Stock Peaks

Lam Research Corporation Q3 2021 Earnings Call Transcript

However, LRCX remains a compelling long-term investment that can fetch handsome returns for shareholders. Currently, the rating on the stock is moderate buy. Though Lam’s current dividend yield is not very attractive it has grown steadily in recent years, eliciting interest among income investors.

Unchallenged

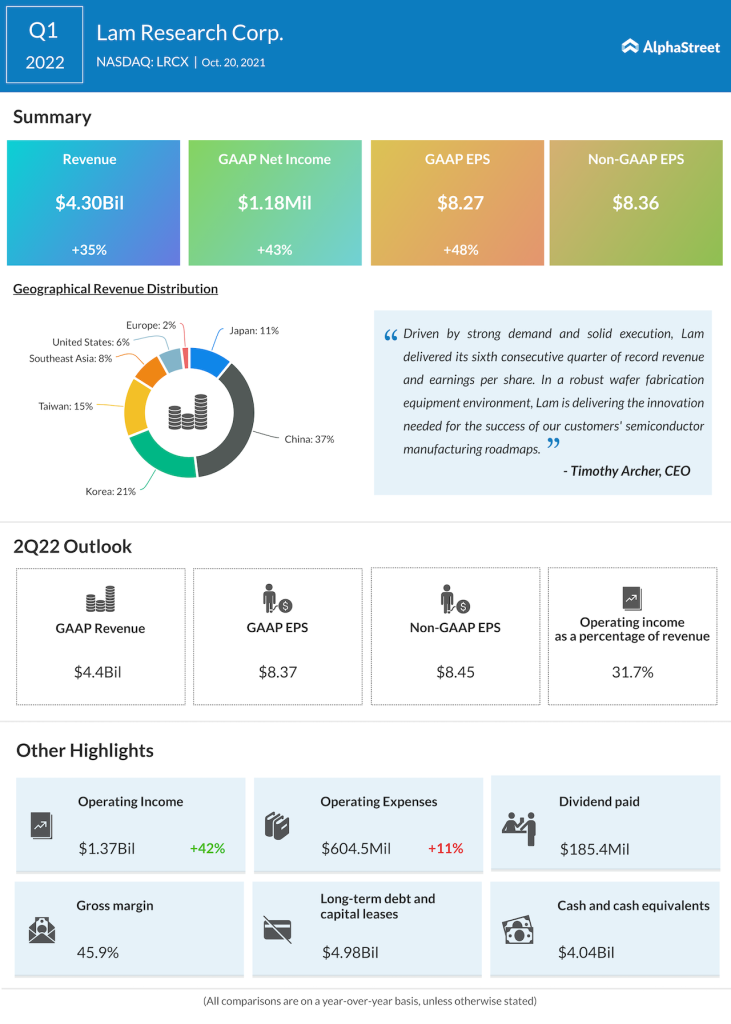

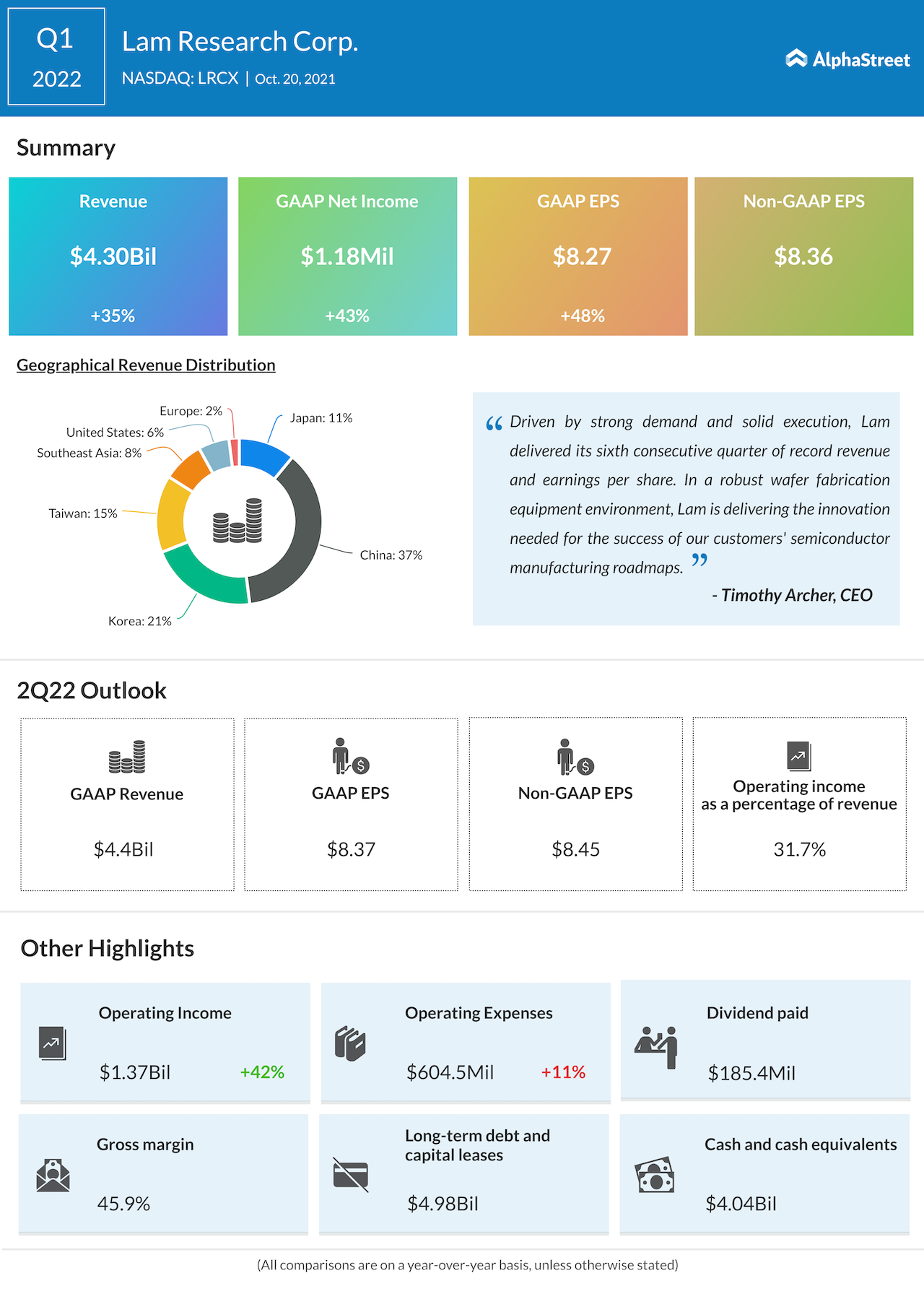

The Fremont–based company, which provides wafer fabrication equipment to the semiconductor industry, has such well-established infrastructure and technology that it faces little competition from new players. So, the tech firm will continue to be a sought-after supplier for leading chipmakers both in the U.S and other key markets like China, which accounted for 37% of revenues in the most recent quarter.

The long-term view on the semiconductor industry is quite encouraging, with certain studies suggesting double-digit annual growth through 2030. Lam’s focus on advanced systems used by memory chipmakers bodes well for it, given the recent spike in the demand for memory products. Since a major chunk of enterprises is yet to fully embrace digital technologies, the positive demand trend is likely to continue in the foreseeable future. The bullish outlook indicates there would be enough space for other players like Applied Materials, Inc. (NASDAQ: AMAT) also to achieve their growth goals comfortably.

“Foundry/Logic performance in the sub-5-nanometer era is being driven by both device architecture innovation and traditional area scaling. We are prioritizing technology development in three areas where we see the fastest growth and the greatest need, namely deposition and etch processes to support the efficient adoption of EUV patterning, new etch capabilities to enable the formation of critical transistor features, and new materials and deposition techniques to assist in RC management,” said Lam’s chief executive officer Tim Archer during his post-earnings interaction with analysts.

Record Numbers

The company’s quarterly earnings either topped or matched the market’s expectations every time over the last decade. In the first three months of fiscal 2022, adjusted earnings rose sharply to $8.36 per share and topped expectations. At $4.3 billion, revenues were up 35% year-over-year. The numbers hit record highs for the sixth time in a row. Lam’s second-quarter earnings release is scheduled for January 27.

Intel Earnings: Q3 profit tops expectations amid strong chip demand

LRCX has gained about 10% in the past six months alone. The stock, which closed the last trading session slightly below the recent peak, traded higher on Wednesday afternoon.