conference Call Transcript

The company is reportedly planning to introduce cash management services for corporate clients by next year, as part of enhancing its revenues to meet the performance goals for 2020.

Among Goldman’s peers, Morgan Stanley (MS) is scheduled to announce results for its latest quarter Wednesday before the opening bell. Citigroup [C], the first among the American banks to release results, reported a 26% jump in fourth-quarter earnings to $1.61 per share, despite a 2% decline in revenues due to softer bond trading.

Goldman Sachs shares have fallen steadily over the past twelve months, losing about 33% during the period. However, the stock started 2019 on a positive note and maintained the uptrend.