Honeywell (NYSE: HON) reported better-than-expected earnings for the fourth quarter of 2019 while sales fell short of estimates. Shares were down slightly in premarket hours on Friday.

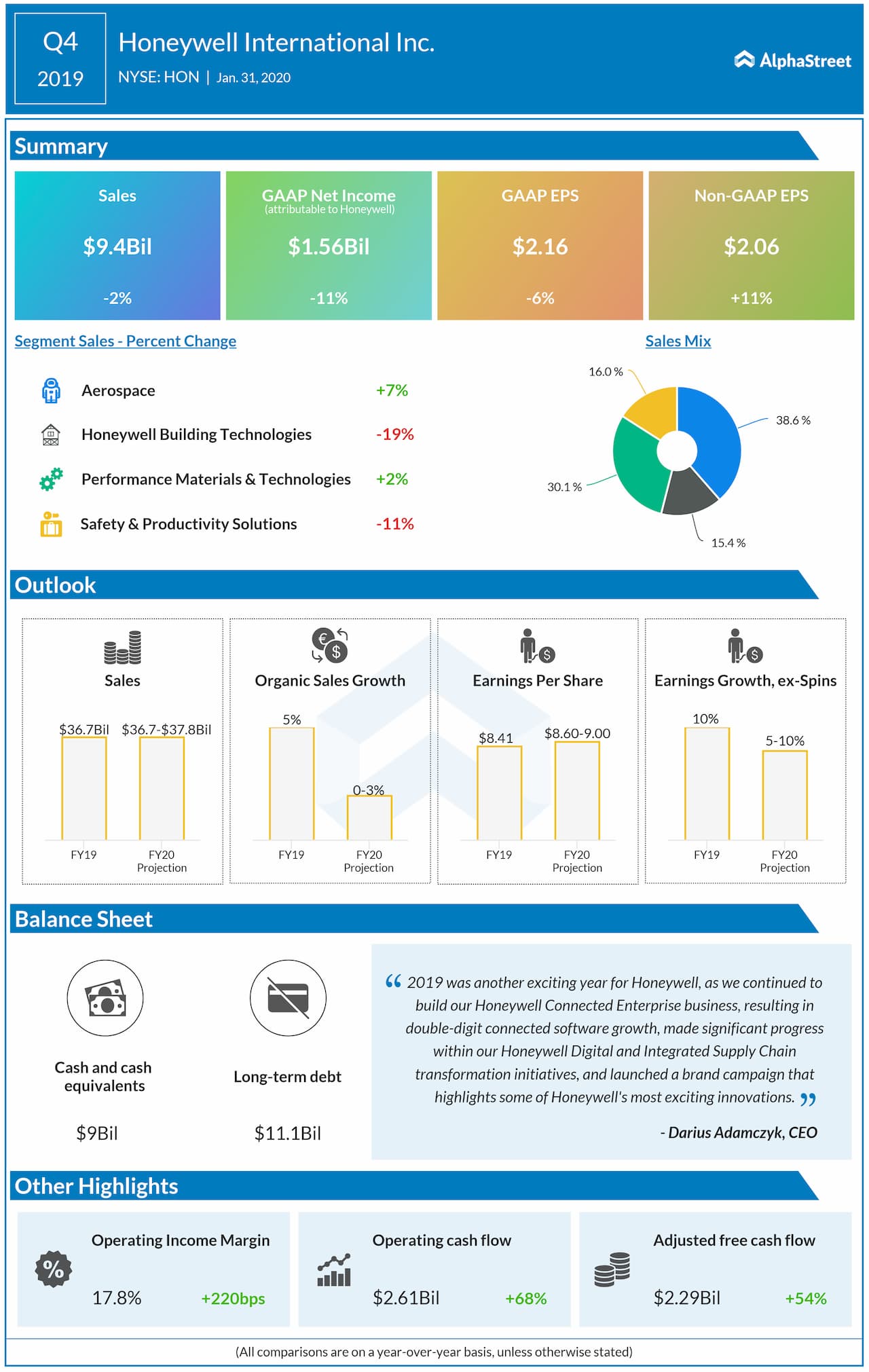

Total revenue of $9.4 billion was down 2% from the same period last year and below projections of $9.6 billion. The topline numbers were impacted by the 2018 spin-off of two business divisions. Sales were up 2% on an organic basis.

Reported net income attributable to Honeywell was $1.5 billion compared to $1.7 billion in the prior-year quarter. Reported EPS fell 6% to $2.16 while adjusted EPS ex-spins rose 11% to $2.06. Analysts had forecast adjusted EPS of $2.04.

During the quarter, organic sales in the Aerospace segment increased 7% helped by strength in Defense and Space, along with air transport commercial aftermarket, as well as demand in business aviation.

In Honeywell Building Technologies, organic sales rose 3% driven by demand in commercial fire and building management products, and security growth across the Americas and Europe. In Performance Materials and Technologies, organic sales grew 3% fueled by strength in Process Solutions, as well as equipment and petrochemical catalysts in UOP.

Also read: Honeywell Q4 2019 Earnings Preview

Organic sales fell 11% in the Safety and Productivity Solutions division due to the impact of major systems project timing in Intelligrated, lower sales volumes in productivity products, and lower demand for personal protective equipment in the Safety business.

For the full year of 2020, the company expects sales to be $36.7-37.8 billion, representing year-over-year organic growth of 0-3%. EPS is expected to be $8.60-9.00, reflecting growth of 5-10% on an adjusted basis.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.