The healthcare industry continues to grow at a rapid pace with diagnostic services playing an important role in this space. Women’s health diagnostic company Sera Prognostics is set to go public this week and here are a few points to note about the transaction:

IPO details

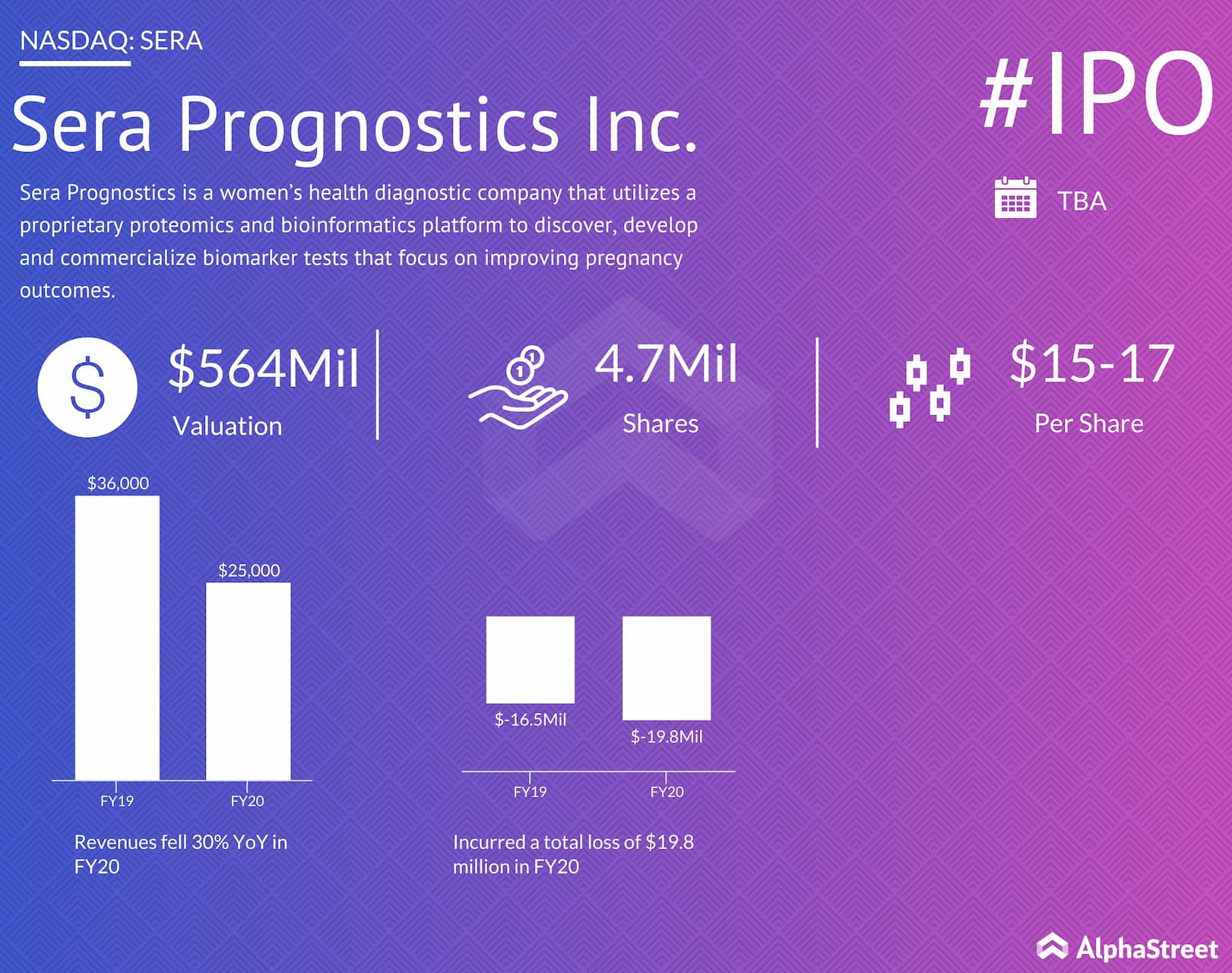

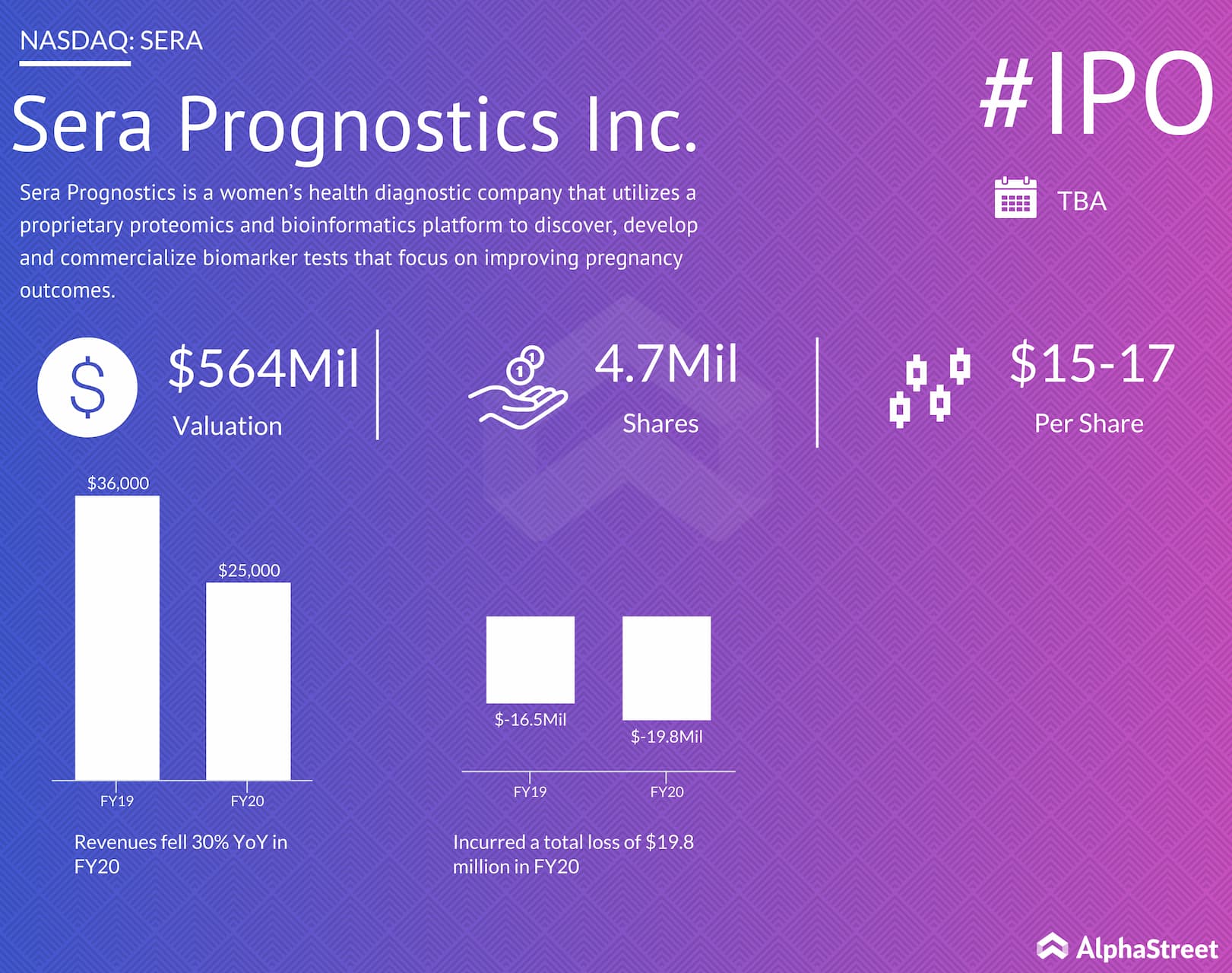

Sera Prognostics is scheduled to go public on Thursday, July 15. The company is expected to begin trading on NASDAQ under the ticker symbol SERA. Sera will offer 4.7 million shares at a price range of $15-17 per share to raise $75 million. The IPO will be managed by Citigroup, Cowen and William Blair.

Company intro

Sera Prognostics develops diagnostic tests that help predict risks associated with pregnancy such as premature delivery. The company uses its proteomics and bioinformatics platform to discover protein biomarkers in blood that can predict dynamic changes during pregnancy. This data helps in predicting various pregnancy-related complications such as the risk of a preterm birth. This will help in significantly improving maternal and neonatal health.

Sera’s product, the PreTRM test, is the only commercially available blood-based biomarker test that helps in accurately predicting the risk of a premature delivery. It is a non-invasive blood test given to pregnant women during weeks 19 or 20 of gestation that predicts the risk of the mother delivering spontaneously before 37 weeks.

Sera has a collaboration with health insurer Anthem Inc. (NYSE: ANTM) under which Anthem will make the PreTRM test available to eligible pregnant members as part of a multi-year contract. Anthem has more than 43 million members and its health plans cover over 10% of pregnancies in the US annually. Sera believes this alliance will de-risk initial commercialization and pave the way for broader market adoption for its PreTRM test.

Financials

Sera generated revenues of $25,000 in FY2020. The company delivered a net loss of $19.8 million during the same period. The company was founded in 2008 and has 76 employees.

Market opportunity

There are approx. 140 million births worldwide each year of which around 25% are affected by various complications such as preterm birth, preeclampsia, fetal growth restriction, stillbirth and gestational diabetes among others. In the US alone, there are around 3.8 million births annually and over 10% of these pregnancies result in preterm birth with profound health consequences to the mother and baby.

These health consequences are estimated to lead to costs of approx. $25 billion annually in the US. Sera believes its biomarker tests can help mitigate the complications associated with premature birth as well as reduce healthcare costs.