J.C. Penney’s (NYSE: JCP) shares have fallen 44% since the beginning of this year. The stock is trading 68% below its 52-week high of $1.92. The share price has fallen below $1, putting the company out of compliance with the NYSE’s listing rules. J.C. Penney might consider a reverse stock split to remedy this issue.

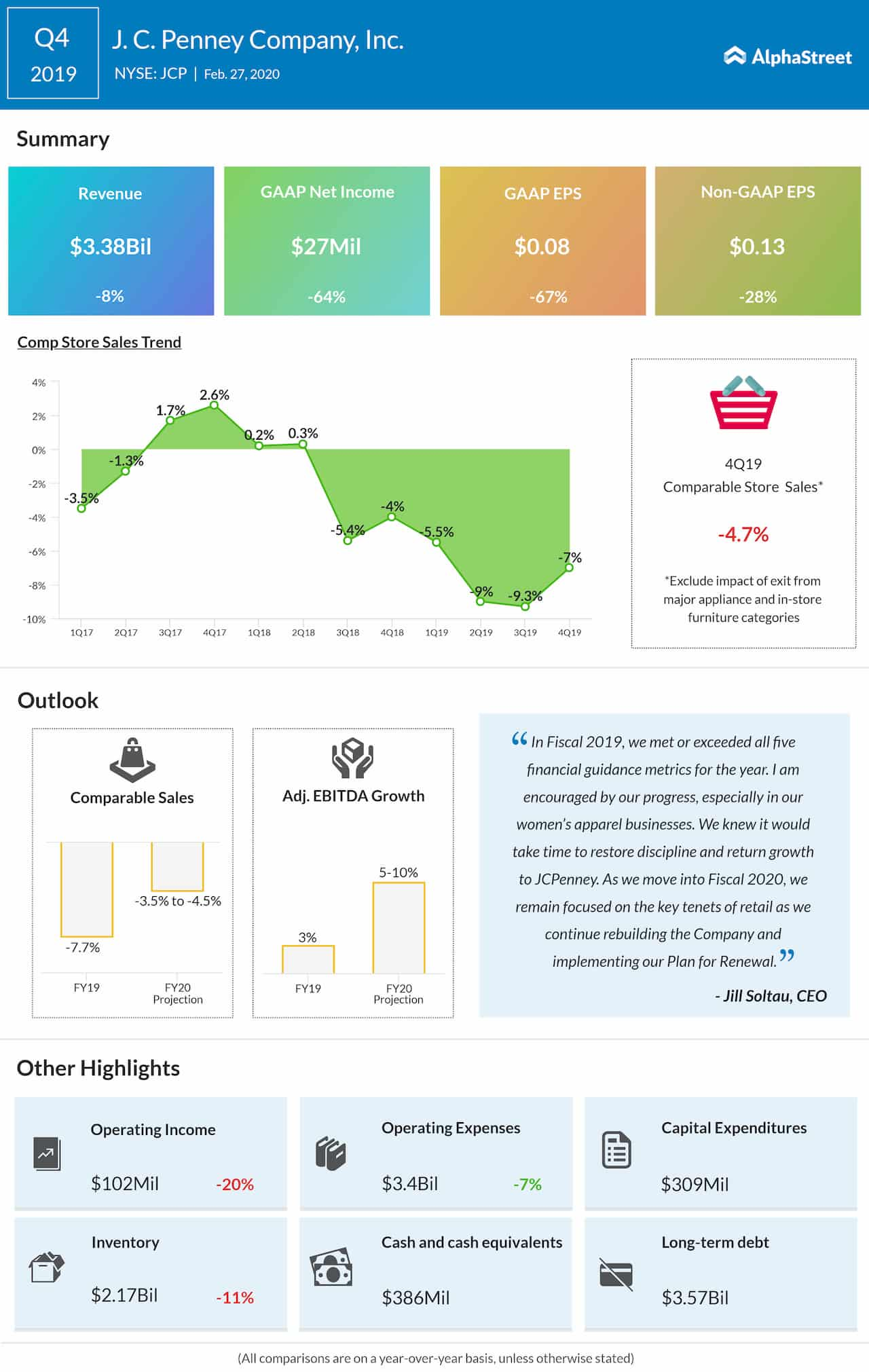

During its most recent quarter, J.C. Penney saw a drop of 7% in both net sales and comparable store sales. Adjusted comp sales, which exclude the impact of the exit from appliance and furniture categories, also fell 4.7%. The company’s expenses remained flat year-over-year, showing no reduction.

J.C. Penney has been making efforts to reduce inventory and improve

shrink and the company has also rolled out innovative methods like curbside

pickup to increase the convenience of the customer. Earlier this week, the

company said it will expand this service to 50 additional locations across the

US.

Changes to its pricing and promotion strategy as well as reductions

in shrink through technology updates and rearranged store layouts have helped

the company improve gross margins by 200 basis points in the most recent quarter.

However, J.C. Penney still needs to pick up its topline.

During the second half of 2019, six of the retailer’s eight merchandise divisions posted comp sales increases versus the first half. This still couldn’t help the overall comp numbers.

J.C. Penney is working on improving its apparel business, with a particular focus on women’s apparel. The company saw positive comps in dresses and sportswear during its recent quarter. It remains to be seen if these efforts are enough to drive sustainable sales growth going forward.

J.C. Penney has a large debt load of $3.5 billion while cash and cash equivalents totaled $386 million at the end of 2019. The outlook for 2020 remains quite bleak. Comparable store sales are estimated to decline 3.5-4.5% and the company plans to close six stores during the year. Although J.C. Penney is working to improve its performance, there appears to be less optimism over the chances of these efforts being sufficient enough to drive growth.