Categories AlphaGraphs, Earnings, LATEST, Technology

Infosys Q1 profit rises 2%, lifts FY20 revenue outlook above consensus

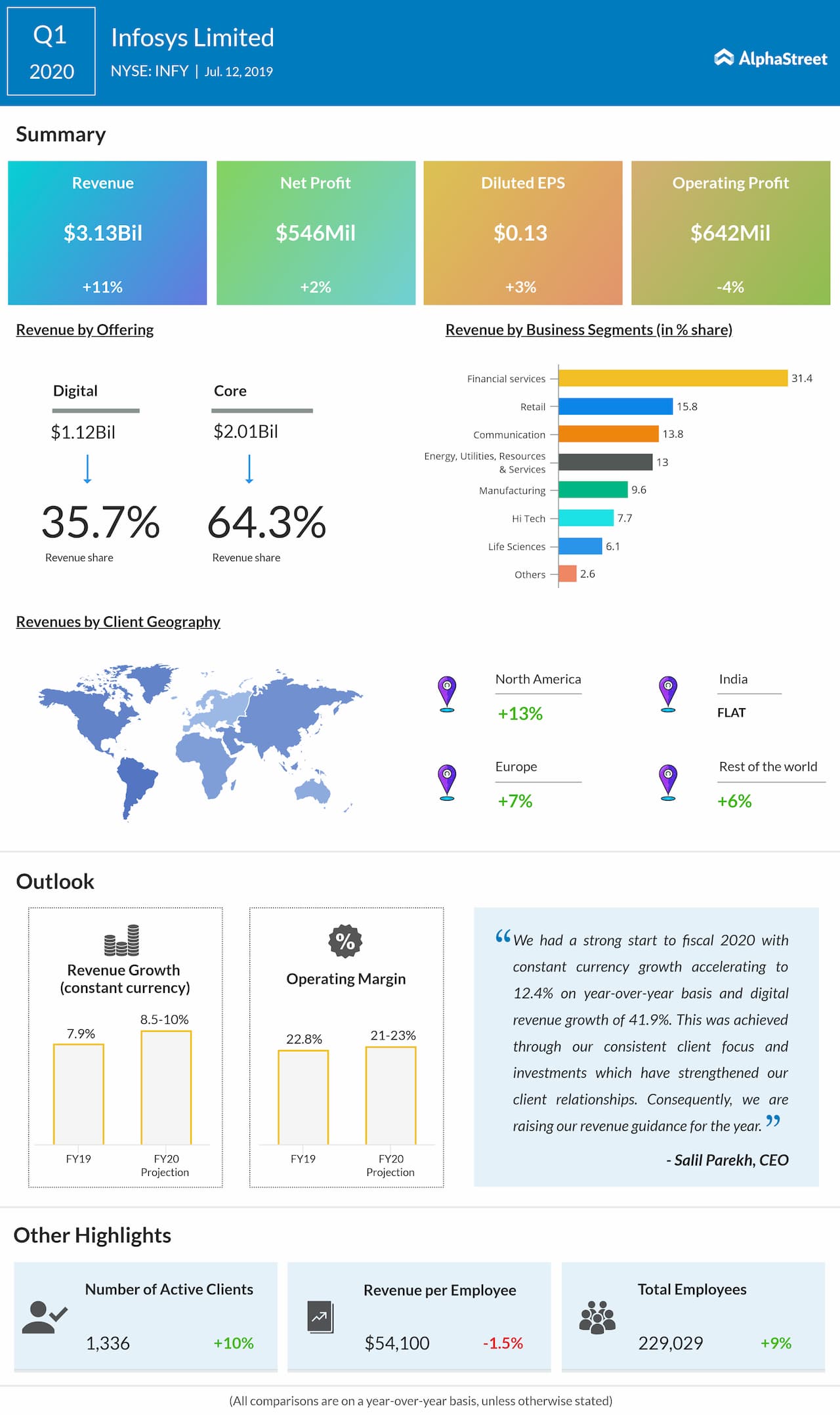

Infosys (NYSE: INFY) reported a 2% increase in earnings for the first quarter of 2020 helped by higher revenues as well as lower income tax expenses. The bottom line came in line with the analysts’ expectations while the top line exceeded consensus estimates. The company lifted revenue growth outlook for fiscal 2020 that is above the Street’s view.

Net profit rose 2% to $546 million while earnings increased 3% to $0.13 due to lower weighted average shares. Revenues grew by 11% to $3.13 billion.

Digital revenues climbed 39% year-over-year to $1.12 billion while core revenues declined 0.8% to $2.01 billion. The company had another quarter of over $2.7 billion large deal total contract value in the first quarter. Segment growth was robust with all large regions and most verticals growing at double digits year-over-year in constant currency.

Looking ahead into fiscal 2020, the company lifted its revenue growth outlook to the range of 8.5% to 10% in constant currency from the previous 7.5% to 9.5% range. Operating margin is still expected to be in the range of 21% to 23%.

Effective from financial year 2020, the company expects to return 85% of the free cash flow cumulatively over a 5-year period through a combination of semi-annual dividends and/or share buyback and/or special dividends.

For the first quarter, by client geography, North America contributed to a higher 61.6% of the share to the total revenues compared to the previous year quarter while Europe, Rest of the World and India contributed a lesser share.

Also read: Adobe stock soars to record high

During the quarter, the company’s active number of clients were 1,336, up 10% from the prior year quarter, and it added 112 clients during the period, which was 60% higher than last year. Revenue per employee declined by 1.5% to $54,100 while total employees increased by 9% to 229,029.

In comparison, its peers International Business Machines (NYSE: IBM) is scheduled to report earnings results for the second quarter of 2019 on July 17, 2019, after the market closes. Wipro Limited (NYSE: WIT) is scheduled to post its first-quarter earnings report on July 17, 2019, after the market closes.

During June-end, Accenture (NYSE: ACN) reported better-than-expected earnings results for the third quarter of fiscal 2019. During May-end, HP Inc. (NYSE: HPQ) posted better-than-expected earnings for the second quarter of 2019.

Shares of Infosys ended Thursday’s regular session up 2.29% at $10.72 on the NYSE. Following the earnings release, the stock advanced over 3% in the premarket session.

Most Popular

BIIB Earnings: Biogen Q1 2024 adj. earnings rise despite lower revenues

Biotechnology firm Biogen Inc. (NASDAQ: BIIB) Wednesday reported an increase in adjusted profit for the first quarter of 2024, despite a decline in revenues. Total revenue declined 7% year-over-year to

Hasbro (HAS) Q1 2024 Earnings: Key financials and quarterly highlights

Hasbro, Inc. (NASDAQ: HAS) reported first quarter 2024 earnings results today. Revenues decreased 24% year-over-year to $757.3 million. Net earnings attributable to Hasbro, Inc. were $58.2 million, or $0.42 per

BA Earnings: Highlights of Boeing’s Q1 2024 financial results

The Boeing Company (NYSE: BA) on Wednesday announced financial results for the first quarter of 2024, reporting a narrower net loss, on an adjusted basis. Revenues dropped 8%. Core loss,

Comments

Comments are closed.