The real estate sector has witnessed steady growth over the past couple of decades, all along weathering market uncertainties including the coronavirus pandemic. Lifestyle real estate is an emerging trend wherein people give priority to communities and locations where they can indulge in activities of interest. LiveToBeHappy, Inc. (OTC: CAVR) is a multi-platform real estate development and technology company, with a focus on lifestyle real estate services.

In an interview with AlphaStreet, the company’s CEO Kevin Cox provided insights into the various aspects of the business and the growth strategy. Here’s the full interview:

Can you provide a brief overview of the business, like the services and the markets you serve?

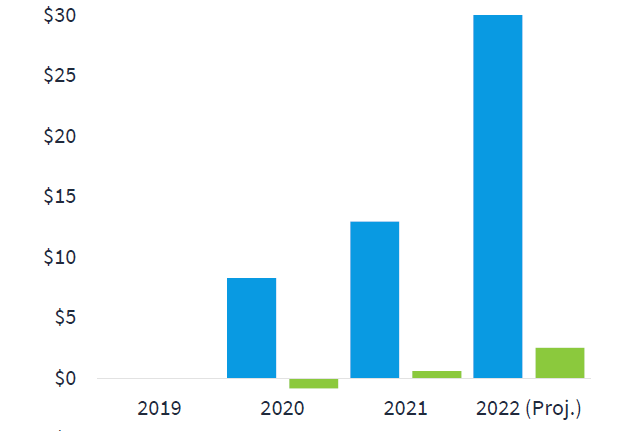

LiveToBeHappy is a lifestyle real estate services company that acquires undervalued or underperforming businesses and builds them into strong lifestyle brands. Our mission is simple … building brands, and improving lives. Today, the company owns 12 business units, and multiple patents, and has grown from no revenue in 2019 to $12 million in 2021 with forecasted revenue of over $20 million for 2022.

Our two core subsidiaries are Sinacori Builders and RenuYou. Sinacori Builders is a land development company in Charlotte and RenuYou is a neurofeedback clinic in Tulsa. We are opening our first RenuYou clinic in Charlotte in October and expect to have Sinacori builders developing land in Tulsa first quarter of 2023. Our aim is to expand each of our business units nationally. We are building lifestyle businesses in education, health and fitness, real estate, and travel and entertainment.

Your outlook for FY22 is quite bullish. Besides contributions from recent acquisitions, what are the other potential growth drivers?

The primary driver is the land development work in Charlotte, a market that continues to grow in spite of the current fed funds cycle. That said, in 2021, 100% of our annual revenue was tied to the fed funds cycle and as of Q2 2022, 50%+ was from businesses unaffected by the fed funds cycle. We believe having multiple recurring revenue streams from businesses that we are transforming into national brand leaders is a winning strategy in the midst of such a volatile market.

Going forward, what would be the strategy for raising capital, since you are pursuing more M&A deals?

We plan to raise capital through private debt and public debt offerings once we complete our S-1 and secure a spot on a leading exchange.

Courtesy: LiveToBeHappy

Can you provide insights into the benefits expected from the government’s infrastructure bill?

As the federal government approaches $2 Trillion of new spending, our real estate division will benefit from regional infrastructure funding in the Southwest and Southeast, our healthcare division will benefit from extensive spending and investment in mental health, and our education division will benefit from substantial spending by the government on remote learning.

Our experience and legacy of excellence give us a large leg up: John LaGourgue of Vicinity Motor

Where do you see LiveToBeHappy five years from now?

I believe LTBH will have a number of nationally recognized brands, a highly diversified recurring revenue stream, and will have many substantive testimonials to how our various brands improved lives.