Home improvement retailer Home Depot (NYSE: HD) will be reporting second-quarter results on August 20 at 6:00 AM ET, after a relatively weak start to the year. The general outlook is positive, with market watchers predicting a rebound in comparable sales growth.

The effective integration of offline and e-commerce channels holds the key to reporting positive results. While the strategy helped the company in the trailing quarters, the main takeaway is the solid uptick in online sales. Innovations, such as automated lockers for picking online orders from physical stores, have enhanced customer experience considerably.

Focus on Pro Segment

Investments in the premium segment, with focus on improving the facilities both in-store and online, added to top-line growth in the recent quarter. The trend is expected to continue this time. It is estimated that customer transactions rebounded in the to-be-reported quarter from the recent lows, helped by the market’s positive response to the improvements in multi-channel capabilities and enhanced assortment.

What needs to be seen is how comparable stores performed this time, after the lackluster show in the recent quarters. Since the main dampener in the first quarter was bad weather, the improved conditions in the recent months point to a rebound.

What to Look for

Wall Street analysts forecast earnings of $3.09 per share for the June quarter, slightly higher than $3.05 per share reported in the year-ago quarter. Revenues are seen growing about 2% to $31.05 billion.

Also read: Canopy Growth stock falls on wider-than-expected Q1 loss

When it comes to future performance, the management bets on its strategic investments and the favorable macroeconomic backdrop that is conducive to employment and wage growth. Though volatilities in the housing market is a cause for concern, the outlook for the sector remains positive.

Looking Back

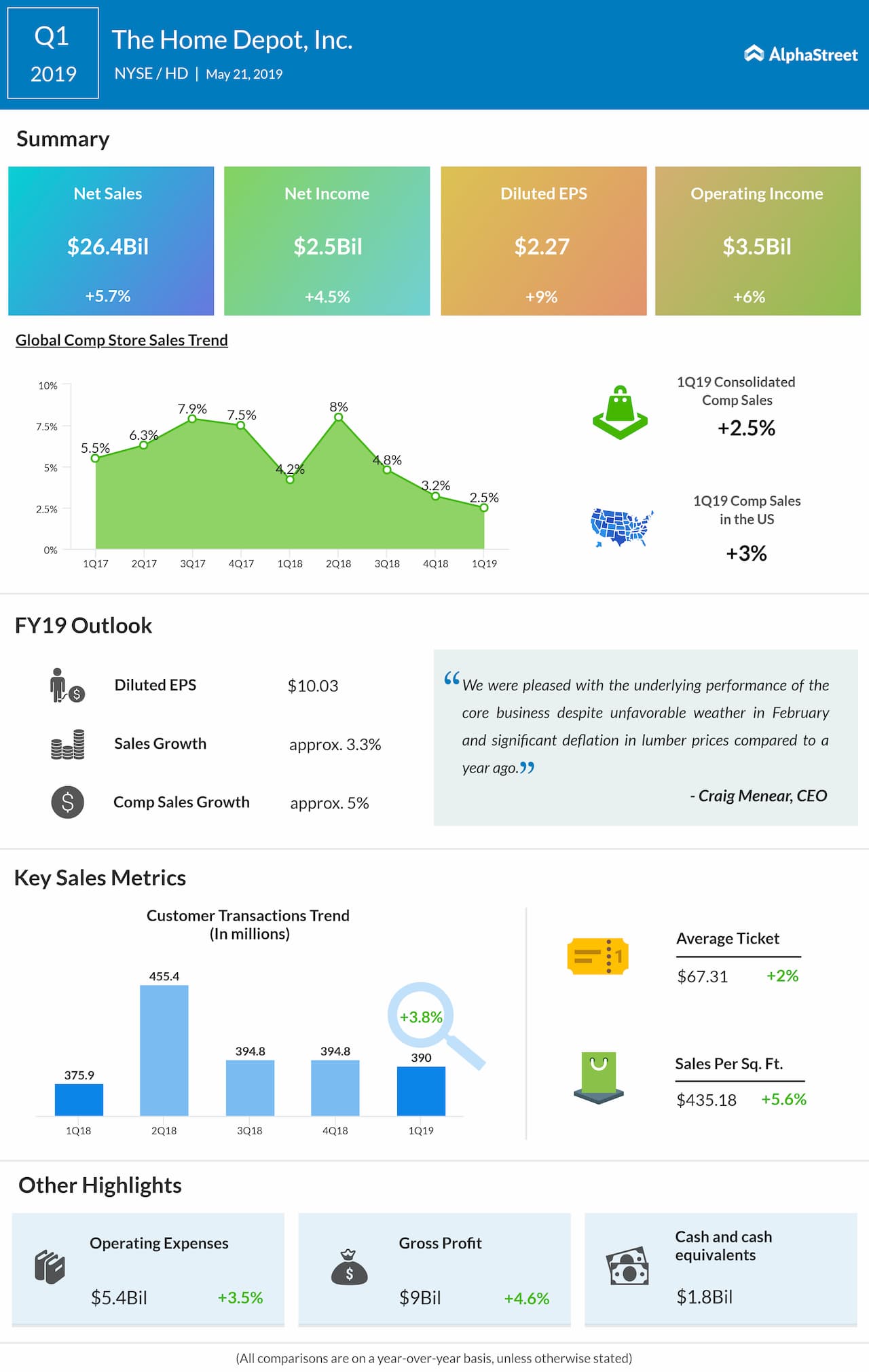

Home Depot had a weak start to the year and reported slower comparable store sales growth for the first quarter. However, revenues grew 5.7% year-over-year to $26.4 billion, driving earnings higher by 9% to $2.27 per share.

Rival retailer Lowe’s Companies (LOW) will be unveiling its second-quarter numbers on August 21 before the opening bell. Market-watchers forecast earnings of $2.01 per share on revenues of $20.96 billion.

After growing steadily in recent years, Home Depot shares reached a peak mid-July but pared a part of the gains in the following days. The stock has gained 18% so far this year and 4% since last year.