Shares of Hormel Foods Corporation (NYSE: HRL) were down over 4% on Wednesday after the company delivered fourth quarter 2023 earnings results that fell below expectations. The stock has dropped 33% year-to-date. Here are the key takeaways from the earnings report:

Results miss estimates

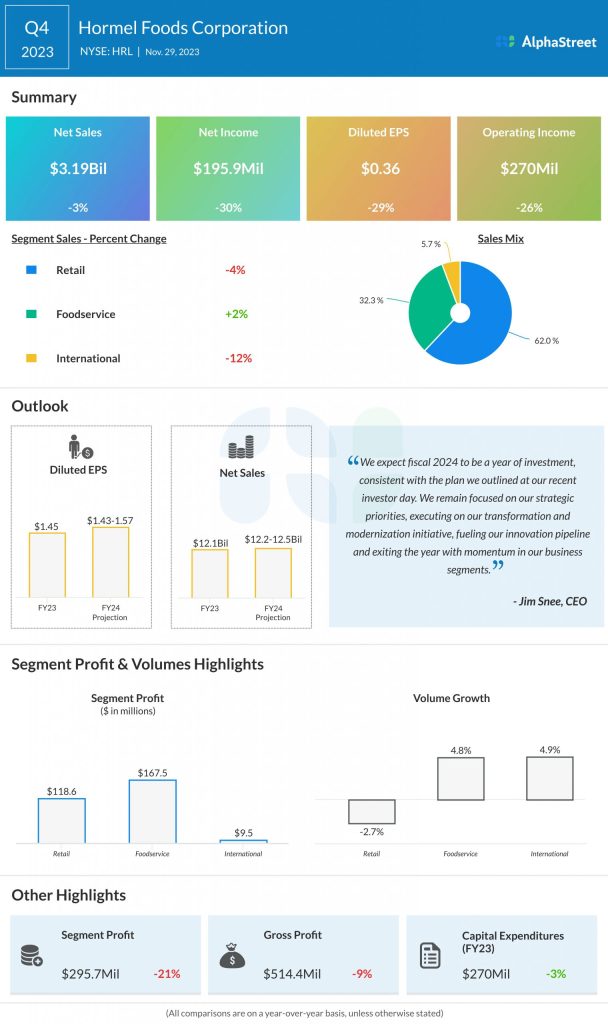

Hormel reported net sales of $3.19 billion for Q4 2023, which decreased 3% year-over-year and missed estimates of $3.26 billion. GAAP EPS declined 29% to $0.36. Adjusted EPS amounted to $0.42, which was below projections of $0.44.

Segment performance

In Q4, volume dropped 3% and sales fell 4% in the Retail segment due to declines in the convenient meats and proteins, and snacking and entertaining verticals, which more than offset growth in value-added meats, emerging brands and bacon. Products such as Applegate natural and organic meats, Hormel Black Label bacon and Corn Nuts saw sales and volume growth in the quarter.

In the Foodservice segment, volume and sales grew 5% and 2% respectively, fueled by recovery across the Jennie-O turkey portfolio as well as strong demand for pizza toppings, and premium bacon and breakfast sausages.

Within the International segment, volume grew 5% driven by low-margin turkey and commodity fresh pork. Sales declined 12% due to lower branded export volumes and lower sales in China, related mainly to the retail business.

Outlook

For fiscal year 2024, Hormel expects net sales to range between $12.2-12.5 billion, representing a year-over-year growth of 1-3%. The guidance assumes volume growth in key categories, higher brand support and innovation, and benefit from pricing actions.

“Looking ahead, our teams continue to navigate through a dynamic operating environment characterized by slowing consumer demand, inflationary pressures and headwinds in our turkey business.” – Jim Snee, CEO.

The company expects GAAP EPS for the year to be $1.43-1.57 and adjusted EPS to be $1.51-1.65. It expects earnings to decline in the first half of the year due to impacts from lower turkey markets, lower volumes in the Retail segment and softness in its China business.